In this paper, we argue that the effects of artificial intelligence (AI) and automation on growth and employment depend to a large extent on institutions and policies. In the first part of the paper we survey the most recent literature to show that AI can spur growth by replacing labor by capital, both in the production of goods and services and in the production of ideas. However, AI may inhibit growth if combined with inappropriate competition policy. In the second part of the paper we discuss the effect of robotization on employment in France over the 1994–2014 period. Based on our empirical analysis on French data, we first show that robotization reduces aggregate employment at the employment zone level, and second that noneducated workers are more negatively affected by robotization than educated workers. This finding suggests that inappropriate labor market and education policies reduce the positive impact that AI and automation could have on employment.

This paper borrows unrestrainedly from our article on AI and economic growth, published in Economics and Statistics (Aghion et al., 2019).

Introduction

Artificial Intelligence (AI) is typically defined as the capability of a machine to imitate intelligent human behavior. True, since 1820 our economies have seen several technological revolutions which resulted in the automation of tasks previously performed by labor. First came the steam engine revolution in the eighteenth century, then the combustion engine revolution in the early twentieth century and then the semiconductor and IT revolutions in the 1970s–1980s. However, AI goes one step further by automating tasks such as driving a car, providing medical advice or playing chess games, which we thought could never be automated.

Now, if one were asked what the effects of AI on growth and employment should be, at first glance the answer would be: AI is good for growth as it fosters productivity but bad for employment as it replaces labor by machines. Yet, in this survey we shall argue that the matter is more complicated, and that the effects of AI on growth and employment crucially depend upon the institutional and policy environment.

Let us first consider the effect of AI on growth. Since the financial crisis of 2008, secular stagnation, that is, the prospect of a durable decline in productivity growth, has become a source of concern for economists and policy advisers. One response to the pessimistic view held by Robert Gordon (see Gordon, 2012) is that the AI revolution will come to our rescue and put us back on a sustained growth path. Indeed, AI can spur growth by replacing labor, which is in finite supply, by capital, which is in unbounded supply, both in the production of goods and services and in the production of ideas. However, we will report on recent work suggesting that AI may end up inhibiting growth if combined with inappropriate institutions, in particular with inappropriate competition policy.

Similarly, we will argue that the AI revolution does not necessarily have a negative impact on employment. First, the aggregate employment impact of automation appears to be positive on skilled labor. Second, those plants that automate end up increasing employment, which suggests that labor market frictions should lie at the heart of any negative correlation one might find between automation and aggregate employment. This in turn points to the importance of education and labor market policies in determining the effect of automation on aggregate employment.

The remaining part of the paper is organized as follows: section 2 discusses the effects of AI on growth; section 3 looks at the effects of AI and automation on employment; and section 4 concludes.

1. Does AI always Boost Economic Growth?

In this section we develop two main points. First, AI has the potential to boost economic growth. Second, with inappropriate institutions, and in particular with inappropriate competition policy, AI may slow down economic growth.

1.1 Why AI Boosts Economic Growth

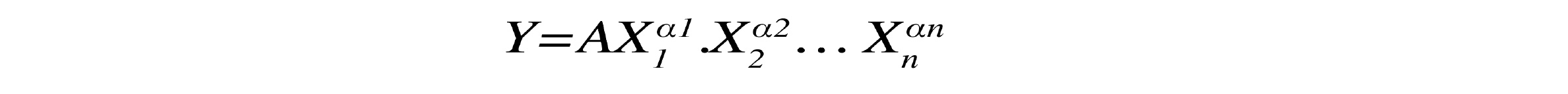

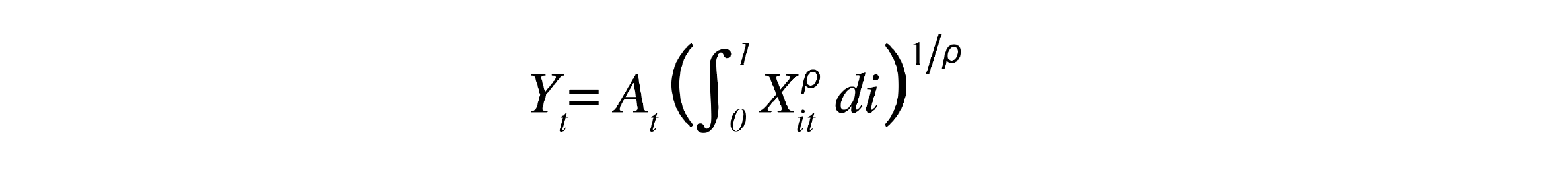

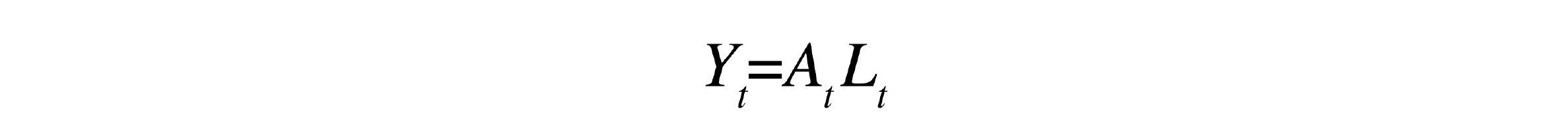

The simplest model which illustrates how AI can boost economic growth, is the model by Zeira (1998). Here we present a simple version of the Zeira model developed in Aghion, Jones, and Jones (2017). Assume that final output is produced according to the Cobb-Douglas technology:

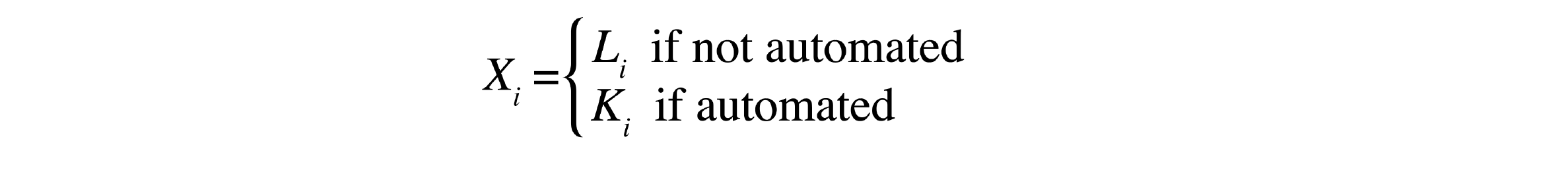

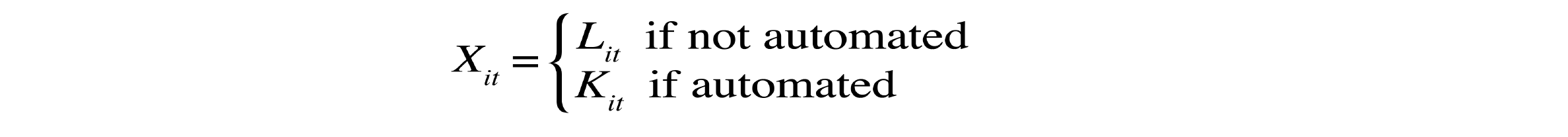

where Σαi=1 and intermediate inputs Xi are produced according to:

While Zeira thought of the Xi as intermediate goods, these can also be viewed as tasks (Acemoglu and Autor, 2011). Hence, tasks that have not yet been automated are produced one-for-one by labor. Once a task is automated, one unit of capital can be used instead of labor (Aghion, Jones, and Jones, 2017). Automation spurs economic growth as it replaces labor, which is in finite supply, by capital, which is in unbounded supply, as the basic production input. Indeed, letting K and L denote aggregate capital stock and labor supply respectively, we can express the above equation for final good production as:

where α reflects the overall share of tasks that have been automated.

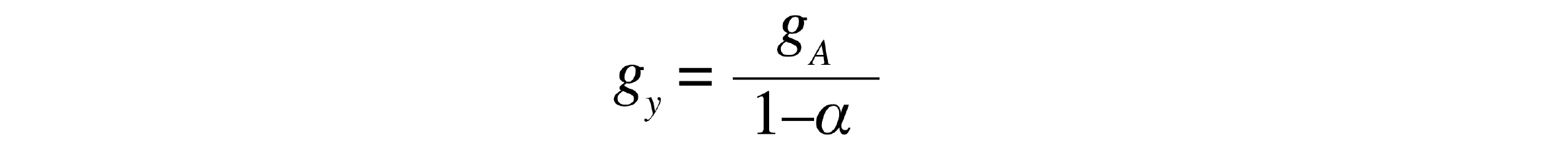

Hence the rate of growth of per capita GDP (i.e., of y=Y/L) is equal to:

Automation (e.g., as resulting from the AI revolution) will increase α, which in turn will lead to an increase in gy, that is, to an acceleration of growth. One issue with this model, however, is that it predicts a rise in capital share, which in turn contradicts the so-called Kaldor fact that the capital share tends to be stable over time.

