The digital revolution is transforming economies. Potential economic gains from digital technologies are enormous, but with new opportunities come new challenges. Within economies, income and wealth inequalities have risen as digitization has reshaped markets and the world of business and work. Inequalities have increased between firms and between workers. The distribution of both capital and labor income has become more unequal, and income has shifted from labor to capital. Technological change, however, is not the sole reason for the rising inequalities. Policy failures have been an important part of the story. Policies will need to be more responsive to the new dynamics of the digital economy to achieve outcomes that are more inclusive.

We are living in an era of mounting societal discontent and political divisiveness. In many countries, social disaffection with economic outcomes is up sharply, stoking populist and nationalist sentiment. Increasing income inequality is one important reason behind this sociopolitical tumult.

We are also living in an era of major technological change, led by the digital revolution. Today’s technological changes—advances in computer systems and software, mobile telephony, digital platforms, robotics, cloud computing, artificial intelligence, and cyber-physical systems—are arguably unparalleled in their scope and speed.

Are these two megatrends of our time connected? The answer is yes. Digital technologies are reshaping the world of business and work in profound ways. Policies have been slow in adapting to the new dynamics. The interaction between technological change and market conditions as influenced by the prevailing policy environment has been a key factor driving income inequality higher. Disruptions caused by technological change have added to business and worker anxieties.

A more unequal distribution of income, however, is not an inevitable consequence of a digitizing world. Outcomes that are more inclusive are certainly possible with better, more responsive policies.

Rising Income Inequality amid Booming Digital Technologies

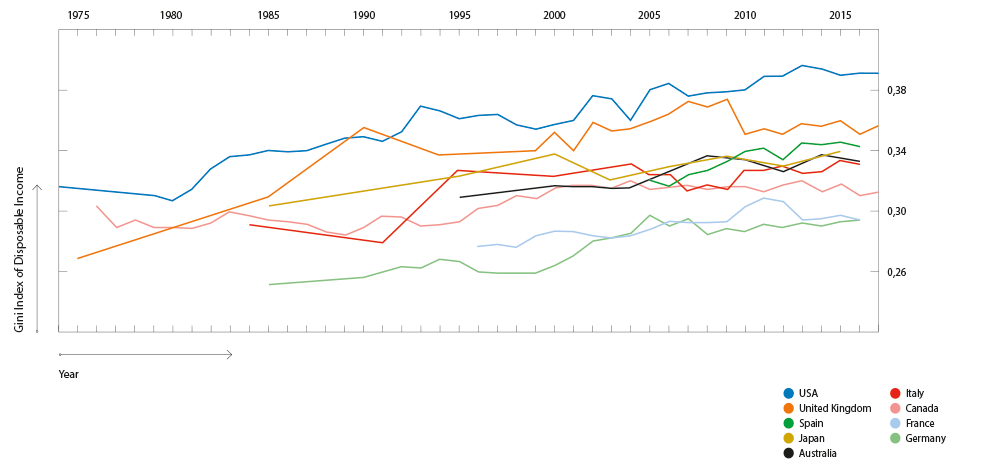

Income inequality has risen in practically all major advanced economies since the 1980s, a period of a rising boom in digital technologies (fig. 1). It has risen particularly sharply at the top end of the income distribution. Wealth inequality is still more acute, roughly twice as high as income inequality. The increase in inequality has been especially marked in the United States. Over a two-decade period ending in 2015, US disposable income inequality, as measured by the broadest measure of inequality (the Gini Index), increased by more than 10%. The income share of the richest 1% has more than doubled since the early 1980s, to around 22%. The share of the top 1% in wealth has risen to around 40%. Those with middle-class incomes were squeezed and the typical worker saw largely stagnant real wages over long periods. Higher inequality has been associated with a decline in intergenerational economic mobility (Chetty et al., 2017).

