As in previous industrial revolutions, there is nothing inevitable or predetermined about the effects of the digital revolution. Its consequences on productivity, consumption, employment, inequality, and other determinants of social welfare will depend on the design and implementation of public policies for the management of the technological transformation of our societies. Governments, firms, and workers need efficient, coherent, and comprehensive strategies subject to permanent evaluation that make the most of the opportunities offered by new technologies in key areas such as human capital, the labor market, competition, and the regulation of goods and services markets, as well as a redesign of the welfare state and a new social contract to reduce inequality. The success of these policies will determine the extent to which our societies will be able to increase productivity, create employment, and grow in an inclusive manner, thereby increasing social welfare.

We are witnessing a new wave of technological progress with enormous but uncertain potential to profoundly transform our societies. This trend, together with globalization and the demographic changes associated with it, is generating far-reaching changes in the global economy.

Despite the fact that the process of economic growth is almost exclusively related to industrial revolutions and is thus relatively recent in human history, social adaptation to technical change has generally been a slow and, therefore, reasonably smooth process. It took between three and five decades for the use of some of the main innovations brought by the Second Industrial Revolution—such as electricity, the telephone, or the automobile—to become widespread. The impact of these innovations and the social changes that public policies were required to address also occurred gradually, so that individuals, firms, and the societies of the time as a whole were able to come to terms with them. In the case of the digital revolution, however, there are indications that changes are taking place more rapidly, reducing the response time available to successfully deal with the new challenges it brings. The success of this response will determine our societies’ capacity to improve productivity, create employment, and grow in an inclusive way, thereby increasing our social welfare.

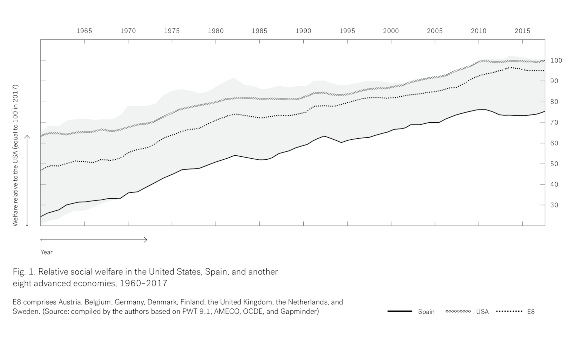

Evidence from the past two centuries allows us to draw various lessons regarding the importance of effectively managing this process of change. Firstly, that the significant increase in social welfare in advanced economies (as shown in fig. 1 from 1960 to the present) and in most of its determinants (per capita consumption, leisure, and life expectancy) is due to technological progress. Secondly, the uptake of innovations is not always simple and, as such, not without costs to individuals and society as a whole. For instance, the new technologies and production methods and the new goods and services available may have harmful effects on the environment or very diverse consequences on different social groups and occupations, with significant implications for inequality. Thirdly, not all countries have been able to capitalize on this progress to the same extent, or to do so in a way that is inclusive for the majority of their citizens, giving rise to economic and social miracles and also failures, examples of which abound in recent history.

The digital revolution does not call for heightened optimism about the ability of robots or of artificial intelligence to do our work while we enjoy more leisure and higher levels of income. Nor does it call for the pessimism of those who think we are heading for technological unemployment, and bound to lose both our jobs and our livelihood to robots. There is no call for utopias or dystopias, but for a balanced analysis of its possible effects in the reasonable timescale of the next two or three decades. Machines and algorithms will not by any means destroy all jobs, but they will destroy some of them while others will be created. If past experience is a useful guide for the future, we can expect the overall balance to be positive. Even so, individuals and firms may lack the capacity to adapt, and those who lose their position may find it difficult to access the new opportunities. This may lead to social polarization in employment status (employed vs. unemployed) and in the quality and remuneration of available jobs. This polarization, and the resulting threat of greater inequality, is a risk to guard against. (See fig. 1)

Fig. 1. Relative social welfare in the United States, Spain, and another eight advanced economies, 1960–2017. E8 comprises Austria, Belgium, Germany, Denmark, Finland, the United Kingdom, the Netherlands, and Sweden. (Source: compiled by the authors based on PWT 9.1, AMECO, OCDE, and Gapminder)

As in the previous industrial revolutions, there is nothing inexorable or predetermined about the effects of the digital revolution. Some societies will be successful because they will be able to make the most of the opportunities created by these changes to increase employment, productivity, and a more equal distribution of income and wealth, thus enhancing social welfare. At the other extreme, those countries which fail to adequately manage this process well may see an increase in unemployment and inequality, with sluggish or stagnant productivity. Even if it is managed well, there is no way to predict whether this technological, economic, and social transformation will be as successful in terms of welfare as the previous industrial revolutions eventually proved to be, even though they also went through periods of serious economic problems and social and political upheavals. Whether the Fourth Industrial Revolution currently underway will or will not end in another leap forward in welfare will depend on how it is managed. A widespread rejection of innovation and globalization may provoke a backlash. In this case, some societies will lag behind others and will not be able to take advantage of opportunities created by new technologies.

