Introduction

The firm is a central institution in the functioning of any economic system in which people meet their needs through the division of labor, cooperative production, and the exchange of goods and services. As part of the system, firms serve to produce goods and services for sale on the marketplace, a necessary function allowing each person to combine specialization in work with the satisfaction of his or her multiple needs. Firms take the form of a legal entity with its own trade name. The heterogeneity of firms with regard to size, the variety of goods and services they offer on the market or the activities and resources they control internally, awakens intellectual interest on the part of the social sciences in general and economics in particular. Why they exist, what their nature is, how they are structured and function internally, and what factors influence their changing nature over time—all these are questions addressed by economic research into firms (1).

Firms arise from the decisions of people, firm executives, who also direct the assignment of resources within the scope of their responsibilities. In complex firms, oversight of resources, generically known as “management,” has to be shared by numerous specialists, leading to a professional setting of considerable quantitative and qualitative importance in developed societies. Alongside the study and positive knowledge of firm reality carried out by economics and other social sciences, there is also a normative knowledge of decision making and management practices, which is included in the training of firm executives and managers. The existence of centers specialized in training professional management personnel throughout the world bears witness to the importance of this knowledge.

Thus, there are two large knowledge bases about firms, both of which are characterized by a dynamic generation and renewal of contents that makes them separate but also interdependent: one of these bases is linked to the why of the phenomena being studied (positive analysis), and that is the area on which the social sciences have concentrated. Its ultimate goal is to learn about the consequences that one firm’s reality or another will have for social wellbeing. The other knowledge base concerns how to act in the event of specific problems (normative analysis) and this is the area occupied by the disciplines of professional management, whose ultimate goal is to contribute to the specific wellbeing of those making decisions within a firm, especially increasing private profits.

A summery of the main aspects of positive and normative knowledge of firms and their management is beyond the scope of the present text, not only because of the multitude of questions involved, but also because of the diversity of academic disciplines interested in them. Therefore, we will limit ourselves here to that part of positive knowledge mostly attributable to economic research into firm theory. Thus, the present text will be organized in the following manner: the first section outlines antecedents in the field of general economic interest and the firm’s place in this setting. The second deals with research into a firm’s limits or delimitation in the market to which it belongs. The third section reviews advances in the economics of internal organization of firms, while the forth addresses questions such as the legal identity of a firm and the social relations that link firm economics with other social sciences. In our conclusions, we will evaluate this theory’s contributions to firm management and society’s expectations with regard to good performance by firms.

Antecedents and the general framework of firm economics

In what are called market economics, the relations between firms, or between firms and their consumers, workers, investors, and so on, are regulated by prices that indicate the relative value of resources available in alternative uses when the needs that must be met outstrip available means. Market economics customarily include the institution of private property so that price is the monetary reward to whoever produces or sells what others demand. “Market” is also synonymous with free firms, which means equality among citizens when deciding to create a new firm and participate with it in the offer of goods and services, shouldering the consequences of that decision (financial sufficiency). The production of goods and services for sale on the marketplace is therefore made, in most cases, in competitive conditions, that is: allowing the possibility of choice to all those agents related to the firm, especially those who purchase and pay a price for its products. Competition creates pressure for continuous improvement and innovation as responses intended to insure survival and the obtaining of rewards commensurate with the resources employed in firm activity. It thus seems realistic for economists to analyze the raison d’être and existence of firms on the basis of their efficiency. In other words, the existence of firms, their nature and internal organization—which we observe and seek to explain with positive analysis—correspond to the goal of obtaining the best possible adaptation to the laws of competition that favor the creation of wealth (the difference between value or utility and cost of opportunity).

The key role of price in coordinating (identifying imbalances between supply and demand) and motivating competition (rewarding those who respond to those imbalances by producing more of what has the highest price) among members of a given social collective converts economic theory into a theory of prices and markets. For a long time, there was hardly a place in this theory for the economic study of firms beyond their consideration as one of several elements in the mechanism of markets, where they serve to make pricing possible. In fact, prices arise from the meeting of supply and demand, and in order to explain the creation of prices, it in necessary to identify the suppliers and demanders who compete in that market. That is where firms find their place. This concept of the role of firms in the market economy was so mechanistic and instrumental that they were described as “black boxes,” in keeping with the absolute indifference with which economics considered their raison d’être and nature.

While the academic discipline of economics was contemplating them with indifference, firms were nevertheless gaining presence and visibility in society. Especially, they were growing larger and more diversified in the forms they adopted for their internal functioning. The division of labor became so much a part of their inner workings that, beyond functions and tasks directly related to production, posts were also created to oversee the assignment of resources—a function that market logic had assumed to be carried out by the system of prices. Administrative functions within firms are complex enough that the persons carrying them out seek professional training beforehand. Business schools have been created to respond to the training needs of business management (one of the most prestigious, the Harvard Business School, is now celebrating its one-hundredth birthday).