1.2 New Tasks Replacing Old Tasks

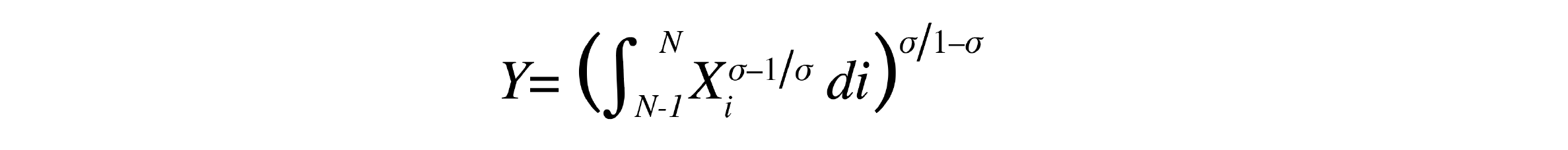

Acemoglu and Restrepo (2016) extend Zeira (1998) by assuming that final output is produced by combining the services of a unit measure of tasks X∈[N – 1, N], according to the CES technology:

The dynamics of I and N (i.e., the automation of existing tasks and the discovery of new lines) results from endogenous directed technical change. Under reasonable parameter values guaranteeing that innovation is directed toward using the cheaper factor, there exists a unique and (locally) stable Balanced Growth Path (BGP) equilibrium. Stability of this BGP follows from the fact that an exogenous shock to I or N will trigger forces which bring the economy back to its previous BGP with the same labor share: the basic intuition is that if a shock leads to too much automation, then the decline in labor costs will encourage innovation aimed at creating new (more complex) tasks which exploit cheap labor.

What makes the capital share remain constant on this BGP, is the fact that the automation of existing tasks is exactly offset by the creation of new tasks which require labor, at least initially. Note that the constancy of the capital share relies entirely on the continuous arrival of new labor-intensive tasks. The model by Aghion, Jones, and Jones (2017), which also extends Zeira (1998), proposes an alternative explanation for the constancy of the capital share and to reconcile AI with the possibility of a constant growth rate in the long run.

1.3 AI and the Baumol’s Cost Disease

In the following model by Aghion, Jones, and Jones (2017), it is the complementarity between existing automated tasks and existing labor-intensive tasks, together with the fact that labor becomes increasingly scarcer than capital over time, which allows for the possibility that the capital share and the growth rate both remain constant over time.

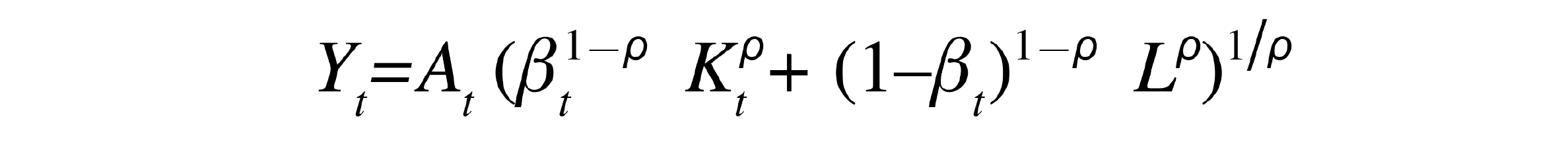

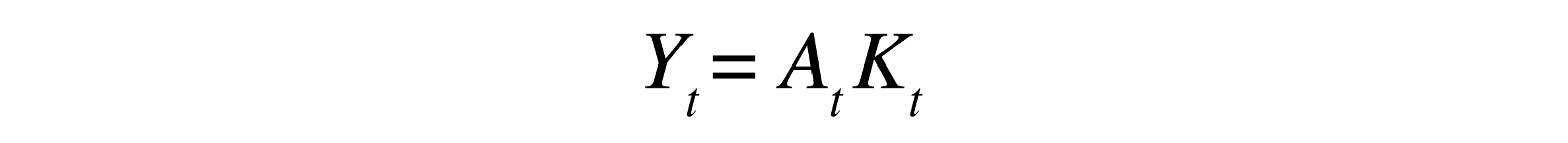

More formally, final output is produced according to:

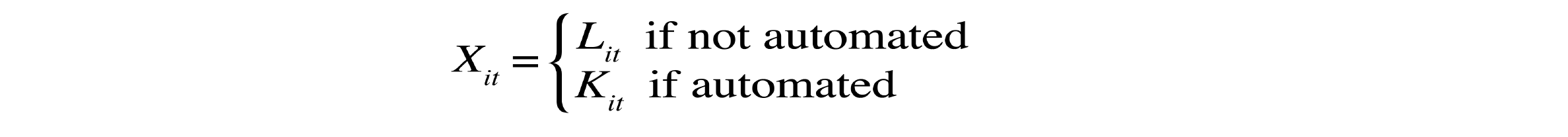

where ρ<0 (i.e., tasks are complementary), A is knowledge and grows at constant rate g and, as in Zeira (1998):

where Kt denotes the aggregate capital stock and Lt≡L denotes the aggregate labor supply.

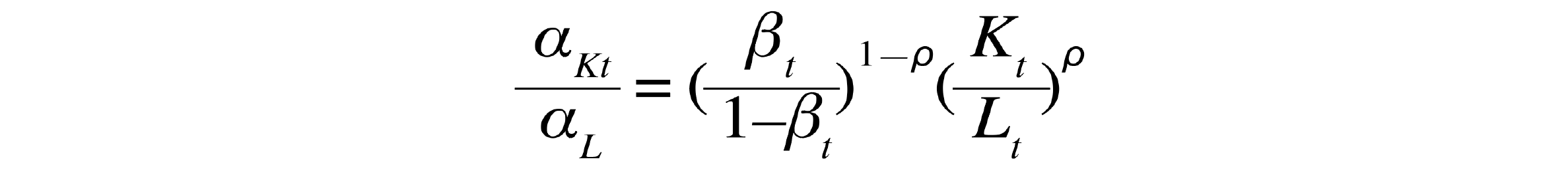

In equilibrium, the ratio of capital share to labor share is equal to:

Hence an increase in the fraction of automated goods βT has two offsetting effects on αKt/αL: (i) first, a direct positive effect which is captured by the term (βt /1–βt)1—ρ; (ii) second, a negative indirect effect captured by the term (Kt /Lt)ρ as we recall that ρ<0. This latter effect relates to the well-known Baumol’s cost disease: namely, as Kt /Lt increases as a result of automation, labor becomes scarcer than capital which, together with the fact that labor-intensive tasks are complementary to automated tasks (indeed we assumed ρ<0), implies that labor will command a sustained share of total income.

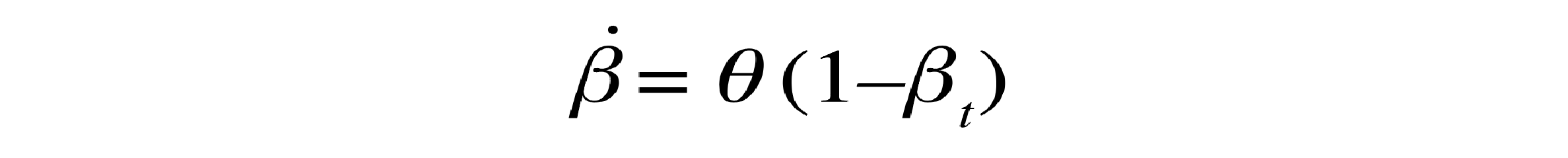

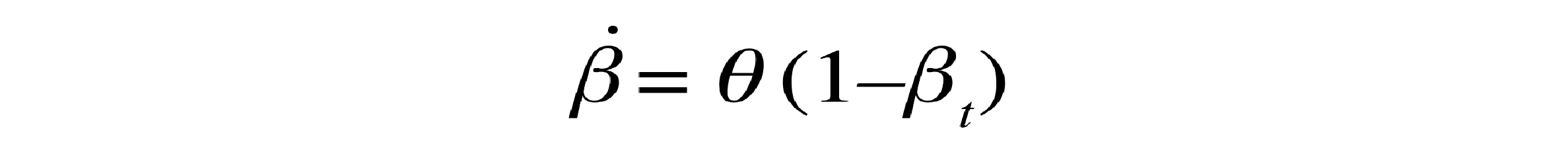

What about long-run growth in this model? Let us first consider the case where a constant fraction of not-yet-automated tasks become automated each period, that is:

In this case, one can show that the growth rate converges toward a constant in the long run.