Well-designed public policies will be required to strengthen the positive effects of technological change in the four key areas that affect us all: as consumers, as workers, as entrepreneurs, and as taxpayers and beneficiaries of the welfare state. It is necessary to improve the efficiency and equity of the labor market, to strengthen high-quality, inclusive education and lifelong learning, to support the increased use of new technologies, to ensure that these new technologies do not reduce competition in the markets but work for the benefit of all, and to apply redistributive measures that mitigate the negative effects of technological change wherever they arise. Success on these fronts will strengthen all, in what should be a comprehensive and coherent economic policy strategy for governing digital societies. A strategy that we need to implement quickly and effectively, with the help of an important ally: technological innovation itself. Used wisely, new technologies can be placed at the service of these public policies to identify new needs, design solutions, deploy measures quickly and efficiently, streamline processes, reduce costs and improve services, evaluate results, and select the characteristics and beneficiaries of effective redistributive measures.

Education and New Digital Skills

The digital revolution favors certain skills and types of knowledge at the expense of others. In general, many of the jobs that are created by new technologies require more skills and abilities than the jobs that are destroyed. Skills-biased technological progress tends to increase the wages of workers with higher qualifications, compared to lower-skilled workers. But with many recent innovations, the relationship between human capital and employment has become more complex. The new robots and algorithms pose a significant risk of automation of jobs with a greater proportion of routine tasks, which do not always correspond to those with higher or lower qualifications. For this reason, it is necessary to ensure that investment in human capital is increasingly geared toward developing skills that are complementary to robots and artificial intelligence. Complementary in a double sense: skills that are unachievable by robots (at least within a reasonable timeframe), and that allow collaboration between machines (or software programs) and workers, increasing their productivity. The prerequisite for achieving these complementary skills is education—both before entering the labor market and through continuous training in increasingly complex, changing working lives—to secure equal opportunities and ensure that everyone can benefit from the digital revolution.

To start with, however, there are major differences between countries in human capital endowment. The educational level of adult populations varies greatly, even among advanced economies, as a result of differences in early leavers from education and training, in the quality of the education received during the years of schooling, and in the access to continuous training. It thus comes as no surprise to find a huge gap between different countries in cognitive and professional development skills such as reading and numerical skills, and problem-solving in computerized contexts.

The new occupations will increasingly require a capacity for analytical reasoning, critical thinking, creativity, originality and initiative, personal leadership, social influence, emotional intelligence, language command, commitment to the job, and social skills, combining technical and humanistic education and with the ability to manage and coordinate teams and projects. But it would be unrealistic to think that we all have to become “superworkers” with all those attributes. It is essential for each person to find where they fit into the production process, and to thrive in this ever-changing and dynamic world. Given the range of skills that can be useful in the digital world of the future, with new or totally modernized occupations, the parameters of what is considered a good education will shift and continue to change over time. A good basic education, flexibility, and adaptability will be decisive for success in this new and changing environment. It is essential to learn to learn, and public policies must ensure high-quality programs that meet these new needs and that provide firms and workers with the opportunity to continue their training and acquire new skills where necessary.

Workers and firms, as well as public administrations, will have to identify labor market trends and anticipate the new emerging occupations and the qualifications they may require. New technologies can play a key role in detecting these needs. There are now algorithms that search the Internet and map the text of job descriptions offered by firms in the form of job characteristics. The education system and ongoing training must also increasingly use new technologies that reduce the cost of investment in education and improve educational performance, removing geographic barriers that limit access to centers of educational excellence.

Policies for a New Labor Market

Improving the human capital and skills of the working population is a necessary but not sufficient condition to achieve abundant, high-quality employment if the labor market is dysfunctional and inefficient. The variation in unemployment and temporary employment rates, and in job quality, indicates that there are major differences between countries in terms of the efficiency of labor regulations and active labor market policies. To prevent the digital revolution from generating unemployment, polarization, and unstable careers doomed to low remuneration, it is essential to remove barriers to job creation and to investment, innovation, and growth; to increase legal certainty in labor relations; to strike a balance between labor market flexibility and employment security for workers; to facilitate the financing of start-ups; and to simplify and improve labor regulations to make them more efficient. In all of these areas, and overall in the generation of a business environment that increases the level and quality of employment, the public sector plays a key role.

