The nature of risk: a sociocultural approach

Quantitative definitions of risk are not the only possible approach. Mary Douglas and Aaron Wildavsky, in their “Risk and Culture: An Essay on the Selection of Technological and Environmental Dangers” (1983) defined the “Cultural Theory of Risk”. According to them, the perception of risk, in terms of how highly we value it and how we act as a result, depends largely on our sociocultural context.

Let’s consider the implications of this definition from a slightly different perspective. The philosopher David Hume, the leading exponent of the empirical school, said that knowledge could only come from evidence, and that any other kind of analysis could give rise to error. Rain causes wetness because this has been demonstrated empirically, and it is impossible to reach this knowledge in any other way. Forcing the argument to the extreme, a cow does not exist if I do not see it; or at least, I have no way of demonstrating its existence. Or, using an argument from the world of physics, the cat is alive and dead at the same time, as long as we cannot see inside the box (the Copenhagen interpretation of the famous Schrödinger’s cat).

In mathematical models the value given to risk is quantified according to the loss of value or return that financial assets, a business line, or a strategic decision may given. In other words, risk is a reality that exists per se, independently of the observer.

The Cultural Theory of Risk attributes a non-objective dimension to risk itself: it depends who is valuing it. At the extreme, once more forcing the argument, risk will exist or not according to who the observer is.

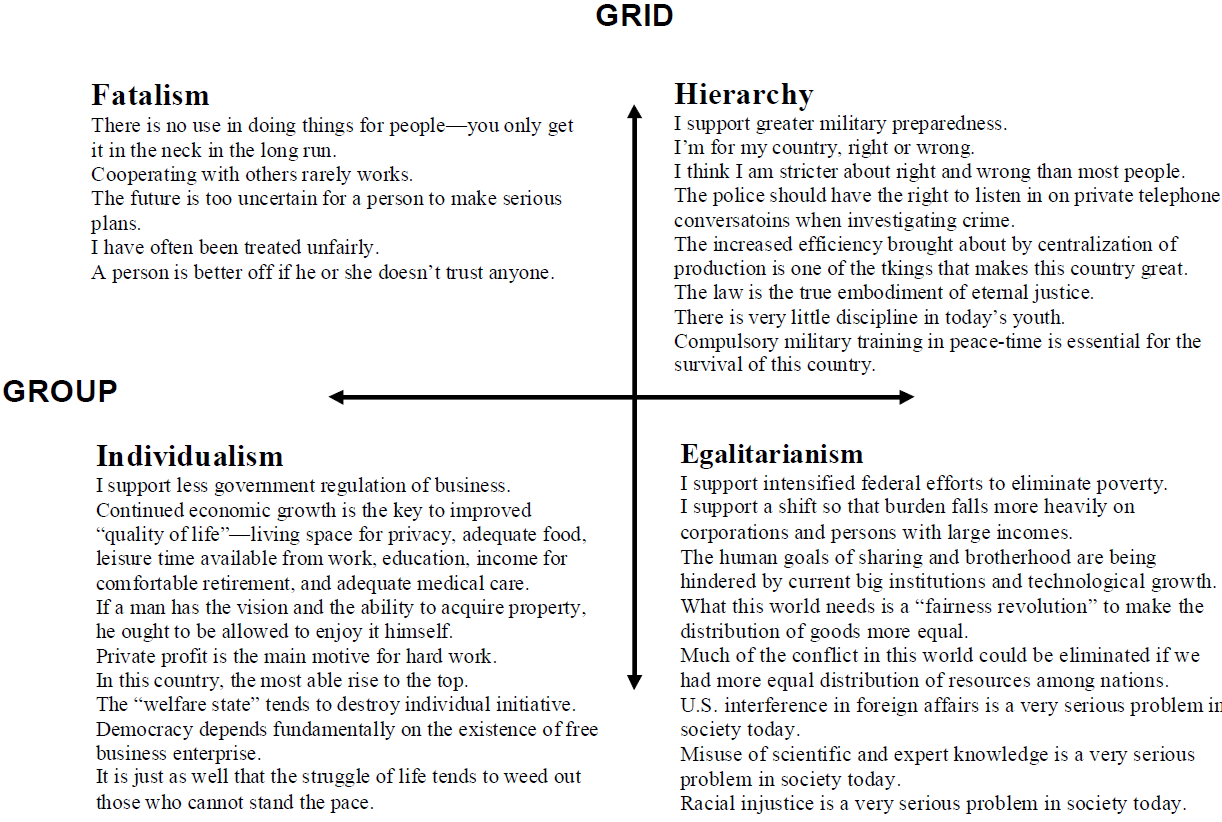

And there are two dimensions that influence the observer, according to Douglas and Wildavsky:

- The Group dimension is a straight line on which individuals position themselves according to the value they give to individualism. At one extreme, meritocracy and individual independence; at the other, the recognition of the inter-dependence and co-dependence of people in society.

- The grid dimension represents and orders the beliefs of individuals about how to organize a society: from a highly stratified point of view with very differentiated roles at one extreme, to more egalitarian positions with a total lack of hierarchy at the other.

People position themselves in each of the four quadrants according to their preferences and beliefs.

The importance they give to problems, how they prioritize them, the solutions they propose and the risks they incur so that these solutions can be successful will depend on the quadrant in which they are positioned. Risk therefore takes on a dimension according to the person’s sociocultural reality.

Karl Dake (1991) carried out various empirical studies on the Cultural Theory of Risk. Using a system of surveys, he defined key parameters that define each of the four quadrants (Table 1. Source: Cultural Cognition as a Conception of the Cultural Theory of Risk, Dan Kahan, 2008).

According to the Cultural Theory of Risk, the risks derived from the existence of a large public sector will be much more highly rated (they will be more “expensive”) for “fatalist” and “individualist” groups (using Dake’s classification), whereas risks derived from a free market economy with no regulation will be very evident, and thus more highly rated, by “egalitarian” groups.

The work of Douglas, Wildavsky and Dake is valuable not only because of its quality, but because it has opened up new lines of research, with broad ramifications into other areas of knowledge.

Our definition of risk is therefore not a fixed structure. Risk is not a mental concept with a real manifestation to which we can anchor ourselves and that can be used as a reference in any circumstances. In fact, risk takes on its justification and its value precisely from the context. This is therefore one of the first and most notable conclusions that we can obtain on the nature of risk.

If you missed the second part of this theory, click here.

Pedro Agudo

Economist, BBVA

Comments on this publication