A sort of specialization has thus arisen that separates economics, as an academic discipline dedicated to the study of how markets function and prices are created, and professional business administration schools, which are dedicated to meeting the demand for trained specialists in management positions. Teaching and research into management has thus become the area for studying specialized administrative functions in firms, from personnel directors to general management, including finances, marketing, and operations. At first, this training revolved almost entirely around case studies and teachers’ personal experiences. The situation changed in the 1960s when a report on the teaching of business administration in the US, commissioned by the Carnegie Corporation and the Ford Foundation, recommended that universities base their teaching of this subject on rigorous academic research, especially economics and behavioral sciences (2).

In response to this recommendation, business schools broadened their teaching staff to include academic economists, along with professors and researchers from other scientific, technological, and social disciplines. At the same time, firms and management processes became the subject of growing intellectual interest. Research into firms took shape and gained substance, receiving contributions from a broad variety of academic disciplines. Economics is one of those disciplines, and economic research has a growing interest in firms themselves, without the need to subordinate that interest to the study of how markets function. This work has posed intellectual challenges to academic economists researching firms and has begun to receive attention. An article on the nature of firms, published by Ronald Coase as far back as 1937, was ignored until much later in the twentieth century. Coase considers the existence of firms, their internal nature, and the firm director’s authority, as an anomaly in economic thought that reveals the great advantage of the marketplace and the system of prices in organizing economic activity. Coase asks: If the market and prices are so effective in their functions, why are there firms in which resource management is not carried out on the basis of prices but rather according to the orders and authority of managers?

Orthodox economics have always recognized the limitations or failures of the market to harmonize individual rationality (private profit) and collective rationality (social wellbeing) in specific contexts. But in those “situations of disharmony, economic policy’s normative prescription calls for intervention by the state in order to reconcile conflicting interests. Coase warns that the market’s limitations or failure to direct (coordinate and motivate) the processes of resource assignment cannot always be resolved by state intervention. When possible (that is, when legislation and transaction costs allow it) institutions will arise in the private sector (ways of directing resource assignment that are not based on market prices) that help overcome the market’s limitations without direct intervention by the state. To Coase, firms exemplify an institution that arises in the private sector when the coordination of resource assignment is most efficient if carried out by the visible hand of the firm director rather than by the invisible hand of the market. Firm and market switch roles to organize exchange, exploiting comparative advantages and suggesting an institutional specialization in terms of relative comparative advantage.

Over time, economics’ contribution to the study of firms has defined two fields of interest that remained separate until just a few years ago. One is the interest in explaining the limits of firms, while the other seeks to explain their internal organization. The limits of a firm have been defined horizontally and vertically, while their inner workings are viewed in terms of problems of coordination and problems of motivation. The study of the horizontal limits of firms has concentrated mainly on explaining the size of a firm in terms of its volume of production (or use of resources needed for that volume, including, for example, the number of workers employed). This explanation relies, fundamentally, on two predetermined variables: the efficient scale of production, and the size of the market. If the market is sufficiently large, competitive pressure will force firms to converge toward a size close to the scale that insures a minimum of production costs (efficient scale). Differences in production that minimize unit costs (differences in production technology and degrees of presence of growing returns to scale) explain the heterogeneity of firm sizes. When market size is small with relation the efficient scale, one can expect the market to be dominated by a single firm, in what has come to be known as a natural monopoly. From a dynamic perspective, a change in the horizontal limits of a firm can be explained by changes in technology or market size.

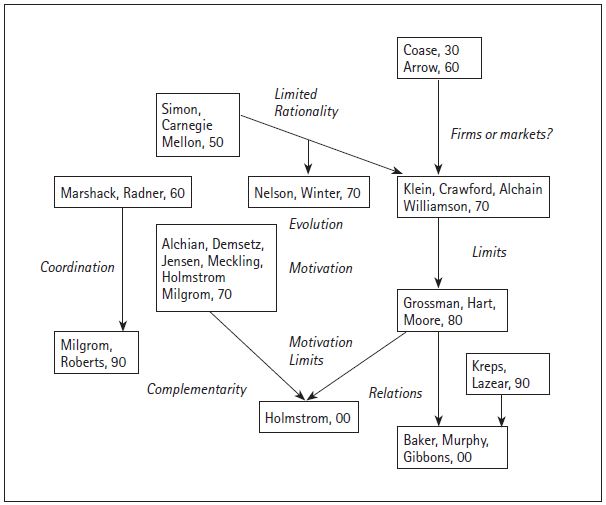

The study of the horizontal limits of firms is part of the broader neoclassical theory of production, in which production technology is summed up as a function that represents the most advanced technological knowledge available at the time being studied, in order to transform resources into goods or services of greater value or utility. This representation of technology and the price of resources is used to derive the functions of unit cost and supply mentioned above. When carefully studied, the theory of production explains the size of production units (production plants) but doesn’t explain the influence of business administrators, which is what defines the perimeter of a firm, according to Coase. That theory fails to explain why some firm executives direct a single production plant while others direct several. The study of the limits of a firm and its internal organization—firm theory—includes contractual considerations such as availability of, and access to, information, and the capacity to process it, as well as the merely technological considerations postulated by production theory. In a nutshell, figure 1 orders and sums up, on the basis of time and thematic areas, the main contributions of firm theory from a contractual perspective, in the broadest sense. This covers the rest of the materials that have drawn the interest of the economic theory of firms.