These active and passive labor market policies are crucial to increasing the likelihood of finding new jobs and reducing the transition costs associated with the disappearance of certain occupations

The digital revolution is introducing major changes in the hiring process. The nonconventional forms of work that have already begun to proliferate call for new measures to ensure enhanced quality and safety standards. Exploring new legal solutions while maintaining existing labor legislation and traditional contractual modalities is unlikely to suffice unless the root of the problem is addressed: the underlying differences in costs and incentives for arbitrage between self-employed and employed workers. A consistent approach requires establishing a charter of common social rights for all workers, regardless of their status, and that all of them contribute to their financing in the same way. The combination of efficient, unbiased regulations for all types of employment contracts and competition between firms in goods and services markets should ensure compatibility between the flexible labor relations required by new technologies and business models and a social protection system similar to that enjoyed by full-time workers in permanent contracts, who are now in the majority.

Another area in which the challenge of digitalization is fundamental is that of active and passive labor market policies, in order to enable rapid reallocation of the workers who are most at risk of being replaced due to the automation of the tasks they perform. These policies are crucial to increasing the likelihood of finding new jobs and reducing the transition costs associated with the disappearance of certain occupations. And they are even more important as we face a profound structural change in labor markets, rather than cyclical fluctuations. But their efficiency varies greatly among advanced economies. Some countries in central and northern Europe have effectively managed labor market policies for years, as in, for example, the “flexicurity” model in Denmark, the Netherlands, and other European countries. Education and training measures for the unemployed and continuous on-the-job training must be at the frontline in the fight to ensure job destruction does not lead to an increase in structural unemployment.

In this field, too, new technologies should be used as a way to shorten the transition period between old and new occupations. This requires a complete overhaul of the institutions responsible for providing intermediation in the labor market, both public employment services and private firms. The digitalization of work records, profiling, knowledge of the characteristics of available vacancies, and the provision of information on labor market tendencies and appropriate training courses are imperative for streamlining the job search process in both the conventional activities and the gig economy. Continuous training is not just necessary for developing new skills for those looking for employment, but also to acquire the basic financial, organizational, and management skills required to move between changing occupations and new forms of labor relations.

In a world in which “winners take most,” collective bargaining has to prevent firms from falling behind in the adoption of technology and innovation, which would jeopardize their survival. Internal organizational flexibility and collective bargaining within firms should favor the adaptation and development of new technologies, the implementation of training programs, and target-based variable remuneration to increase the workers’ share in firm profits. This more flexible collective bargaining must extend to all types of workers, including those under new forms of professional relationships. Like employed workers, independent workers on platforms must have the opportunity to defend their rights through the creation of associations, even if their bargaining power does not extend to price collusion or unjustified professional qualification requirements that may reduce competition.

Competition and Regulations in Goods and Services Markets

Market regulation is one of the key public sector interventions in the organization of economic activity. Technological change and globalization can give rise to the emergence of firms with a huge concentration of market power and externalities or asymmetries in data and information use, leading to situations that are inefficient from the economic and social point of view. One of the characteristics of many new technology firms is the fact that the fixed costs of R&D and innovations are very high, but once the technology is available (a software program, for example), the average cost of producing new units tends to zero, favoring the emergence of natural monopolies.

The digital revolution will create more opportunities, increase social welfare, and be perceived as fairer to the extent that it becomes easier for firms, workers, and consumers to access innovations and to reduce the gap with the world technological frontier, leveling the playing field and favoring conditions for increased competition. To this end, the public sector must invest in conventional, technological, and communication infrastructures; develop regulatory and legal frameworks at the national and supranational levels to reduce the uncertainty associated with the adoption of new technologies; promote the digitalization of the public administration; and foster innovation and forms of artificial intelligence with the potential to create new jobs, more productive occupations, and new forms of work that contribute to an increase in social welfare.

New technologies should be used as a way to shorten the transition period between old and new occupations. This requires a complete overhaul of the institutions responsible for providing intermediation in the labor market, both public employment services and private firms

As well as closing the digital divide, public policies should prevent new sectors and firms from gaining excessive market power that limits competition and innovation to the detriment of social welfare. Competition policy must closely monitor changing market conditions and ensure there is effective competition between firms. Measures that can be used to achieve this objective include the diffusion of technological advances and patents to facilitate the entry of new competitors and the financing of start-ups; the protection of consumer rights; access to big data, supercomputers, and cloud computing; and data sharing, when permitted by data owners.