Next, let us consider the case where all tasks become automated in finite time, that is, where βt≡ 1 for t>T. Then, for t>T aggregate final good production becomes:

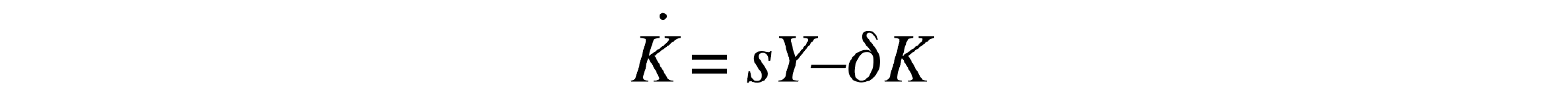

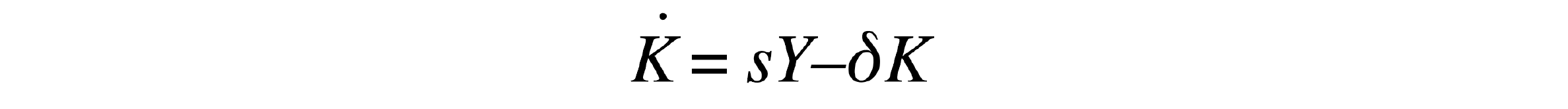

so that, if capital accumulates over time according to:

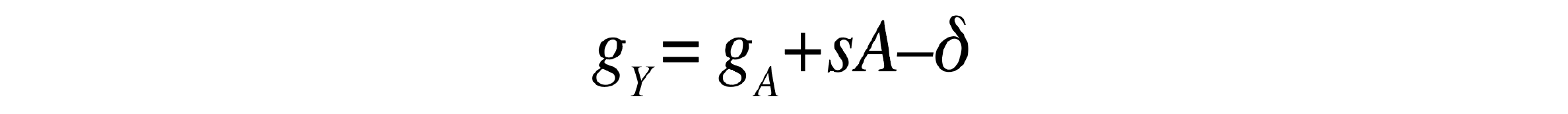

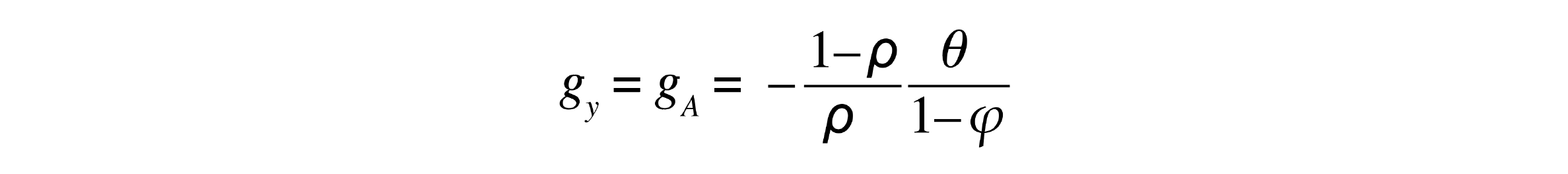

we get a long-run growth rate equal to:

which increases unboundedly over time as A grows at the exponential rate gA.

1.4 AI in the Production of Ideas

Aghion, Jones, and Jones (2017) also consider the case where automation affects the production of knowledge. Namely they consider an economy where final output is produced with labor:

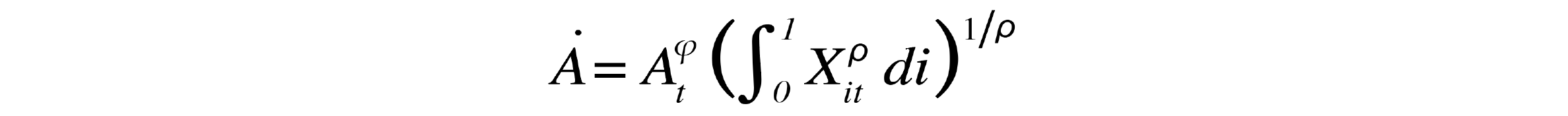

but where automation affects the growth of At

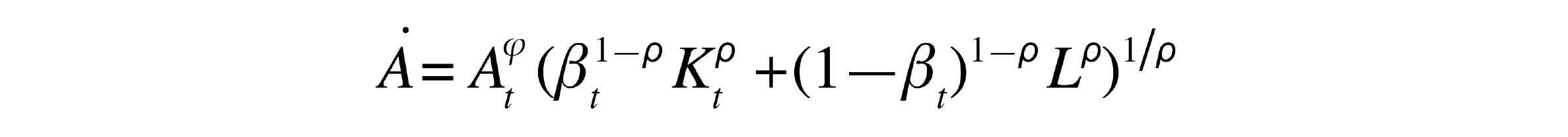

Letting βt denote the fraction of “idea-generating” tasks that have been automated by date t, then the knowledge growth equation supra becomes:

Let us first consider the case where a constant fraction of not-yet-automated tasks become automated at each period, that is:

In this case, one can show that:

Now consider the case where all tasks become automated in finite time, that is, where βt≡ 1 for t>T. Then, for t>T the growth of knowledge satisfies the equation:

where:

In this case Aghion, Jones, and Jones show that At = Yt/L becomes infinite in finite time. This extreme form of explosive growth is referred to as a “singularity.”

1.5 Why IT or AI can Generate a Growth Decline

We have not observed a surge in growth as predicted by the above models with AI, but quite the opposite: TFP growth has been sharply declining in the US since 2008, and so has the rate of new firm creation or intangible investments. At the same time, we have observed an increase in the average markup and in the degree of sales or employment concentration.

Aghion et al. (2019) propose the following explanation. Suppose that there are two main sources of heterogeneity across firms in the economy. The first one is “product quality” which improves as a result of innovation on each product line. But on top of product quality, some firms—call them “super-star” firms—may enjoy a persistent “efficiency advantage” over other firms. Natural sources of such an advantage are the organizational capital, the development of networks, or the ability to escape taxation: these help super-star firms to enjoy higher markups than non-super-star firms with the same level of technology. The story developed by Aghion et al. (2019) is that a technological revolution, by reducing the firms’ cost of monitoring each individual activity, will induce all firms to expand their range of activities. However, since super-star firms enjoy higher profits on each product line than non-super-star firms with the same level of technology, the former will end up expanding at the expense of the latter. But this, in turn, will deter innovation by non-super-star firms, as innovating on a line where the incumbent firm is a super-star firm always yields lower profits than innovating on a line where the incumbent firm is a non-super-star firm. Thus, overall, the technological revolution can result in lower aggregate innovation and lower average productivity growth in the long run, following an initial burst of growth associated with the expansion of super-star firms into more product lines.1

AI may end up inhibiting growth if combined with inappropriate institutions, in particular with inappropriate competition policy

This can explain why productivity growth in the US has declined continuously since 2005, after a burst of growth between 1995 and 2005, in the wake of the AI revolution following the IT revolution. Moreover, it also accounts for the fact that, over the past decade, the average markup has markedly increased in the US, and why this was mostly due to a composition effect: namely, the share of higher-markup firms in the economy has gone up, but markups within firms have not shown any significant upward trend.

This explanation illustrates the fact that technological revolutions like IT or AI may end up having adverse effects on productivity growth if the appropriate institutions are missing. Indeed, it is the combination of the IT revolution and the absence of appropriate competition rules that has made it possible for super-star firms to expand boundlessly, thereby discouraging innovation and entry by non-super-star firms. Here we have particularly in mind the absence of M&A regulations or the fact that super-star firms are under no obligation to share their data success with other firms. The challenge is then to rethink competition policy so that the IT and AI revolutions can fully deliver on their growth promises.

Having stressed the importance of appropriate institutions and policies for turning IT and AI into a growth opportunity, in the next session we look at the impact of AI on employment, where, again, institutions and policies matter: there we have in mind education and labor market policies.

2. Automation and Employment

2.1 A Brief Survey of the Existing Literature

Since AI is only in its infancy, empirical job data with hindsight are not available yet. It is therefore impossible for now to deliver a serious message on the potential impact of AI on employment. Hence, empirical studies have focused on automation in a broad sense and on its impact on employment. Several consequences of automation have been highlighted:

– an increase in the wage gap due to a better return on education (Katz and Murphy, 1992; Krueger, 1993; Autor et al., 1998; Bresnahan et al., 2002; Acemoglu, 2002; Autor and Dorn, 2013);

– an increase of unemployment: technological unemployment increases (Lucas and Prescott, 1974; Davis and Haltiwanger, 1992; Pissarides, 2000), manufacturing and routine jobs disappear because of automation (Jaimovich and Siu, 2012);

– the over-qualification of workers: Beaudry et al. (2013) show that there is less demand for qualified workers, who are therefore “forced” to accept underqualified jobs, while non-qualified workers may be kicked out of the labor market;

– the polarization of the labor market. Automation would give rise to more high-skilled and low-skilled jobs, while crowding out medium-skilled jobs (Goos and Manning, 2007). Autor and Dorn (2013) focus on the structural change in the labor market: middle-income jobs in the manufacturing sector would be replaced by low-income jobs in the service sector, which are less threatened by automation.