Vertical limits

The study of the vertical limits of firms is directly tied to Coase’s observations regarding the co-participation of markets and firm executives in the coordination of economic activity and the assignment of resources. The limits of a firm coincide with the authority with which a firm director is able to direct the assignment of resources, while the market determines coordination among firms. How many resources a firm director can control, and how much activity his firm can carry out and place on the market, depend on the relative efficiency of a mechanism that coordinates one or the other. That efficiency is defined by comparing respective transaction costs. An important part of knowledge about firms’ vertical limits revolves around determinants of transaction costs from a comparative perspective: first, firm verses market, and then, firm, market, and intermediate forms of organization that include non-standard contracts in relations among firms (long-term contracts, sub-contracting, franchising, alliances, joint ventures, and so on). Early research (Arrow 1969, Williamson 1975–1985; Klein, Crawford and Alchian, 1978) concentrated mostly on those attributes that facilitate an ex ante prediction, in terms of transaction cost, of comparative advantages when resources are directed by either a firm director or the market. Uncertainty and asymmetrical information among those involved in such an exchange, as well as the specificity of assets (of various types) invested in transactions are the attributes that must, according to this theory, be most clearly discerned when explaining the vertical limit of firms. Empirical evidence supports those conclusions.

Given that specificity of assets and asymmetry of information are conditions that relatively favor the use of a firm rather than the market, and given that they occur in a very high portion of economic transactions, the TTC (theory of transaction costs) tends to predict a leading role for firms in the direction of resources in a higher percentage than is actually observed. On that premise, beginning with the work of Grossman and Hart (1986) and especially Hart and Moore (1990), the theory of property rights (TPR) offers considerations about brakes to vertical expansion by firms on the basis of an identification of the source of transaction costs to the firm, which are ignored by TTC. Particularly, the TPR emphasizes how the key to defining the limits of a firm is the distribution of ownership of non-human assets. In that sense, the TPR sees the definition of firm limits in term of the assets it owns. One important implication of this view of firms is that, since people cannot be owned—excluding slavery—workers are outside the limits of a firm.

When a firm expands its presence as a coordinating mechanism (taking on more activities under the direction of management), it is generally increasing the amount of non-human assets it owns, to the detriment of ownership by others outside the firm. Supposing that non-human assets are complementary with those specific assets that result from the investment in human capital by people; when a firm increases its control of non-human assets it is decreasing incentive to invest in human capital on the part of those who lose those assets that they previously owned. This opportunity cost of expanding the limits of a firm with more assets justifies the TPR’s prediction that the distribution of ownership of non-human assets will be spread among a greater number of firms than is predicted by the TTC.

The TTC emphasizes the transaction (transfer between technologically separable units) as the basic unit of analysis whose inclusion in, or exclusion from, the perimeter of a firm is decided in the margin. The TPR, on the other hand, emphasizes decisions about assigning the property of non-human assets as a determinant of firm limits. In both cases, one detects a certain distancing with respect to the view of united management adopted by Coase in referring to the nature of firms. One way of reconciling these differing approaches is to include a contractual viewpoint in the analysis. Ownership of assets and the hierarchy of authority attributed to the firm and its director are economically significant to the degree that transaction costs require the regulation of transactions through incomplete contracts, that is, contracts that define the general framework of relations among agents even though there are many contingencies for which particular responses have not been predetermined.

Ownership of assets implies the capacity or power to decide about their use in any sense not previously dictated by contract, while the authority that Coase attributes to firm directors is fullest when job contracts are incomplete and the director has the contractual right to direct (order) his workers. Simon (1957) was a pioneer in identifying the economic importance of incomplete contracts in relations between firm and workers although he did not relate his discoveries to the authority of contractual origin proposed by Coase. In a world where all relations among persons were regulated by complete contracts (where anything that could happen in each relation was predetermined), the ownership of non-human assets and the authority of firm executives would be irrelevant since there would be no residual rights to decision, which do indeed exist when contracts are incomplete (3).