The use of big data helps make our lives easier and more creative. But competition policy must ensure the neutrality of access to information by all firms, so that the IT giants do not gain leverage from the use of their existing user data in the case of the vertical integration of new products and services in their platforms. Regulations must ensure the correct use of this data and of artificial intelligence for the benefit of users, protecting the right to privacy. Algorithms have to be transparent and verifiable, and they must be evaluated to prevent any type of bias or illegal discrimination in their design. Policies should promote the use of “sandboxes,” pilots, and experimental protocols, as in the case of self-driving cars, for example.

Lastly, a crucial field of action for the public sector in the use of new technologies has to do with cybersecurity, to which the usual characteristics of public goods apply (the existence of externalities, non-rivalry, and nonexclusion of potential beneficiaries). Just as ensuring national security and the physical and legal security of individuals and firms are fundamental public services, public administrations must also ensure cybersecurity in order to expand the digital economy.

Equal Opportunities and Redistribution

As in previous industrial revolutions, the available evidence suggests that the digital revolution is already having some mixed effects on workers and firms. In principle, if the net social benefits are positive, it will suffice to design efficient redistribution mechanisms to compensate those who lose out, so that they will also benefit from the new technologies and globalization. But these mechanisms must be carefully designed if they are to be truly useful and efficient, and this is not always easy. The efficiency and quality of the welfare state and institutions is essential to guarantee equal opportunities first, and then provide a safety net for individuals facing unexpected adverse situations. Societies that are already doing better in terms of equal opportunities and ex post redistribution have a head start when it comes to facing the challenges of the digital revolution in regards to inequality.

Efficient redistribution must satisfy a number of principles in order to maximize its benefits and reduce its costs. Firstly, redistribution should be carried out at the lowest possible cost in terms of management and of the use of taxes in income policies. Secondly, the beneficiaries should be properly identified so that benefits, public services, or tax reductions are provided to those who really need them. Thirdly, redistributive policies should be financed through a tax system that is as non-distorting as possible. The distortionary effects of taxes have been thoroughly studied by the optimal tax theory. To the extent that taxes generate distortions and incentives, they end up affecting economic activity, investment, innovation, and employment. It is necessary to strike a balance between an efficient tax structure (to boost innovation and employment creation) and sufficient income (to finance public expenditure and to reduce the inequality of disposable income after taxes and transfers).

Insofar as automation destroys jobs, should robots pay taxes? This proposal presents several problems. First of all, at least for the time being, automation and robots destroy some occupations but create jobs in others, so that the most automated and digitalized countries also have the lowest rates of unemployment. Just as there is no reason to fear mass technological employment for now, there is also no reason to tax the use of robots, at least in the near future. On the other hand, it makes no sense to discourage the production of new goods and services or the adoption of available technologies that increase productivity, lower production costs, and eliminate the need to employ workers for dangerous or unpleasant tasks. In any case, it is very difficult to quantify how many jobs are directly affected by new technologies, and thus to determine the appropriate tax base for a hypothetical tax of this kind. Lastly, given globalization, internationally tradeable activities that do not incorporate robots or available technologies because of these taxes would be at the mercy of foreign competition, jeopardizing the survival of firms and their jobs.

The digital revolution will create more opportunities, increase social welfare, and be perceived as fairer to the extent that it becomes easier for firms, workers, and consumers to access innovations and to reduce the gap with the world technological frontier

Since the objective must be to distribute the new wealth, not impede its creation, it makes more sense to tax profits through corporate taxation, regardless of the technologies they are using. Or to expand other taxes that, even if distortionary, do not directly affect the incentive to innovate, which would eventually stall the engine of economic growth. If innovation were to lead to higher unemployment in the long term, it would be necessary to fight inequality through more intensive redistribution of income, with gradual increases in the taxes that can raise the most revenue with less distortions in employment, innovation, and productivity.

On the expenditure side: is “universal basic income” (UBI) the best redistributive transfer? Although UBI has some advantages (it is unconditional, eliminates the risk of absolute poverty if generous enough, does not stigmatize recipients, and is easy to manage because it is universal), it would be very expensive to ensure a minimum level of well-being to all citizens. Funding a UBI would require significant tax increases. The increased progressivity and tax burden would also reduce labor supply by making work more expensive relative to leisure. At the same time, the UBI generates an income effect that encourages people to consume more and also to enjoy more leisure. Higher levels of capital taxes also discourage saving and investment, which negatively affects labor demand and productivity. The result of a lower supply and demand of labor is a lower level of employment, with ambiguous effects on wages. And globalization also increases the costs of UBI. Higher tax rates on labor and capital incomes encourage more qualified workers and internationalized firms to move to other countries with a lower tax burden. Some estimates suggest that the distortionary effects of generous-enough UBI as intended by some of its most ardent supporters could lead to significant decrease in the GDP.

