Every new trend, product or idea goes through 3 leans or filters: Technology, Business, and Society. Libra is not different in this sense; in Part 2 of this article we will examine how technology and business filtered Libra as a technology and a business (you can read the first part here). In order for Libra to thrive in the first stage Facebook needs the technology to make it possible and that includes Blockchain technology as the underline one for all cryptocurrencies. Also Libra must make sense as a business vertically for all the customers and vendor and horizontally for the members of Libra.org (28 members now with the goal to reach 100 members in 5 years).

Technology

Libra will be built on the Libra blockchain, a natively developed open-sourced blockchain that uses a Byzantine Fault Tolerant (BFT) consensus approach called LibraBFT Consensus Protocol (voting based protocol used in hyperledger networks). However, the Libra blockchain will initially be a permissioned (closed) blockchain. This means that access to the network is limited to a handful of selected and pre-approved entities who will become nodes in the system.

Libra will gradually transit into a permissionless network (similar to Bitcoin and Ethereum networks) within five years of the public launch of Libra blockchain and ecosystem. The rationale behind this is that a permissionless network has limitations in terms of speed and scalability, and in order to deliver a scalable, secure, and stable solution globally across billions of people and transactions, it needs to be a permissioned system at first. That said, Libra blockchain will be open in the sense that anyone can use the network and even build applications on top of the blockchain. [8]

The Libra Blockchain

With 5KB transactions, 1000 verifications per second verifications on commodity CPUs, and up to 4 billion accounts, the Libra Blockchain should be able to operate at 1000 tps (transactions per second) if nodes used at least 40Mbps connections and 16TB SSD hard drives. Transactions on Libra cannot be reversed. If an attack compromises over one-third of the validator nodes causing a fork in the Blockchain, the Libra Association says it will temporarily halt transactions, figure out the extent of the damage, and recommend software updates to resolve the fork. [8]

Libra blockchain will facilitate smart contract functionality, using a relatively new language called ‘Move’. Smart contracts are pre-programmed contracts that are self-executable, thereby allowing for the automation of contracts without the need of any third parties or intermediaries. Move is a simple but powerful language, and is relatively suitable as a “first programming language”. More importantly, Move is designed with a key focus on security and safety, since leveraging a simpler language facilitates easier code writing and execution, and reduces the risk of unintended bugs or security flaws.

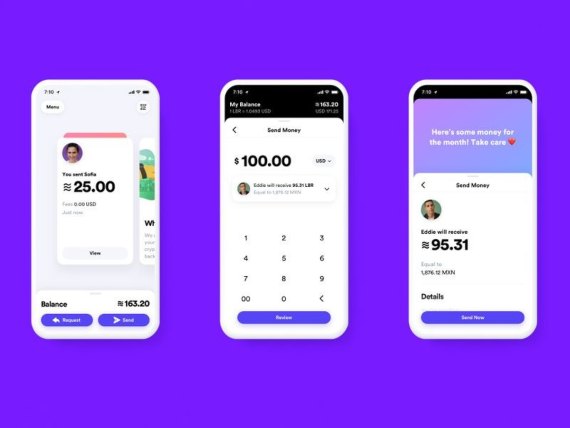

The first application to be built to support a cryptocurrency must be a wallet. This is exactly the case with Libra, in which Calibra, a cryptocurrency wallet, will facilitate the storage and exchange of Libra coins. Calibra will be the first application to be built on the Libra blockchain.

Calibra is also the name of the company which will develop the wallet, and is in fact a subsidiary of Facebook, built to ensure separation between financial and social data, and to build and operate services on its behalf on top of the Libra blockchain.

Calibra will be available as a mobile application and will also be integrated with Facebook’s Messenger application and WhatsApp, allowing users to convert fiat currency into Libra in their wallets and thereafter send, receive, and pay for stuff using Libra. [8]

Business

According to Facebook, almost half of adults in the world don’t have an active bank account, with the figures worse in developing countries and even worse for women. Approximately 70% of small businesses in developing countries lack access to credit, and $25 billion is lost by migrants annually through remittance fees. [9]

Facebook has more than 1.5 billion users on both WhatsApp and Messenger yet makes almost no money from the messaging services. When Facebook revealed its Libra plans, the company also said it would soon put new digital wallets inside these apps so users can easily use the cryptocurrency to send money to friends and businesses anywhere in the world. If the plan works, WhatsApp and Messenger will become new payments and commerce hubs that take small-but-profitable cuts from billions of transactions.

Facebook has a checkered record in payments. But China’s WeChat and QQ show what’s possible when messaging apps cleverly fold payments and other services into the mix. WeChat and QQ make money by facilitating payments between users and merchants, distributing mobile games, and selling digital goods, such as stickers and avatars. The services have turned owner Tencent Holdings Ltd. into the most valuable publicly traded company in China.

Facebook’s crypto push could facilitate similar offerings in payments, shopping, apps and gaming, while tapping into the company’s huge user base in Asia, where it has nearly four times as many monthly active users as it does in North America, according to RBC Capital Markets.

For now, Facebook and its new subsidiary Calibra, which is building the digital wallets, are framing the new currency as a way for individuals to send money to each other across borders. David Marcus, who is leading Facebook’s Libra efforts, said that the company doesn’t plan to take a fee when people send money to friends, and will likely charge “tiny transaction fees” for payments to businesses.

If people do start stuffing their new digital wallets with Libra, it might not take years for Facebook to turn that activity into revenue. Marcus believes the new wallets could have a more immediate financial impact on a business line Facebook knows well: Targeted advertising. If users have Libra on hand as they scroll through Facebook’s News Feed, when they click on an ad it will be easier to buy something. That would make Facebook ads more appealing to marketers.

“If there is more commerce happening on the platform, then small businesses will end up spending more and advertising will be more effective for them,” Marcus said. [7]

To generate higher levels of adoption among users, Libra has developed an incentive program to encourage more developers to create applications on Libra blockchain, and more merchants to accept Libra as a payment currency. Node operators, who represent the founding members of the Libra association, will be rewarded with Libra coins for getting users to sign up and use Libra. Businesses that attract users towards Calibra will also be rewarded with incentives which they can pass on, in part or in their entirety, to users in the form of discounts or free Libra tokens for their purchases. Merchants in the network are also incentivized by receiving a percentage of the transaction value back for each transaction that is processed on the platform.

The incentive programs are targeted towards the entire Libra network, ensuring that a holistic approach is undertaken to foster adoption in the usage of Libra.

Comments on this publication