The fact that contracts have to be incomplete (to avoid excessive transaction costs) along with the repetition of relations among agents, opens the path to another type of contract whose viability and efficacy affect decisions about the limits of a firm: implicit contracts. In effect, implicit contracts are those in which agreement between parties is based on the expectation of good faith in the other party’s conduct and mutual trust. Trust more easily emerges in interpersonal relations in which the power to make decisions is shared by all agents involved, rather than in situations where decision-making is more one-sided. In order to exploit the advantages of implicit contracts (in terms of low transaction costs), a decision about the limits of a firm (in terms of the assignment of ownership of non-human assets employed in production) will largely depend on a certain distribution of ownership. This distribution will serve to balance power and strengthen trust, forming a basis for relations among agents in the successive stages of the chain of production (Baker, Murphy, and Gibbons 2001).

Internal organization

Economic research has separated the study of firm limits from the study of what occurs within a firm with given limits. To a high degree, the study of the inner workings of a firm has more-or-less explicitly concentrated on an analysis of the manner in which firm directors assign resources, as well as the directors own raison d’être. The internal organization of a firm (the order that stems from the internal division of work, the exchange of information and the distribution of power in decision making) is achieved through the coordination (determining what each person is supposed to do) and motivation (being interested in doing it) of the persons involved. The difference with respect to a market is that, in a firm, the manner of approaching coordination and motivation is influenced by the firm director’s capacity to intervene.

Economic analysis begins by separating the study of coordination problems from the study of motivation problems, although both play a significant part in a very realistic concept of firms and their management: the team concept. In order to study coordination, the concept of teamwork is postulated. This is defined as collective action in which all involved persons share the same goal, which also represents the group’s interests. For example: maximizing shared wealth. While each person acts for the general good, what he or she must decide or do to achieve maximum efficiency and results depends on the information and actions of the other team members (interdependence). In this context, coordinating individual action means influencing individual decisions (mainly by exchanging information) in order to harmonize them in the context of the existing interdependence, or else to change that interdependence in order to thus influence the needs of coordination itself (Marshack and Radner 1972; Milgrom and Roberts 1995). In team organizations, coordination becomes a relevant problem because there is a considerable cost involved in producing and transmitting information. Thus, the solutions to coordination problems discussed in articles, as well as those applied by firms, have had much to do with advances in information technology.

On the other hand, production or team technology, refers to complementarity between resources belonging to different people who cooperate in the production process so that the joint exploitation of technology creates more potential wealth than individual exploitation would. Alchian and Demsetz (1972) place this characteristic of technology at the origin of firms as we know them, analyzing the collective functioning of team production with the opposite suppositions of team organization. That is, that people who contribute complementary resources to production do so with the expectation of obtaining a maximum net individual reward regardless of the collective interest. Technology and teamwork lead only to coordination problems; team technology plus overlapping individual interests (also called coalition) lead to coordination problems and also to other motivation problems, which have attracted the greatest academic interest.

Team technology impedes a consideration of joint production as the sum of individual production by those who participate in it. The individual benefits that lead to participation in collective action and motivate the contribution of resources by each agent involved can only be defined in terms of joint production and contribution of resources, if these are observable. In principle, compensating participation in collective action with participation in joint output has the advantage of needing to measure only one variable. Nevertheless, it has disadvantages known as stowaway behavior (Holmstrom 1982). The alternative to measuring resource contribution (quantity and quality) demands specialization in that task and a capacity to address the question of how to insure the efficiency of whoever is monitoring the process. Alchian and Demsetz offer an organizational solution in which the monitor bilaterally contracts each participant in a collective action, agrees on a compensation commensurate with the amount of resources he or she has contributed, acquires the right to supervise his activity and direct his work, and retains the difference between what is produced and what he has agreed to pay, as his own compensation. In sum, firm theory gives economic meaning to capitalist firms as we know them; in which firm directors centralize contracts and act as supervisors and coordinators in exchange for residual profits.

The paradigm of team production, the bilateral character of contracts, and residual income (profit) for the firm director are the basis for successive contributions to firm theory, which characterize it as a nexus for contracts. Developments since the 1970s have taken account of the supervisor’s limitations when precisely measuring the quantity and quality of resources, as well as the unequal assignment of risks implied by retribution in the form of profits when the result of collective action depends in chance factors as well as on the resources employed and the available technology. This has led to new contributions in the organizational design of firms, such as: 1) determining the number of hierarchical levels of supervision and control (Calvo and Wellisz 1978; Rosen 1982); 2) efficiently assigning risks (for example, by creating separate collectives for the functions of director of resources, coordination, and motivation, and the functions of risk assumption, which led to the complex capitalist firm, or corporation (Jensen and Meckling 1976); 3) determining the optimal distribution of decision-making power—centralization versus decentralization (Agnion and Tirole 1997; Alonso, Dessein and Matouschek 2008); 4) designing complex incentive systems to stimulate effort that cannot be observed by a supervisor—agency theory (Holmstrom 1979, 1982; Holmstrom and Milgrom 1987, 1991) (4).

With all of this work on the theory of firm limits and internal organization, the concept of a firm draws away from the idea of production and becomes that of a structure that governs the process of assigning resources, processing information, assigning decision-making power, evaluating work and awarding recompense.