Fig. 1. Rising income inequality: major advanced economies / Source: OECD Income Distribution Database

This article focuses on advanced economies, but the rise in income inequality is not confined to this group. In emerging economies, income distribution trends are more mixed but many major emerging economies also witnessed a rise in income inequality. In the two largest emerging economies, China and India, inequality has increased appreciably.1

In the cauldron of political debate, much of the blame for the rise in income inequality and underlying business and job dislocations is heaped on globalization—often from both ends of the political spectrum. The backlash against globalization threatens a retreat into economic nationalism and inward-looking policies. Globalization has, indeed, been a factor behind rising inequality. However, a much bigger factor has been technological change.

Not only is the proverbial economic pie being shared more unequally, it has also been growing more slowly, adding to social discontent. Paradoxically, productivity growth in major economies has slowed rather than accelerated during the boom in digital technologies. This has slowed overall economic growth. Research finds that the same interaction between technological change and policy failures that contributed to higher income inequality also explains why the new technologies have not delivered their full potential to boost productivity (Brookings Institution and Chumir Foundation, 2019). Developments in income distribution and productivity have been linked by shared dynamics.

Transformations in the World of Business

Digital technologies are altering business models and how firms compete and grow. They are reshaping market structures. Change affects all markets, from production and commerce to finance. The manner in which the new technologies deploy across industries and firms has important implications for their economic impact and the distribution of rewards.

Uneven Diffusion of New Technologies and Widening Gaps between Firms

How technological innovation diffuses within economies and interacts with market conditions matters greatly for both productivity growth and income distribution (Comin and Mestieri, 2018; OECD, 2018a; Aghion et al., 2019). The benefits of the new technologies have not been diffusing widely across firms. They have been captured for the most part by a relatively small number of larger firms. Productivity growth has been relatively strong in leading firms at the technological frontier. However, it has slowed considerably in the vast majority of other, typically smaller firms, pulling aggregate productivity growth lower. Between 2001 and 2013, in OECD economies, labor productivity among frontier firms rose by around 35%; among non-frontier firms, the increase was only around 5% (Andrews et al., 2016).2 Aggregate labor productivity growth in OECD economies in the decade to 2015 was only about half of that in the preceding two decades. The growing inequality in productivity performance between firms not only depressed productivity growth, but also caused income disparities to rise.

A weakening of competition is one important reason for these adverse productivity and distributional dynamics. Barriers to competition and related market frictions are preventing a broader diffusion of the new technologies and causing a persistent rise in productivity and profitability gaps between firms. Evidence for OECD economies shows that in industries less exposed to competition, technological innovation and diffusion are weaker, inter-firm productivity divergence is wider, and aggregate productivity growth is slower (Cette et al., 2016; Égert, 2016). Studies of the United States and European economies also find that lower competitive intensity in markets depressed investment in new productive capital, as firms wielding increased market power invested less and made a lot more on existing capital through higher markups and increased stock buybacks (Gutiérrez and Philippon, 2017; Égert, 2018).

The erosion of competition is reflected in a variety of indicators: rise in market concentration in industries, higher markups showing increased market power, and corporate ossification with declining business dynamism as measured by new firm formations. These trends are observable broadly across advanced economies but have been particularly marked in the United States. The share of top four US companies in total sales has risen since the 1980s in each of the major sectors covered by the US Economic Census (Autor et al., 2017). The rise in market concentration is greater in industries that are more intensive users of digital technologies. Markups over marginal cost for US publicly traded firms have nearly tripled, with the rise concentrated in high-markup firms gaining market share (De Loecker et al., 2018). The share of young firms (five years old or less) in the total number of US firms has declined from about one-half to one-third (Decker et al., 2017).

With increased market power, the distribution of returns on capital has become more unequal, with a relatively small number of firms reaping supernormal profits. In the United States, for example, the ninetieth percentile firm earned a return on invested capital reaching around 100% in 2014, which was more than five times the return earned by the median firm; this ratio was around 2 about twenty-five years ago (Furman and Orszag, 2018). The uneven distribution of returns on capital was particularly marked in technology-intensive industries. There is also evidence of low churning among high-return firms, with a large proportion of such firms persistently achieving high rates of return.