Some authors have tried to be prospective and to go beyond the scope of “traditional” automation by questioning the feasibility of automating jobs given current and presumed technological advances. They notably relax the assumption according to which automation could not threaten nonroutine jobs. Whereas Autor et al. (2003) argued that nonroutine tasks, such as legal writing, truck driving, medicine, selling, could not be substituted, this view has been questioned by Brynjolfsson and McAfee (2011) who advocate that automation is no longer limited to routine tasks, recalling the example of self-driving cars. Frey and Osborne (2017) have followed this path and shown that automation can also affect nonroutine tasks like legal writing or truck driving. Frey and Osborne (2017) have estimated the probability of computerization2 of 702 jobs, in order to analyze which ones were at risk, and to investigate the relationship between the probability of computerization, wages, and educational level. Their main conclusion has showed that 47% of employment in the US is at risk of automation in the next ten or twenty years, whereas only 33% of jobs have a low risk of automation. Their method is based on assessments from AI experts on the scope for automation in occupations across seventy jobs, and extended to other jobs according to their main features thanks to a probabilistic scoring method. They have also showed that there is a strong negative relationship between, on the one hand, wages and educational attainment and, on the other, the probability of computerization.

Frey and Osborne have been under harsh criticism: they condone the task content of the jobs, and do not factor in the variability of a specific occupation across workplaces. Yet, automation would put at risk some tasks rather than an entire job, therefore their method would overestimate job destruction. Arntz et al. (2017) show that when factoring in the heterogeneity of tasks within occupations, only 9% of all workers in the US face a risk of automation that exceeds 70%. Frey and Osborne also do not take account of the legal and ethical barriers which could prevent some job destruction. Lastly, their method does not integrate the response of the economy in a general equilibrium model, that is, the cost of automation, the response of wages, and the creation of new jobs. Despite technological advances, the cost of substitution between machines and labor could prevent firms from automating rapidly, especially if wages adapt. Moreover, other activities could develop and hire the redundant workers. Therefore, being prospective without reasoning in a general equilibrium pattern seems very unrealistic. Thereupon, Hemous and Olsen (2014) provide the first dynamic model to analyze the interaction between automation and the creation of new products and tasks.

2.2 Automation and Employment in the US

Getting an accurate measure of automation is crucial, and this is what recent studies have tried to do. Earlier studies were based on the measure of computers or IT (Krueger, 1993; Autor et al., 1998, Bresnahan et al., 2002), whereas recent papers investigate other measures of automation like automation-related patents (Mann and Püttmann, 2017), or the number of robots (Autor and Dorn, 2013; Acemoglu and Restrepo, 2017; Dauth et al., 2017; Graetz and Michaels, 2018; Cheng et al., 2019). As regards the impact of robots on net employment, evidence is mixed. Chiacchio et al. (2018) report negative effects—one more robot per thousand workers reduces the employment rate in six EU countries by 0.16–0.20 percentage points. Yet, Autor et al. (2015) and Graetz and Michaels (2018) find no effect of automation on aggregate employment. On German data, Dauth et al. (2017) find no evidence that robots cause total job losses, but they show a significant negative effect on employment in the manufacturing industry: each additional robot per thousand workers reduces aggregate manufacturing employment-to-population ratio by 0.0595 percentage points.

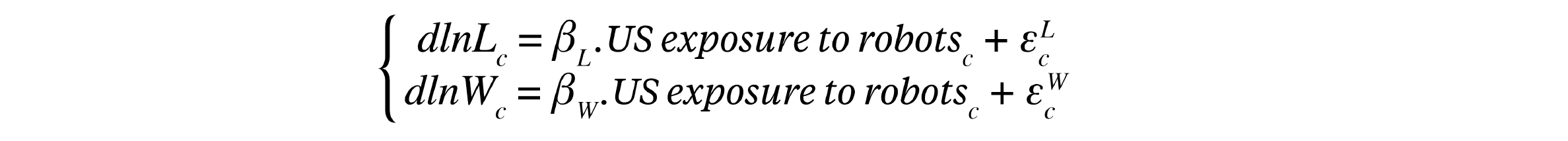

In their paper “Robots and Jobs: Evidence from US Labor Markets,” Acemoglu and Restrepo (2017) analyze the effect of the increase in industrial robot usage between 1990 and 2007 on US labor markets. They answer this question using within-country variation in robot adoption. They notably show that, for each labor market, the impact of robots on jobs may be estimated by regressing the change in employment and wages on the exposure to robots and finally find that one more robot per thousand workers reduces the employment-to-population ratio by about 0.37 percentage point and wage growth by 0.73 percent.

In detail, Acemoglu and Restrepo focus on the 722 commuting zones covering the US continental territory. For each commuting zone, they gather employment and wage data, and build a measure of the exposure to robots. Then they run regressions on all commuting zones, in order to investigate the impact of this exposure on the change in employment and the change in aggregate wages, that is, to estimate the following relationships:

Data on robots are provided by the International Feder- ation of Robotics (IFR), which gathers sales data from robot producers worldwide, the destination of sales, and their classification by industrial sector. The IFR defines a robot according to an ISO standard, as “an automatically controlled, reprogrammable, multipurpose manipulator programmable in three or more axes, which can be either fixed in place or mobile for use in industrial automation applications.” The main feature lies in the autonomy of the robot to perform tasks. From these data, they deduce the stock of robots by country and by year from 1993 on,3 but only on a country—or a group of countries—scale. The IFR provides data on the stock of robots for nineteen employment categories.

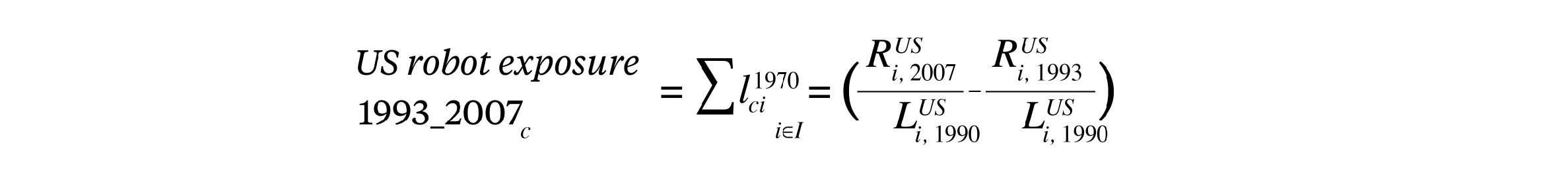

Acemoglu and Restrepo (2017) build a local index, which is based on the rise in the number of robots per worker in each industry and on the local distribution of labor between different industries.

For each commuting zone, the index measuring the exposure to robots between 1990 and 2007 is constructed in a similar way as the index measuring the exposure to Chinese imports, which has been developed by Autor, Dorn, and Hanson (2013). The main idea underpinning this index is to exploit the variation in local industry employment structure before the period of interest, in order to spread a variable (robots, imports, etc.) which is only available at the national level. The measure used in the paper to measure the robot exposure at the commuting zone level is:

The sum runs over all the nineteen industries i in the IFR data. l ci1970 stands for the 1970 share of employment in industry i for a given commuting zone i. Ri and Li stand for the stock of robots and the number of people employed in a particular industry i.

The variation of robot exposure between commuting zones is then used in order to explain the observed evolution of employment and wages. Several controls are included in the regressions. An important feature is to take into account changes in trade patterns. Acemoglu and Restrepo therefore use data from Autor, Dorn, and Hanson (2013) to construct measures of the exposure to imports from Mexico. Another feature is controlling for growth of capital stock (other than robotics) and growth of IT capital. Other controls include the share of employment in routine jobs in 1990, a measure of offshoring of intermediate inputs, baseline differences in demographics in 1990, baseline shares of employment in manufacturing, durable manufacturing and construction, as well as the share of female employment in manufacturing.

A major concern with this empirical strategy is that the adoption of robots in a given US sector could be related to other trends in that sector. Therefore, Acemoglu and Restrepo adopt an instrumental variable strategy, using the exogenous exposure to robots in selected advanced European countries as a proxy for the world technology frontier of robots. The main result is that the commuting zones which are the most exposed to robots have experienced the worst evolutions in terms of employment and in terms of wages between 1990 and 2007.