Given that it is more efficient to redistribute, to those who are genuinely in need, through spending, many countries have already been running programs that are more selective, conditional, and less expensive than the UBI, such as earned income tax credits for lower-income individuals and households. The level of social acceptance of these kinds of conditional programs is usually very high, because they reduce poverty more selectively, at a lower cost, and without discouraging employment. And these wage supplement programs for employees with low pay are provided in addition to the minimum wage, which seeks to reduce wage inequality and reduce the risk that firms may have the power to set wages below productivity.

Another alternative to UBI is the participation income proposed by Anthony Atkinson: an income conditional on participation in social activities that would supplement other social security benefits and allowances. Contribution to society is understood in a broad and not exclusively economic sense, through work, education and continuous training, active job search, or the care of children and the elderly, except in the case of illness or disability. Participation income is very general, but it would explicitly exclude individuals who in the hypothetical case of receiving this income would choose to devote their time to leisure. Atkinson himself proposed starting to implement the participation income with a child income program in the European Union.

Before launching new redistribution mechanisms to deal with problems that do not yet exist—such as massive technological unemployment—we must fully exploit the margins of the existing welfare state policies and improve their coverage and efficiency, as some societies are already doing. At least in the short term, there are options that are more economically sound and viable than UBI, with the potential to achieve better outcomes in the fight against inequality, particularly against extreme inequality and poverty.

Here again, new technologies can help improve the results of existing policies, as the Opportunity Insights project in the United States is doing, for example.2 Artificial intelligence applied to big data makes it possible to identify the beneficiaries who really need assistance in the form of wage supplements, guaranteed minimum income, school aid, or subsidies for intergenerational and geographical mobility, or to eliminate child poverty. New technologies could also be used to determine optimal minimum wages, so as to reduce the power of monopsonists without jeopardizing employment. For all of this, it is necessary to consolidate information on all the social benefits, aid, and subsidies provided by all public administrations, on recipients and their socioeconomic conditions, and on the characteristics of firms and employees.

Toward a New Social Contract

The digital revolution is giving rise to a new society. The social contract and the welfare state that emerged after the Second Industrial Revolution were crucial to the prosperity of most societies in advanced economies, and did much to reduce the high levels of inequality in the first third of the twentieth century. Now, with the digital revolution, it has become necessary to rethink and redesign the welfare state. Failure to do so may give rise to social antagonism that could jeopardize the actual process of technological change, as is already happening in the case of globalization. The welfare state will very soon come under pressure in terms of both expenditure and revenue. New spending policies will emerge, and it will be necessary to protect those who lose in the digital disruption process. On the revenue side, there is an erosion of the tax base due to globalization and activities in the gig economy and new forms of employment relationships. It is foreseeable that the welfare state will move away from Bismarck’s conception of the state as an intermediary guaranteeing contributory insurance (health and pensions) to those who participate in its financing, toward a more general Beveridge model that provides support for all, although taking into account the economic capacity of each citizen. In this context, international cooperation is essential, as is tax harmonization for processing income generated in the digital economy.

Artificial intelligence applied to big data makes it possible to identify the beneficiaries who really need assistance in the form of wage supplements, guaranteed minimum income, school aid, or subsidies for intergenerational and geographical mobility, or to eliminate child poverty

We do not believe that it will be necessary to reinvent the market economy in the next few decades, but only to adapt its institutions and rules so that increased income and welfare will extend to all citizens. The further we progress along this path, the greater the likelihood that society in general will benefit from technological progress, and the smaller the likelihood that it will oppose it. Faced with this challenge, the public sector has an enormous responsibility to ensure an environment in which the private sector can improve and develop its potential, while also ensuring equal opportunities. Governments have to embark on a process of permanent improvement of their efficiency, reducing administrative costs and unnecessary burdens for firms and workers. And they must lead the technological and digital transformation, providing more and better services to citizens and businesses, and constantly evaluating the effectiveness of their policies.

There are reasons to be optimistic about the future, but only if our societies are able to properly manage the changes, promoting economic growth and providing a welfare state that adapts to the new individual and collective needs. It is very likely that some countries will do this more successfully than others. The social impact of new technologies will depend on how the new challenges are managed. In this process of change, there is no trade-off between fairness and efficiency: societies that are able to design a welfare state that works more efficiently will make the most of new technologies to increase social welfare, while at the same time attaining lower levels of inequality and greater intergenerational equity.

Comments on this publication