Markets have shifted toward more monopolistic structures, giving rise to higher economic rents (Krugman, 2016; Stiglitz, 2016; Summers, 2016). The share of “pure profits” or rents (profits in excess of those under competitive market conditions) in total income in the US economy rose from 3% in 1985 to 17% in 2015 (Eggertsson et al., 2018). As monopoly profits boosted the market value of corporate stocks and produced large capital gains, the share of total US stock market value reflecting monopoly power (“monopoly wealth”) rose from negligible levels to around 80% over the same period (Kurz, 2018).

Winner-Takes-Most Dynamics and Competition Policy Failures

Why is market power rising and competition weakening? First, the new technologies are contributing to increased market concentration by altering competition in ways that produce “winner-takes-most” outcomes. Digital technologies offer first-mover advantages, scale economies, network effects, and leverage of “big data” that encourage the rise of dominant firms—and globalization reinforces the scale economies by facilitating access to markets worldwide. The rise of “the intangible economy,” where assets such as software and intellectual property matter more and more for economic success, has been associated with a stronger tendency toward the emergence of dominant firms (Haskel and Westlake, 2017). Digitization also allows firms controlling big data to extract more of the consumer surplus through increasingly sophisticated algorithmic pricing and customization of offerings.

Between 2001 and 2013, in OECD economies, labor productivity among “frontier firms” rose by around 35%; among other firms, the increase was only around 5%

The winner-takes-most dynamics have been most marked in the high-tech sectors, as reflected in the rise of “superstar” firms such as Facebook and Google. Increasingly, however, they are affecting economies more broadly as digitization penetrates business processes in other sectors, such as transportation, communications, finance, and commerce. In retail trade, for example, the big box stores, which previously had replaced mom and pop outlets, are now losing market share to online megastores such as Amazon.

Second, failures in competition policies have reinforced the technology-driven dynamics producing more concentrated market structures. These include weaknesses in antitrust policies, flaws in patent systems that act as barriers to a wider diffusion of innovations, and regulatory acts of omission and commission (deregulation unsupported by competition safeguards, and regulations that restrict competition). Related factors include an increase in overlapping ownership of companies that compete by large institutional investors, rise in rent seeking, and firm behavior showing greater adeptness in erecting barriers to entry through product differentiation and other means.

Financialization

Digital technologies have been instrumental in the financialization of economies, reinforcing the impetus from financial sector deregulation. In OECD economies, credit and other financial intermediation has grown three times as fast as economic activity in recent decades. The rapid financialization compounded the inefficient and unequal outcomes resulting from decreased competition in markets (OECD, 2015; Philippon, 2016). In the credit boom that preceded the global financial crisis, the lion’s share of the credit went to households rather than firms, boosting stock and real estate markets rather than productive investment—an allocation of credit with negative implications for growth, stability, and income distribution. There has been much innovation in financial services based on the new technologies. A large part of it, however, has been focused on areas such as trading and asset management that primarily benefit the well-off and do not have first-order effects on economic productivity.

Rewards in the financial sector rose sharply relative to the real economy. In the United States, the financial sector captured an outsize share of profits—35–40% of all corporate profit in the years leading to the financial crisis. A sizable part of these high profits reflected rents in an increasingly concentrated sector: the top five banks’ share of banking assets increased from 25% in 2000 to 45% in 2014. In European countries, financial sector workers on average accounted for one in five of the top 1% of earners even though they accounted for only one in twenty-five of the total workforce (Denk, 2015). Financial wealth boomed but benefited mainly those at the top; in the United States, the top 1% of the wealth distribution held half of stock and mutual fund assets in 2013, and the top 10% held more than 90% (Wolff, 2014).

Transformations in the World of Work

Just as transformations in the world of business caused by digitization-driven technological change have been a key factor influencing the distribution of capital income, technology-driven transformations in the world of work have been a key factor influencing the distribution of labor income.