In their main specification, Acemoglu and Restrepo (2017) estimate that each additional robot per thousand workers reduces aggregate employment-to-population ratio by 0.37 percentage points and aggregate hourly wages growth by about 0.73 percent. Adding control variables such as Chinese and Mexican import volumes, the share of routine jobs and offshoring has little impact on the estimates. Excluding the commuting zones with the highest exposure to robots does not change the magnitude of the estimates. Therefore, their results are not solely driven by highly exposed areas.

2.3 Automation and Employment in France

We reproduce the method developed by Acemoglu and Restrepo (2017) on French data over the 1994–2014 period.

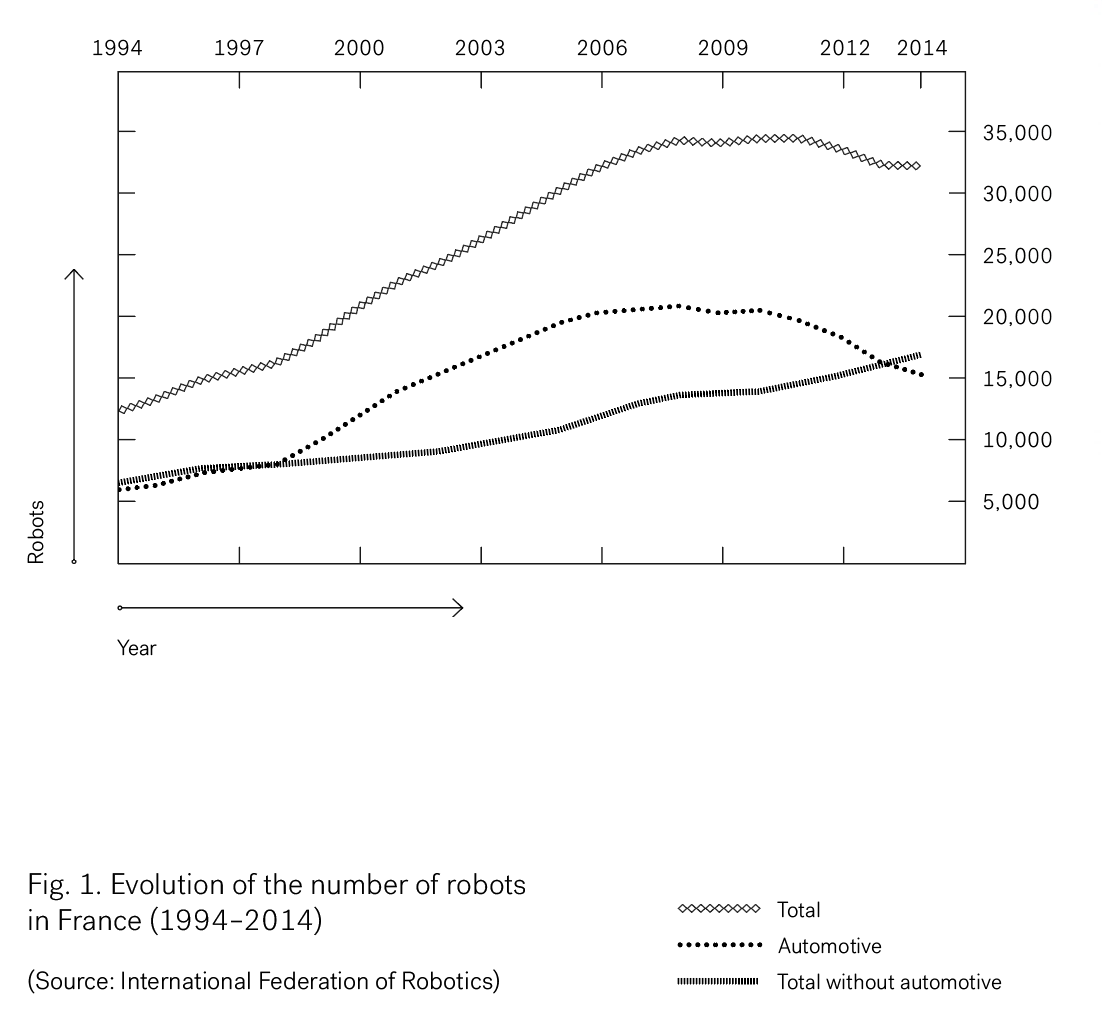

Figure 1 plots how the number of robots evolved in France from 1994 to 2014. Data on robots are provided by the IFR. The overall number of robots grows steadily between 1994 and 2007, then stagnates from 2007 to 2011, and finally slightly decreases between 2012 and 2014.

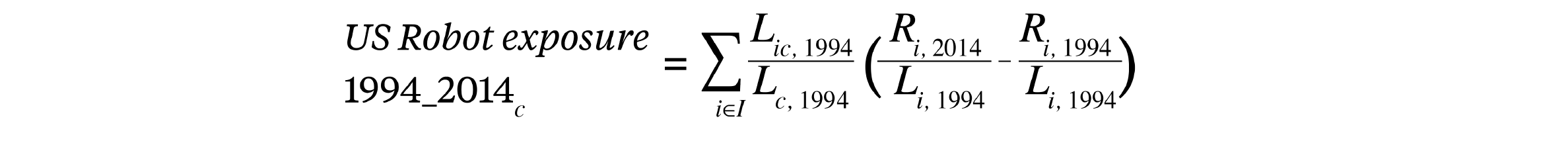

Following Acemoglu and Restrepo (2017) and Dauth et al. (2017), we define the exposure to robots in a French employment zone4 between 1994 and 2014:

where L ic, 1994 refers to employment in the employment zone c in industry i in 1994, L i, 1994 refers to employment in employment zone c in 1994 and L i, 1994 refers to employment (in thousands) in industry i in 1994. R i, 1994 and R i, 2014 respectively stand for the total number of robots in industry i in 1994 and 2014. Data on employment are obtained from the French administrative database DADS.

Those plants that automate end up increasing employment, which suggests that labor market frictions should lie at the heart of any negative correlation one might find between automation and aggregate employment