Figure 1. Contributions to the Economic Theory of Firms. Source: Salas Fumás (2007).

The firm as a mini-economy or community of persons

The economic theory of firms has unwittingly used the terms “firm” and “firm director” almost interchangeably. A careful reading of the works of Coase, and Alchian and Demsetz, reveals that they are really explaining the existence of a firm director who carries out concrete functions in the general framework of the specialization and division of work. Coase’s firm director directs resources with coordination, giving orders and taking advantage of his central position in the network of contracts with other owners of resources wherever the market and prices face imbalances in the economies of scale. Alchian and Demsetz’s supervising firm director is needed to measure the quantity and quality of resource contributions that feed production with team technology. Contractual approaches inspired by those authors, which cast the firm as a nexus for contracts, do not explain whether that nexus is the firm director in person, or an undefined entity called the “firm.” It can thus be reasonably stated that many firm theories proposed by the field of economics are really theories about firm directors. The figure that emerges from this literature complements Schumpeter’s view of this social agent as the protagonist of innovation and creative destruction.

The best way to separate the firm from its director is to consider a firm as a legal entity recognized by law as a legitimate party in contracts and the capacity to own property. The common nexus among contracts, which is identified with firms, is generally a legal entity that enters into bilateral contacts with the different agents with whom it has relations. In order for a firm director to be able to coordinate and motivate people within the firm, its contract with them must include the possibility that a third party, also contracted by the firm, can carry out those functions. In the TPR, where the limits of a firm are related to the non-human assets it owns, it is necessary to explain why this property belongs to the legal entity that is a firm, rather than to the physical person that is its director. In short, economic theories about firms will not be complete until they explain why the legal entity of the firm emerges as something different than the physical person that is its director.

Texts about these theories offer various possible answers, all of which are somehow related to the desire to economize transaction costs:

I. The firm, as a legal entity, is not affected by the temporal limitations that affect living people. A longer time span, with no finite demarcations, is relevant to the viability of relations based on reciprocity that sustain mutual trust (implicit contracts) and bring economic value to a good reputation (Kreps 1990).

II. The legal entity, complemented by the variety of legal forms a firm can take when constituted under law, offers the possibility of managing risks, directing firm resources and financing its assets, which would not be possible if people were unable to differentiate between personal assets and firm assets. The intellectual and technical entity of questions posed by a firm’s chosen legal form and the response to available options when assigning management and control responsibilities have generated a field of highly relevant studies of modern capitalist firms such as that of corporate government, where law and economics merge (5).

III. By concentrating ownership of non-human assets in the legal entity of the firm, rather than spreading ownership among the different persons who are linked by it, the firm’s directors find efficient ways of coordinating and motivating workers in contexts of asymmetrical information that would not be feasible if ownership of those assets were spread among all workers (Holmstrom 1999). With this explanation of the firm as a legal entity that owns assets, Holmstrom combines in a single problem of organizational design, decisions concerning firm limits, the assignment of ownership of non-human assets, and decisions about the coordination and motivation of work in the firm, which depend on internal organization. With this inclusive view of , Holmstrom manages to define a firm as a mini-economy whose directors wield solutions for inefficiency derived from problems of asymmetrical information and external effects in a way that resembles how the state wields authority in overall society. There is, however an important difference: a firm is surrounded by markets that offer ways out, limiting possible excesses of power derived from the high concentration of assets that can be accumulated.

As a legal entity that owns assets whose accessibility and conditions of use are decided by its directors, a firm becomes a powerful lever that affects the conduct of those persons who combine their work and knowledge with those assets. Therefore, although it is formally true that a firm does not own human capital—the persons working there are outside its perimeter—its overall functioning is better understood when the workers are considered a part of it. A theory of the firm that includes employees who are combining effort and knowledge with assets belonging to the firm will be much closer to approaches to the study of firms carried out in other social disciplines, such as psychology and sociology. From the very start, those disciplines have considered firms to be a community of persons, minimizing the relevance of its other assets, which is the opposite of what economics has done. Moreover, the link between economics and other social disciplines studying firms becomes more solid when theories employ more relaxed views of the concept of rationality, which have recently emerged in economics and other studies.

The firm as a community of persons

Economic studies of firms are carried out under the premise of human behavior characterized as rationality: people know their preferences, and their behavior is coherent with them. Rationality allows academic research to simulate the private and social consequences of specific behavior and restrictions, recommending corrections or adjustments according to the foreseeable results. Nevertheless, economic rationality has been criticized for its unrealistic suppositions and for the aspects of human behavior it leaves unexplained. Williamson (1975), in the book that reconsiders the institutional comparison between market and firm (hierarchy) put forth by Coase forty years earlier, brings criticism of the hypothesis of rationality into firm theory. This criticism was initiated by Herbert Simon and his colleagues at Carnegie Mellon when they realized that economists’ suppositions about the capacity to store and process information, implicit in utility maximization, are unrealistic in light of the physiology of the human brain.