Rising Wage Inequality and Falling Labor Income Share

Across OECD economies, increased inequality in firm productivity and profitability is mirrored by increased inequality in labor incomes. As profitability gaps widened between firms, so did wage gaps. Rent sharing also contributed to wider wage differences between firms. Better-performing firms reaped a higher share of total profits and shared part of their supernormal profits with their workers. Increased fissuring of the workplace through outsourcing played a role as well, with noncore activities typically employing low-skill workers farmed out to other firms, cutting such workers from the rent sharing. Between-firm wage inequality rose more in industries that invest more intensively in digital technologies. Overall, wage inequality has risen sharply in the past couple of decades and much of that rise is attributable to increased wage differences between firms (Song et al., 2019).

There has been much innovation in financial services based on the new technologies, but much of it has focused on areas such as trading and asset management that primarily benefit the well-off

While workers in firms at the technological frontier earned more than those in other firms, gains from higher productivity at these firms were shared unevenly, with wage growth lagging behind productivity growth. Wages rose in the better-performing firms but by less than the rise in productivity. For most other firms, limited wage growth reflected limited productivity growth, although even at these firms wage growth tended to fall short of the meager gains in productivity (OECD, 2018b; Schwellnus et al., 2018). In the United States, net labor productivity increased by 72% between 1973 and 2014, while real hourly compensation of the median worker increased by only 9% (Bivens and Mishel, 2015).

The decoupling of wages from productivity contributed to a shift in income distribution from labor to capital. In the past couple of decades, most major economies have experienced both increasing inequality of labor earnings and declining labor-income shares. In the United States, for example, the percentage share of labor in total income dropped from the mid-60s around 2000 to the mid-50s around 2015.

Increased market concentration has played a role in the shifting of income from labor to capital as it reallocated labor within industries to dominant firms with supernormal profits and lower labor-income shares (Autor et al., 2017). Dominant firms not only acquired more monopoly power in product markets to increase markups and extract higher rents but also monopsony power to dictate wages in the labor market (CEA, 2016; Azar et al., 2017). A new phenomenon has been the fast-expanding digital labor markets—online jobs platforms such as Task Rabbit and Amazon Mechanical Turk. Here too, employer concentration has been high (Dube et al., 2018). While employer market power strengthened, worker bargaining power weakened with a decline in unionization and erosion of minimum wage laws.

The largest US firm in 2017, Apple, had a market capitalization forty times as high as that of the largest US firm in 1962 (AT&T), but its total employment was only one-fifth that of the latter

These developments reinforced the effect of labor-substituting technological change on the distribution of income between labor and capital. Production shifted toward firms and processes using more capital (tangible and intangible) and less labor. The largest US firm in 2017 (Apple) had a market capitalization forty times as high as that of the largest US firm in 1962 (AT&T) but its total employment was only one-fifth that of the latter (West, 2018). The shift of income from labor to capital increased overall income inequality, as capital ownership is highly uneven.3

International trade and offshoring also contributed to the shift in income toward capital by putting downward pressure on wages, especially of lower-skilled workers in tradable sectors. Overall, research shows that globalization has played a significant role in the decline of the labor-income share. However, it also shows that globalization’s role has been much smaller than that of technological change and related outcomes. IMF research finds that, in advanced economies, technological change has contributed about twice as much as globalization to the decline in the labor-income share (IMF, 2017a).

Shifts in Labor Demand, Job Polarization, and Skills Mismatches

Technology has been the dominant force in reshaping the demand for labor. Digital technologies and automation have shifted demand toward higher-level skills. Globalization has exerted pressure in the same direction. Demand has shifted, in particular, away from routine, middle-level skills that are more vulnerable to automation, as in jobs like clerical work and repetitive production. Job markets have seen an increasing polarization, with the employment share of middle-skill jobs falling and that of higher-skill jobs, such as technical professionals and managers, rising. The employment share of low-skill jobs has also increased but mainly in nonroutine manual jobs in services such as personal care that are hard to automate. Between 1995 and 2015, the share of middle-skill jobs in total employment fell by about 9.5 percentage points in OECD economies on average, while the shares of high-skill and low-skill jobs rose by about 7.5 and 2 percentage points, respectively.4 A concurrent development has been the rise of the “gig” economy, with more workers engaged in nonstandard work arrangements, such as temporary or part-time contracts and own-account employment.