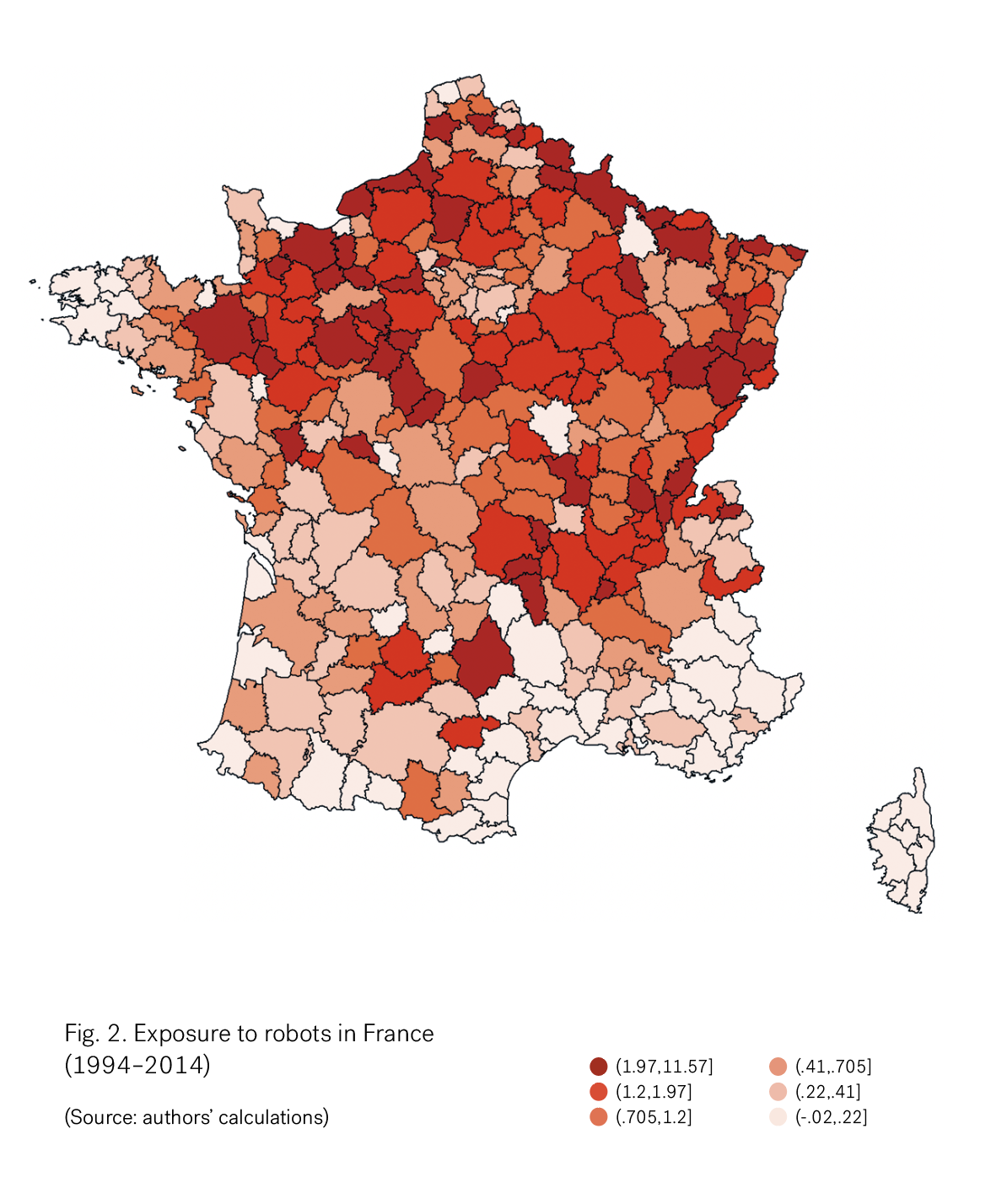

Our index therefore reflects the exposure to robots per one thousand workers between 1994 and 2014. Figure 2 plots the geographical distribution of the exposure to robots. The average exposure in France is 1.16 between 1994 and 2014, well below the average exposure in Germany of 4.64 during the same period. This exposure is also more homogeneous in France, with a standard deviation of 1.42 versus 6.92 in Germany. The order of magnitude of exposure to robots in France is closer to the exposure in the United States between 1993 and 2007. Figure 2 shows a fairly marked north/south divide in France. Indeed, while the north has high exposure rates, most southern employment zones have exposures close to 0. The northeast, with a strong industrial heritage, but also the west (Normandy and eastern Brittany) are among the highly exposed regions. In the least exposed regions, one finds the entire Atlantic coast and the French Riviera.

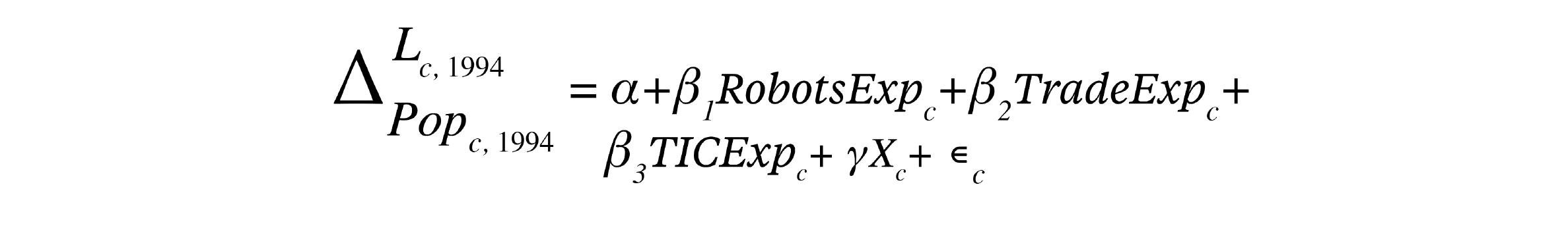

In the first and most naive specification, we study the impact of exposure to robots on the evolution of employment-to-population ratio between 1990 and 2014. This ratio is constructed from census data. However, we control for other characteristics that may impact the evolution of the employment-to-population ratio. To do so, we construct two other exposure indices. First, an exposure index for information and communication technologies (ICT) TradeExp, built in a similar way as the exposure to robots index. The number of robots is replaced by the ICT capital stock in industry i. Second, we build an international trade exposure index TradeExpr. The number of robots is replaced by net imports from China and selected Eastern Europe countries in industry i. In some regressions, we also add a vector Xc of control for the employment zone c: demographic characteristics in 1990 (population share by level of education and population share between twenty-five and sixty-four years old), broad industry shares in 1994 and broad region dummies. Finally, we can write:

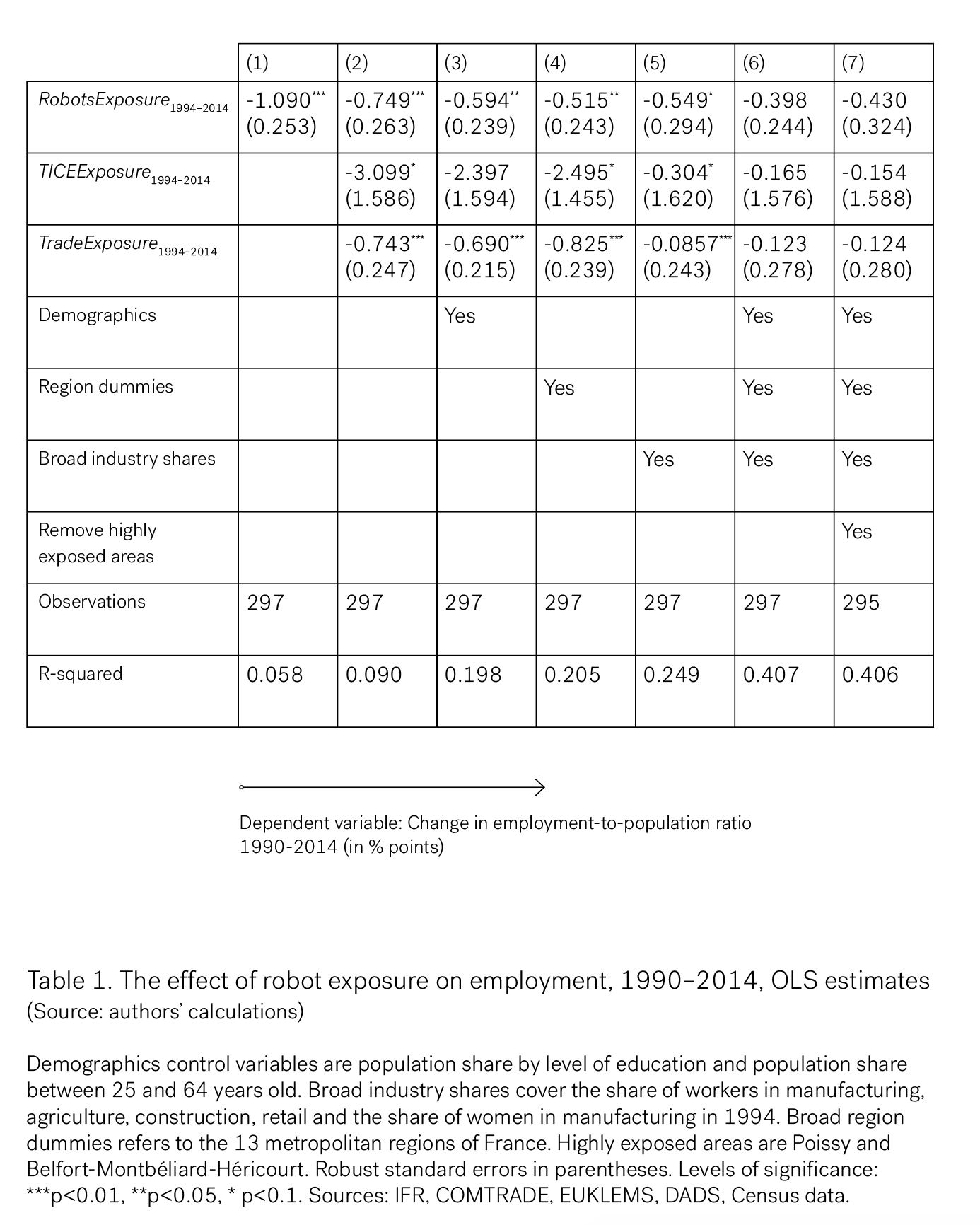

Table 1 displays the results of the OLS regressions. This table shows a negative correlation between exposure to robots and change in employment-to-population ratio. However, the correlation becomes nonsignificant in column 6 when we include all the controls and in column 7 when we exclude the commuting zones with the highest exposure to robots. In the first five columns where the correlation is significant, the magnitude of the effect ranges between -1.090 and -0.515.