This criticism by Simon and his colleagues led to the proposal of an alternative to the supposition of absolute rationality under which economic studies of firms and markets had been carried out. Known as limited rationality, this alternative supposition proposes that, while people are intentionally rational, their behavior is affected by the limits of their capacity to store and process information. These limits are as relevant to an explanation of reality as are those restrictions coming from technology. On this basis, the explanation of human behavior includes a supposition of heuristic decision-making, rather than the optimization predicted by the supposition of unlimited rationality. Evolution and adaptation in processes of transit from one equilibrium to another are steady states in the system and cannot be ignored as they have been by neoclassical economics, which only compares situations of equilibrium (Nelson and Winter 1982).

Laboratory experiments and the observation of reality offer evidence about human behavior that does not fit the supposition of consistency and transitivity of preferences associated with the most conventional rationality. They have led to the development of the specialized field of behavioral economics, which emphasizes prospect or reference-point theory, Khaneman and Tversky (1979), which questions the theory of expected utility used to analyze a considerable portion of behavior in risk situations when studying firms and markets. Then there is the theory of social preferences (Guth et al. 1982), which questions the classic supposition that people only consider their own payment when choosing among alternatives (see Camerer, Loewenstein and Rabin (2004) for a review of this literature). Behavioral economics marks an important reduction of the distance between economics and psychology, and one of the most recent steps in that reduction is the importation from the field of psychology of the concept of “happiness,” as an alternative to economics’ traditional concept of “utility,” when expressing personal preferences (Frey 2008). Classic economics eschews introspection as a way of explaining how people form their preferences, opting instead for the idea of preferences as a means of inferring the utility of proposed alternatives. It draws on the supposition of rationality (consistency and coherence between preferences and conduct). Research into happiness, however, adopts forms of measuring utility developed by psychology—especially neuroscience—with clearly introspective goals. The experimental results of this research indicate that people not only evaluate tangible goods and services available to them through economic income, they also base their concept of utility on less tangible aspects, such as social conditions, relations, the capacity to decide and the possibility of developing their own competence. This leads to the idea of utility associated with processes, rather than utility based solely on results, which is predominant in the most orthodox economics.

Behavioral economics are modifying the way in which we analyze how markets function (Frey refers to happiness as a concept that will revolutionize the science of economics). They also help to explain certain particularities of how firms function, which were previously considered anomalies in neoclassical models. For example, one factor regularly observed in firms is the stability in their relations with workers, with long-term contracts and internal job markets (internal promotion is the dominant mechanism to cover job openings, rather than resorting to outside hiring). The stability of such relations is partially due to the impossibility of acquiring on the market, the specific knowledge that can only be acquired through learning routines that arise from the mutual adjustment and evolving adaptation to conditions in a specific context. In that sense, the limits of a firm can be explained on the basis of the need to protect and exchange valuable specific knowledge that constitutes a competitive edge in the marketplace (Teece 1986; Kogut and Zander 1992).

This theoretical work expands the conventional model of preferences and rationality to make room for empirical regularities that appear in a historical moment when the dominant firm model in Japan (organization by processes and in highly autonomous teams oriented towards clients) brought into question firm models generated according to the empirical referent of the dominant firm model in the US (hierarchical firms), especially in light of the proven commercial success of Japanese firms in markets where they compete with American ones. Research into happiness poses a new challenge to firm theory and the management practices therein, in that people’s preferences about to how achieve results, as well as the results themselves, make it necessary to evaluate the internal organization (the design of jobs, the autonomy of the people doing those jobs, participation in decision making, mechanisms of socialization) as an end unto itself, rather than just a means to obtain better results.

Conclusion

Academic knowledge about firms is imperative to an understanding of the functioning of the overall economy because what happens inside firms is as important, quantitatively and qualitatively, as what happens among those firms (Simon 1991). It is difficult to develop a theory of firms, even if only in one academic discipline, such as economics, because the ideas and concepts generated by such a process are not at all precise in delineating the concept. In that sense, firms appear to be more-or-less explicitly associated with a technical production unit (plant), with the function of a firm director or a person in charge of directing resources, with a legal entity created under law, or with a community of people. Sometimes, firm theory addresses questions about the determinants of its limits or borders, and other times, questions associated with the solution of inner motivation or coordination problems.