As the demand for skills has shifted, supply has been slow to adapt. Education and training have been losing the race with technology (Goldin and Katz, 2008; Autor, 2014). Shortages of higher-level skills demanded by the new technologies have prevented a broader diffusion of the innovations across firms. Workers with skills complementary with the new technologies have been clustered increasingly in leading firms at the technological frontier. Across industries, skills mismatches have increased: in OECD countries, on average around one-quarter of workers report a mismatch between their skills and those required by the job (Adalet McGowan and Andrews, 2017).

Imbalances between skills demand and supply have fueled income inequality, by increasing the wage premia on higher-level skills (Autor, 2014; Hanushek et al., 2015). The skill premium rose in all major economies, especially over the 1980–2000 period. The rise has been particularly sharp in the United States: those with a postgraduate degree could expect to earn around 215% of the wages received by those with only a high-school education in 2016, compared to around 155% in 1980.5 The rise in nonstandard work arrangements imparted more flexibility to the labor market. However, it probably also contributed to increased earnings inequality as nonstandard jobs (especially at lower skill levels) typically paid less than standard jobs.

Weakening Redistributive Role of the State

As technological change interacted with developments in product, financial, and labor markets to drive income inequality higher, making the distribution of both capital and labor income more unequal and shifting income from labor to capital, the state’s role in alleviating the inequality of market incomes arising from the interplay of these forces weakened. In advanced economies, taxes and transfers reduce market income inequality on average by about one-third: in 2015, the average Gini Index for disposable income in these economies was 0.31 compared with 0.48 for market income. Between 1985 and 1995, fiscal redistribution offset about 60% of the increase in market income inequality in advanced economies. Between 1995 and 2010, it hardly offset any (OECD, 2016).

Fiscal redistribution declined because of reduced progressivity of personal income taxes and lower taxes on capital as well as tighter spending on social programs as countries took steps to rein in fiscal deficits and rising public debt. In OECD economies, the average top personal income tax rate fell from 62% in 1981 to 35% in 2015. International tax competition resulting from capital mobility led to a large fall in corporate income tax rates as well. The average corporate tax rate in advanced economies fell from around 45% in 1990 to 26% in 2015 (IMF, 2017b).

Harnessing Technology for More Inclusive Growth

The rise of the digital economy has pushed income inequality higher. At the same time, the potential of the new technologies to spur productivity growth has not been fully realized. However, this should not provoke despair, much less a negative backlash.

Most dynamic economic change is inherently disruptive, creates winners and losers, and entails difficult transitions. Technology—and globalization—are no exceptions. They are key forces that drive economic progress. Advances in digital technologies hold great promise to boost productivity and economic growth, create new and better jobs to replace old ones, and enhance human welfare. Policies have a crucial role to play in ensuring that the potential gains are captured effectively and inclusively—by improving the enabling environment for firms and workers to broaden access to the new opportunities that come with change and to enhance capabilities to adjust to the new challenges. Unfortunately, policies and institutions have been slow to rise to the new challenges of the digital economy. Indeed, they have often exacerbated rather than ameliorated the outcomes.

Policies to reduce inequality are often seen narrowly in terms of redistribution—tax and transfer policies. However, there is a much broader policy agenda of “predistribution” that can make the growth process itself more inclusive. Much of the reform agenda to achieve more inclusive outcomes from technological change is also an agenda to achieve stronger growth outcomes, given the linked dynamics between the recent rise in inequality and the slowdown in productivity.

Revitalize Competition for the Digital Age

Competition policies should be revamped for the digital age to ensure that markets continue to provide an open and level playing field for firms, keep competition strong, and check the growth of monopolistic structures. This includes regulatory reforms and stronger antitrust enforcement. The winner-takes-most dynamics associated with digital technologies is raising new challenges for competition policies, including how to address market concentration resulting from tech giants that resemble natural or quasi-natural monopolies. Once in dominant positions, firms can entrench themselves by erecting a variety of barriers to entry and taking over rising competitors. The beneficiaries of an open, competitive system often work to close the system and stifle competition, necessitating reform to “save capitalism from the capitalists” (Rajan and Zingales, 2003; Krugman, 2015). Competition policy also needs to become more global to address cross-border issues posed by multinational tech giants that affect market concentration and competition in many countries.