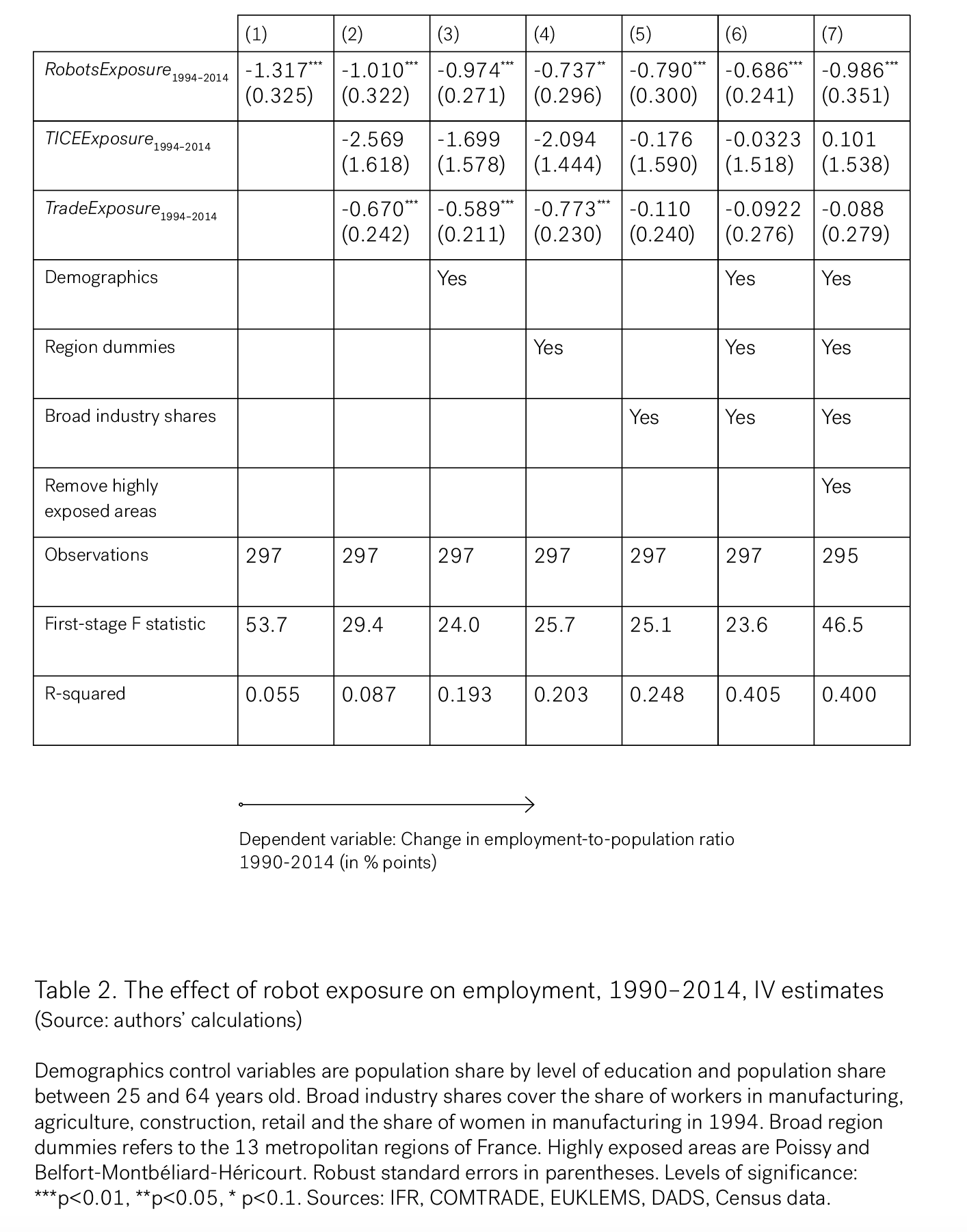

Even if these control variables partially purge OLS estimations, an instrumental variable approach is necessary to discuss causal impact of robots on employment. In fact, one may imagine a shock, which we do not capture in our controls, but which may impact both the installation of robots at local level and local labor markets’ characteristics. In the instrumental variable regression shown in table 2, the coefficients of robot exposure are significant whatever the specification chosen, even the one with all the controls. Moreover, we observe that the magnitude of the effects increases in comparison with those obtained by OLS. In column 1 (regression without any control), the negative impact of exposure to robots on employment is massive: one more robot per one thousand workers leads to a drop in the employment-to-population ratio of 1.317 percentage points. When adding controls on ICT and imports exposures (column 2), there is a negative impact of net imports on employment-to-population ratio, as in Autor, Dorn, and Hanson (2013) for the United States, even though the ICT exposure coefficient is not statistically significant. The coefficient for exposure to robots remains of the same order of magnitude. Columns 3 to 5 successively test three other controls, while column 6 incorporates them simultaneously. First, column 3 adds demographic characteristics. Then, column 4 adds broad region dummies. Finally, column 5 adds broad industry share before 1994. In each specification, the coefficient of exposure to robots remains negative and significant, even if its magnitude decreases slightly. On the contrary, the coefficient of exposure to imports becomes insignificant when we add information about the industry composition of the employment zones. Finally, column 6 combines all the controls and column 7 removes highly exposed areas. The effect of the exposure to robots is still negative and significant, even though its magnitude has been reduced in comparison with the specification without any control.

In our last specification, we obtain a negative effect of exposure to robots on employment: one more robot per one thousand workers leads to a drop in the employment-to-population ratio of 0.686 percentage points. A quick calculation allows us to conclude that the installation of one more robot in a commuting zone reduced employment by 10.7 jobs.5 The order of magnitude is similar to Acemoglu and Restrepo (2017), who found an impact of 6.2 fewer jobs for one more robot. According to the IFR, the number of robots in France increased by around 20,000 between 1994 and 2014. Our result implies a loss of 214,000 jobs (10.7*20,000) during this period due to robots.

TFP growth has been sharply declining in the US since 2008, and so has the rate of new firm creation or intangible investments

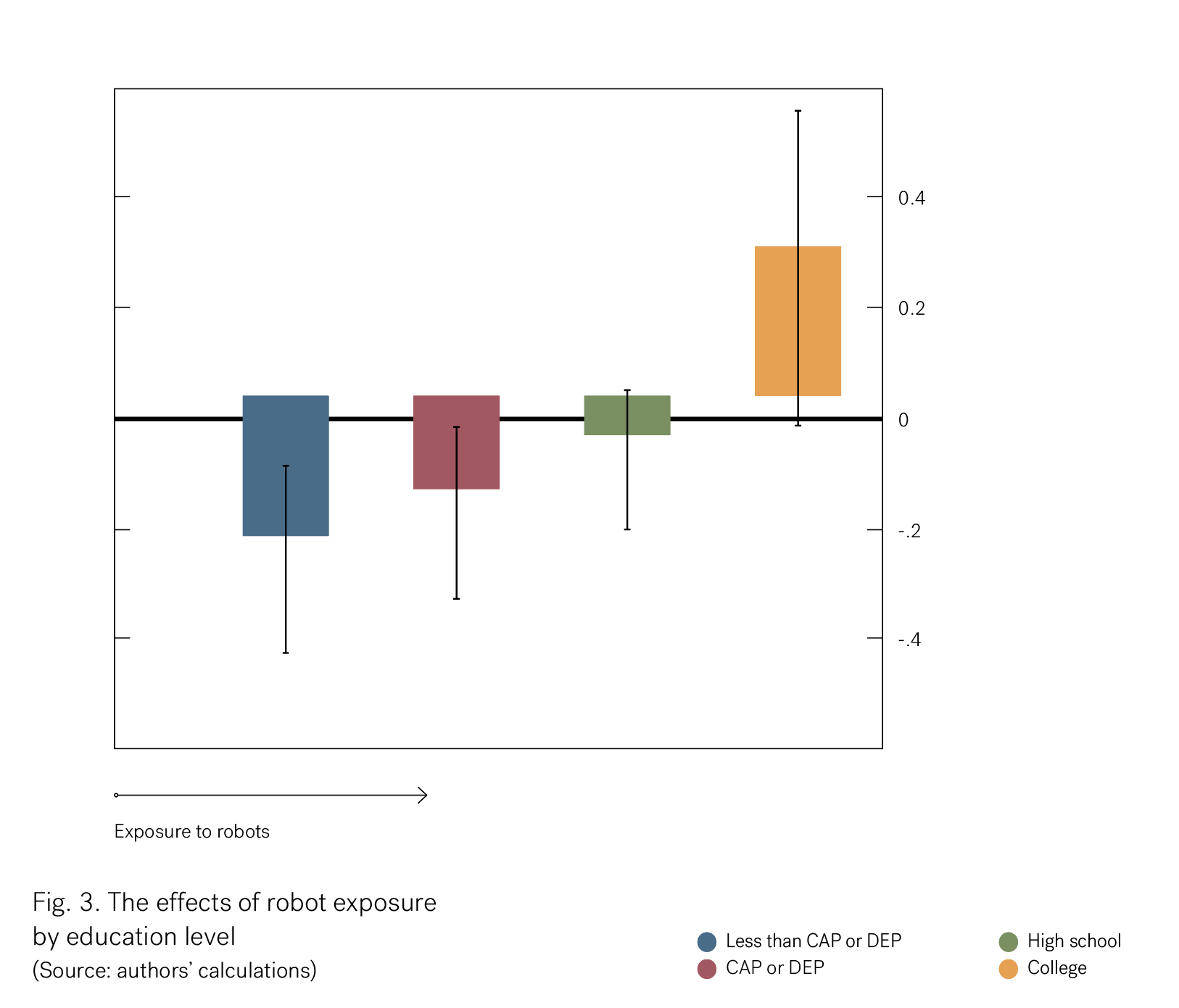

Finally, we investigate the possibility of heterogeneous employment effects of the exposure to robots across education levels.6 Coefficients estimation of exposure to robots on population by education level is presented in fig. 3 (with confidence intervals of 90 %). The Certificate of Professional Aptitude (CAP) and the Diploma of Occupational Studies (BEP) are both French professional education degrees. The lower the level of education, the greater the negative impact of exposure to robots. The impact is nonsignificant for people with a high-school diploma. The effect is even positive, even if slightly nonsignificant, for college graduates. This heterogeneity highlights the key role played by education and the need for public policies. In order to limit the negative effects of automation on employment, public policies should aim at raising the education level and at promoting continuous training.