In any case, economic analysis casts firms as entities that function to produce goods and services for the market in conditions of competition and financial sufficiency. To do so, they adopt one or another of the multiple judicial forms dictated by law. One aspect that differentiates a firm from the market to which it belongs is its condition as a nexus for contracts, which allows it to take the place of its director as that nexus. This central situation with regard to contracts helps to avoid multilateral contracts among investors, workers, and clients, which would be necessary in a market solution. The result is a savings of transaction costs. The fact that the nexus is a legal entity facilitates the accumulation of assets and the management of risks, as well as internal management in the face of asymmetrical information and external effects. None of this could be achieved if that nexus resided in a physical person, rather than a legal entity. While each judicial form imposes certain restrictions on how problems of coordination and motivation are resolved (in order to reduce aggregate transaction costs), they all leave enough freedom so that each can adopt solutions most compatible with the characteristics of the transactions in which agents are involved. Moreover, the dominant form taken by firms changes over time and in different countries with similar levels of economic development during the same time period, but this should not lead us to forget that the firm is a human invention and is thus subject to modification and transformation in keeping with technological conditions, including developments in information technology and institutional changes (legal systems) (6). Firm theory seeks to identify basic problems of coordination and motivation that are structurally permanent but allow different solutions in different surroundings and conditions.

Knowledge of firms as an institutional response to problems of exchange and collaboration arising from the division of labor should not be confused with knowledge of business administration (management) that is transmitted to those who hold, or seek to hold, management positions in the world of business. It would seem to be a good idea for the positive knowledge of firms offered by theory to become a part of the normative knowledge about how to run a firm that is taught in business schools, but that is not currently the case. One explanation for this distance between normative and positive knowledge is that firm theory presupposes an absolute rationality of behavior by agents, and its interest lies exclusively in discovering the implications of that individual rationality for collective wellbeing. This explanation fails when decisions and conduct by firm directors are difficult to reconcile with the rationality on which the theory is based. Advances in behavioral economics and the introduction of the concept of happiness in the introspection of preferences and utility serve to bring positive and normative knowledge about firms closer together. That way, firms may no longer be considered instruments or means to obtain the best possible economic results (greater income and consumption), as they are by conventional economic analysis; instead they may be evaluated in terms of the concrete solutions they adopt in the presence of internal problems of coordination and motivation. Means and results should be evaluated together, although one or the other might have greater social importance. References to ethics and social responsibility on the part of firms in recent years may well indicate that society is showing preferences as to how the performance of firms should be evaluated, above and beyond their results.

Bibliography

Aighon, P. and J. TIROLE. “Formal and real authority in organizations.” Journal of Political Economy, 105, 1997, 1–29.

Alchian, A. and H. Demsetz. “Production, information and economic organization.” American Economic Review, 62, 1972, 777–795.

Alonso, R., W. Dessein, and N. Matouschek. “When does coordination require centralization?” American Economic Review, 98, 2008, 145–179.

Arrow, K. “The organization of economic activity. Issues pertinent to the choice of market versus non market resource allocation.” In US Joint Economic Committee, The analysis and evaluation of public expenditures. The PBS system, 1969.

Baker, G., R. Gibbons, and K. Murphy. “Relational contracts and the theory of the firm.” Quarterly Journal of Economics, 117, 2001, 39–83.

Calvo, G. and S. Wellisz. “Supervision, loss of control and the optimal size of the firm.” Journal of Political Economy, 87, 1978, 943–952.

Camerer, C., G. Loewenstein, and M. Rabin. Advances in Behavioral Economics. Princeton: Princeton University Press, 2004.

Castells, M. The Rise of the Network Society. Vol. 1: The Information Age: Economy, Society and Culture. Berkeley: University of California Press, 1996.

Chandler, A. Strategy and Structure. Cambridge: MIT Press, 1962.

—. The Visible Hand. Cambridge: Belknap Press, 1977.

Coase, R. “The nature of the firm.” Economica, 4, 1937, 386–405.

Dimaggio, P., The Twenty–First–Century Firm. Princeton: Princeton University Press, 2001.

Frey, B. Happiness: A revolution in economics. Cambridge: MIT Press, 2008.

Gintis, H., S. Bowles, R. Boyd and E. Fehr. Moral Sentiments and Material Interests: The Foundations of Cooperation inEconomic Life. Cambridge and London: MIT Press, 2005.

Grossman, S., O. Hart. “The costs and benefits of ownership: A theory of lateral and vertical integration.” Journal of Political Economy, 94, 1986, 691–719.

Guth, W., R. Schmittberger, and B. Schwarze. “An experimental analysis of ultimatum bargaining.” Journal of Economic Behavior and Organization, 3, 1982, 367–388.

Hansmann, H. The Ownership of Enterprise. Cambridge: Belknap Press, 1996.

Hart, O., J. Moore. “Property rights and the theory of the firm.” Journal of Political Economy, 98, 1990, 1.119–1.158.

Hayek, F. “The use of knowledge in society.” American Economic Review, 35, 1945, 519–530.

Helpman, E. “Trade, FDI and the organization of firms”, Journal of Economic Literature, 3, 2006, 589–630.

Holmstrom, B. “Moral hazard and observability.” Bell Journal of Economics, 10, 1979, 74–91.

—. “Moral hazard in teams.” Bell Journal of Economics, 13, 1982, 324–340.