Proprietary agglomeration of data, as in digital platforms, is an increasingly important source of competitive advantage. Regulations pertaining to digital platforms, ownership of data, how user data are handled, and privacy protections matter increasingly for competition. There has been more action on this agenda in Europe than in the United States, an example being the General Data Protection Regulation (GDPR) introduced in Europe in 2018.

Enhancing competition is also important in financial markets, to address issues such as increased concentration, interconnectedness, and rent seeking. It would spur better use of advances in digital technology to expand the range of financial services and reduce their cost, open new gateways to entrepreneurship, and democratize access to finance. Innovations such as mobile financial services, digital platforms, equity crowdfunding, and blockchains have much potential. Young FinTech firms are in the vanguard in the application of such innovations. A challenge for policy-makers is to foster the growth of these new entrants into the financial industry while managing associated risks.

IMF research finds that, in advanced economies, technological change has contributed about twice as much as globalization to the decline in the labor-income share

Improve Innovation Ecosystem for Wider Technology Diffusion

Intellectual property regimes need to be better balanced so they reward innovation but also foster wider economic impacts. “The copyright and patent laws we have today look more like intellectual monopoly than intellectual property” (Lindsey and Teles, 2017). Arguing that patents are locking in incumbents’ advantages rather than spurring the hoped-for bursts of innovation, some have called for a complete dismantling of the patent system (Boldrin and Levine, 2013). That would be too radical an approach. What is needed is a fundamental reexamination, to change excessively broad or stringent protections, align the rules with current realities, and give freer rein to competition. Long patents may have been appropriate for pharmaceutical innovations, which involve protracted and expensive testing, but the case is less clear for advances in digital technologies that have much shorter gestation periods and typically build on previous innovations in an incremental fashion.

Innovations such as mobile financial services, digital platforms, equity crowdfunding, and blockchains have much potential

Government research and development (R&D) spending focuses on supplying the public good of basic research, which often produces knowledge spillovers that benefit the economy at large. Yet, it has been declining. In the United States, government R&D spending has fallen from 1.2% of GDP in the early 1980s to half that level in recent years (Shambaugh et al., 2017). This underscores the need to revitalize public research programs and ensure broad access to their discoveries. Many breakthrough innovations developed commercially by private firms originate from government-supported research. Recent examples include Google’s basic search algorithm, key features of Apple smartphones, and even the Internet itself. Governments should consider how to give taxpayers a stake in such profitable outcomes from publicly supported research, not least to replenish public R&D budgets. Here, the tax system has an important role to play.

Infrastructure that supports digitization should be strengthened. Despite progress, the digital divide remains wide. Even in advanced economies, population remaining offline could be as high as one-fifth (ITU, 2016). Most sectors of the US economy are less than 15% as digitized as the leading sectors (McKinsey, 2015).

Invest in Skills for a Changing World of Work

Advances in digitization, robotics, and artificial intelligence have led some to draw up dire scenarios of massive job losses from automation (a “robocalypse”). However, experience with past major episodes of automation shows that as technological change made some old jobs redundant, it generated new ones by creating new roles and tasks and spurring economic growth. How technological change impacts employment must be seen as a dynamic adjustment process of old jobs giving way to new ones (Acemoglu and Restrepo, 2018; World Bank, 2019). Looking ahead, not only will the skill needs of jobs continue to evolve, but the composition of employment will evolve as well, with more people working independently—including as microentrepreneurs in an expanding “crowd-based capitalism” enabled by digital platforms, as exemplified by Uber and Airbnb (Sundarajan, 2016; Brynjolfsson and McAfee, 2017).