2.4 Moving from Aggregate to Plant-Level Analysis

In current work with Xavier Jaravel, we analyze the effect of automation on employment using French plant-level and firm-level panel data. We measure automation using electricity consumption in a way that excludes heating and other fixed-cost components of energy consumption by plants. Our main preliminary findings are that: (i) more automation today raises plant-level employment in the short and long run; (ii) the increase in employment is positive for middle-skilled (specialized workers, etc.), and high-skilled workers (engineers, etc.); it remains positive but less significantly so for low-skilled employees. Another finding is that plants that automate less today are more likely to exit the market in the future. Thus, the negative correlation we found between automation and employment at the aggregate employment zone level is not so much due to automating firms laying off redundant labor; rather, it seems to reflect a business-stealing effect whereby automating firms drive out nonautomating firms.

Conclusion

In this paper, we have surveyed recent work on artificial intelligence and its effects of economic growth and employment. Our conclusion is that the effects of AI and automation on growth and employment depend to a large extent on institutions and policies.

In section 1 we argued that while AI can spur growth by replacing labor which is in finite supply by capital which is in unbounded supply, on the other hand, AI may inhibit growth if combined with inappropriate competition policy.

In section 2, we discussed the effects of AI and automation on employment: our analysis suggested that a better education system and a more effective labor market policy enhances the positive effect of automation on employment.

A natural next step would be to bridge the analysis in the two sections, by investigating how labor market characteristics affect the nature of innovation: for example, whether innovation is aimed at automation versus the creation of new lines. This and other extensions of the analyses presented in this paper await future research.

Notes

Bibliography

—Acemoglu, D. 2002. “Technical Change, Inequality, and the Labor Market.” Journal of Economic Literature 40(1): 7–72.

—Acemoglu, D., and Autor, D. 2011. “Skills, Tasks and Technologies: Implications for Employment and Earnings.” In O. Ashenfelter and D. Card (eds.), Handbook of Labor Economics 4: 1043–1171.

—Acemoglu, D., and Restrepo, P. 2016. “The Race between Man and Machine: Implications of Technology for Growth, Factor Shares and Employment.” NBER Working Paper no. 22252.

—Acemoglu, D., and Restrepo, P. 2017. “Robots and Jobs: Evidence from US Labor Markets.” NBER Working Paper no. 23285.

—Aghion, P., Jones, B., and Jones, C. 2017. “Artificial Intelligence and Economic Growth.” NBER Working Paper no. 23928.

—Aghion, P., Bergeaud, A., Boppart, T., Klenow, P., and Li, H. 2019. “A Theory of Falling Growth and Rising Rents.” Mimeo, Collège de France.

—Aghion, P., Antonin, C., and Bunel, S. 2019. “Artificial Intelligence, Growth and Employment: The Role of Policy.” Economics and Statistics, forthcoming.

—Arntz, M., Gregory, T., and Ziehrahn, U. 2017. “Revisiting the Risk of Automation.” Economics Letters 159: 157–160.

—Autor, D., Katz, L.F., and Krueger, A. B. 1998. “Computing Inequality: Have Computers Changed the Labor Market?” Quarterly Journal of Economics 113(4): 1169–1213.

—Autor, D., Levy, F., and Murnane, R. J., 2003. “The Skill Content of Recent Technological Change: An Empirical Exploration.” Quarterly Journal of Economics 118(4): 1279–1333.

—Autor, D., and Dorn, D. 2013. “The Growth of Low Skill Service Jobs and the Polarization of the US Labor Market.” American Economic Review 103(5): 1553–1597.

—Autor, D. H., Dorn, D., and Hanson, G. H. 2013. “The China Syndrome: Local Labor Market Effects of Import Competition in the United States.” American Economic Review 103(6): 2121–2168.

—Autor, D. H., Dorn, D., and Hanson, G. H. 2015. “Untangling Trade and Technology: Evidence from Local Labor Markets.” The Economic Journal 125(584): 621–646.

—Beaudry, P., Green, D. A., Sand, B. M. 2013. “The Great Reversal in the Demand for Skill and Cognitive Tasks.” NBER Working Paper no. 18901.

—Bresnahan, T. F., Brynjolfsson, E., and Hitt, L. M. 2002. “Information Technology, Workplace Organization, and the Demand for Skilled Labor: Firm-Level Evidence.” Quarterly Journal of Economics 117(1): 339–376.

—Brynjolfsson, E., and McAfee, A. 2011. Race Against the Machine: How the Digital Revolution Is Accelerating Innovation, Driving Productivity, and Irreversibly Transforming Employment and the Economy. Lexington, MA: Digital Frontier Press.

—Cheng, H., Jia, R., Li, D., and Li, H. 2019. “The Rise of Robots in China.” Journal of Economic Perspectives 33(2): 71–88.

—Chiacchio, F., Petropoulos, G., and Pichler, D. 2018. “The Impact of Industrial Robots on EU Employment and Wages: A Local Labor Market Approach.” Bruegel Working Paper 2.

—Dauth, W., Findeisen, S., Südekum, J., and Wößner, N. 2017. “German Robots: The Impact of Industrial Robots on Workers.” IAB Discussion Paper 30/2017.

—Davis, S. J., and Haltiwanger, J. 1992. “Gross Job Creation, Gross Job Destruction, and Employment Reallocation.” Quarterly Journal of Economics 107(3): 819–863.

—Frey, C. B., and Osborne, M. A. 2017. “The Future of Employment: How Susceptible Are Jobs to Computerization?” Technological Forecasting & Social Change 114: 254–280.

—Goos, M., and Manning, A. 2007. “Lousy and Lovely Jobs: The Rising Polarization of Work in Britain.” Review of Economics and Statistics 89(1): 118–133.

—Gordon, R. 2012. “Is US Economic Growth Over? Faltering Innovation Confronts the Six Headwinds.” NBER Working Paper no. 18315.

—Graetz, G., and Michaels, G. 2018. “Robots at Work.” Review of Economics and Statistics 100(5): 753–767.

—Hémous, D., and Olsen, M. 2014. “The Rise of the Machines: Automation, Horizontal Innovation and Income Inequality.” CEPR Discussion Paper no. 10244.

—Jaimovich, N., and Siu, H. E. 2012. “The Trend Is the Cycle: Job Polarization and Jobless Recoveries.” NBER Working Paper no. 18334.

—Jones, C. 1995. “R & D-Based Models of Economic Growth.” Journal of Political Economy 103: 759–784.

—Katz, L., and Murphy, K. 1992. “Changes in Relative Wages: Supply and Demand Factors.” Quarterly Journal of Economics 152: 35–78.

—Krueger, A. B. 1993. “How Computers have Changed the Wage Structure: Evidence from Microdata, 1984–1989.” Quarterly Journal of Economics 108(1): 33–60.

—Liu, E., Mian, A., and Sufi, A. 2019. “Low Interest Rates, Market Power, and Productivity Growth.” NBER Working Paper no. 25505.

—Lucas, R. E., and Prescott, E. C. 1974. “Equilibrium Search and Unemployment.” Journal of Economic Theory 7(2): 188–209.

—Mann, K., and Püttmann, L. 2017. “Benign Effects of Automation: New Evidence from Patent Texts.” Unpublished manuscript.

—Pissarides, C. A. 2000. Equilibrium Unemployment Theory. Cambridge, MA: The MIT Press.

—Zeira, J. 1998. “Workers, Machines, and Economic Growth.” Quarterly Journal of Economics 113: 1091–1117.

Comments on this publication