—. “The firm as a subeconomy.” Journal of Law Economics and Organization, 1999, 74–102.

Holmstrom, B. and Milgrom. “Multitask principal–agent analysis: Incentive contracts, asset ownership and job design.” Journal of Law, Economics and Organization, 7, 1991, 24–52.

—. “Aggregation and linearity in the provision of intertemporal incentives.” Econometrica, 55, 1987, 308–328.

Jensen, M. and W. Meckling. “Theory of the firm: managerial behaviour, agency costs and ownership structure.” Journal of Financial Economics 3, 1976, 305–360.

Kahneman, D., A. Tversky. “Prospect theory: An analysis of decision making under risk.” Econometrica, 47, 1979, 263–291.

Kandel, E. and E. Lazear. “Peer pressure and partnerships.” Journal of Political Economy, 100, 1992, 801–817.

Klein, B., R. Crawford, and A. Alchian. “Vertical integration, appropriable rents and the competitive contracting process.” Journal of Law and Economics, 21, 1978, 297–326.

Kochan, T. and R. Schmalensee. Management: Inventing and delivering its future. Cambridge: MIT Press, 2003.

Kogut, B. and U. Zander. “Knowledge of the firm, combinative capabilities and the replication of technology.” Organization Science, 3, 1992, 383–379.

Kreps, D. “Corporate Culture”, in J. Alt, K. Shepsle edrs. Perspectives on Positive Political Economy. Cambridge: Cambridge Uni. Press, 1990.

Malone, T. H., R. Laubacher and M. Scott Morton (eds.). Inventing the Organizations of the 21st Century. Cambridge: MIT Press, 2003.

Marschak, J. and R. Radner. Economic Theory of Teams. New Haven: Yale University Press, 1972.

Milgrom, P. and J. Roberts. Economics, Organization and Management, New Jersey: Prentice Hall, 1992.

—. “Complementarities and fit: Strategy, structure and organizational change in manufacturing.” Journal of Accounting and Economics, 19, 1995, 179–208.

Nelson, R. and S. Winter. An Evolutionary Theory of Economic Change. Cambridge: Belkman Press, 1982.

Roberts, J. The Modern Firm. Oxford: Oxford University Press, 2004.

Rosen, S. “Authority, control and the distribution of earnings.” Bell Journal of Economics, 13, 1982, 311–323.

Simon, H. “A formal theory of employment relationship.” Econometrica, 19, 1951, 293–305.

—. “Organizations and markets.” Journal of Economic Perspectives, 5, 1991, 25–44.

Teece, D. “Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy.” Research Policy, 15, 1986, 285–305.

Tirole, J. “Corporate governance.” Econometrica, 69, 2001, 1–35.

Williamson, O. Markets and Hierarchies. Nueva York: Free Press, 1975.

—. The Economic Institutions of Capitalism. New York: Free Press, 1985.

Notes

- DiMaggio (2001) and Roberts (2004) offer an integrated view of the recent past and future of firms from different disciplines—sociology and economics—that are, nevertheless, complementary. See also: Malone et al. (2003) and Salas Fumás (2007).

- Handler (1962, 1977) offers historical documentation of the growth of large firms in the US in the early twentieth century, and of the development of the professional manager. A view of the role of business schools in the training of professional directors can be found in Kochan and Schmalensee (2003), a book written on the occasion of the fiftieth anniversary of the Sloan School at MIT.

- The empirical referent of the theory on the limits of a firm is made up by the firm’s decisions to make, buy, or establish alliances with third parties. In recent years, terms such as outsourcing and offshoring have been added to characterize the relocation of activities of a firm’s value chain on global markets. The theory of firm limits has fully entered studies of the multinational firm (Helpman 2006).

- In reviewing this literature, we find that, rather than configuring a theory of firms, it defines a field of study: the economics of information. Many of the problems of transactions in conditions of asymmetrical information that are analyzed with models adverse selection or moral risk are not limited to firms; they also occur in the domain of markets. Therefore, agency theory is not firm theory, but rather a theoretical framework for the study of problems of moral risk, some of which are part of the problems of internal organization faced by firms.

- Corporate government includes a more general subject, which is that of decisions about firm property (Hansmann 1996). Tirole (2001) offers a view of the problem of governing a firm that fits the contractual perspective adopted in this text.

- With the development of information and communications technologies (TIC), new models of firms and firm business emerge—Microsoft, Intel, Cisco—as the empirical referents, replacing Ford and GM (referents until the 1980s) and Toyota (in the late twentieth century). The new firm model refers to the virtuality and network structure adopted by firm organization and breaks with the tradition of lasting relations (life employees, long-term contracts with suppliers, client fidelity) that were predominant in earlier firms. If the view of a firm as a human community has any reason to exist in this new setting, it must be reinvented (Castells 1996).

This text is largely based on the author’s book, El Siglo de la Empresa, published by the BBVA Foundation.

Comments on this publication