Many breakthrough innovations developed commercially by private firms originate from government-supported research. Recent examples include Google’s basic search algorithm, key features of Apple smartphones, and even the Internet itself

The main issue is that the nature of work is changing, and the main policy challenge is to equip workers with nonroutine, creative, and higher-level skills that the new technologies demand and to support workers during the adjustment process. Traditional formal education must be complemented with new models and options for reskilling and lifelong learning. As the old career path of “learn-work-retire” gives way to one of continuous learning—a process reinforced by the aging of many economies’ workforces—the availability and quality of continuing education must be scaled up. This will demand innovations in the content, delivery, and financing of training, including new models of public-private partnership. It will involve experimentation, and learning from what works, such as the apprenticeship system in Germany. The potential of technology-enabled solutions, such as online learning platforms, must be harnessed, supported by a stronger foundation of digital literacy.

A strong commitment to improving access to affordable and quality education, including skills upgrading and retraining, for the economically disadvantaged is also vital. Even in an advanced economy such as the United States, almost two-thirds of workers do not have a college degree. Gaps in higher education attainment by family income level have widened rather than narrowed (Turner, 2017).

Revamp Labor Market Policies and Social Protection

Labor market policies and social protection arrangements must be reformed to improve workers’ ability to change jobs. This means shifting the focus from backward-looking policies, such as the stringent job protection laws in many European economies that seek to keep workers in existing jobs, to forward-looking policies that encourage reemployment, including innovative unemployment/wage insurance mechanisms, retraining, and placement services.

Other barriers to worker mobility and competition in labor markets, such as the ever-increasing professional licensing requirements and noncompete covenants in worker contracts, should also be addressed. Well-functioning labor market institutions—collective bargaining, minimum wage laws, labor standards—are important to ensure that workers get a fair share of economic returns, especially at a time of rising market power of dominant firms.

Social contracts will need to be overhauled. Benefits such as pension and health care, traditionally based on formal long-term employer-employee relationships, need to be made more portable and adapted to evolving work arrangements, including the expanding gig economy. Here, several proposals have been put forward, including a universal basic income currently being piloted in some jurisdictions, a negative income tax up to a certain income threshold, and social security accounts that pool workers’ benefits and are portable across jobs. Reform options will need to be considered in a context where many social security systems already face financial sustainability challenges.

Pursuing labor market and social protection reforms as a package will have the advantage of capturing reform synergies and easing the adjustment for workers. For example, in 2017, France implemented reforms to its job protection laws to boost labor market flexibility combined with the introduction of a portable “personal activity account” that enables workers to accrue rights to training across multiple jobs.

The wealth dynamics of recent decades paint a picture of private riches and public poverty. While private wealth has soared, public wealth has declined, hobbling the capacity of public policy

Reform Tax Systems

Tax policy is often seen as presenting trade-offs between efficiency and growth on the one hand and equity on the other. Trade-offs do exist, but there are win-win opportunities for reform. In labor-income taxation, reducing the tax wedge for low-wage workers through greater use of options such as earned-income tax credit can boost labor force participation as well as improve distributional outcomes. Countries may consider shifting part of the financing of social benefits to general tax revenue to avoid overburdening social security contributions and labor-income taxation (OECD, 2017). Such a shift in financing may also be needed to extend social security coverage to those working independently or in short-term or other atypical contracts. The changing nature of work will require more attention to horizontal equity in taxes and transfers for workers in different types of work arrangements.

In capital income taxation, recent progress under OECD/G20 processes on international cooperation to curb tax base erosion and profit shifting should enable national tax authorities to make better use of corporate taxes that have been driven lower in recent years by international tax competition for mobile capital. In a period when corporate profits have been high, boosted by rents associated with increased market power, the optimal policy would be to tax profits at relatively high rather than low rates. In an increasingly networked global economy and fast-expanding digital commerce, international cooperation on tax matters will be even more important.

Making better use of wealth taxes can improve both the efficiency and equity of tax systems. Wealth taxes are underutilized and have not kept pace with the surge in wealth. High wealth inequality is a key driver of intergenerational persistence of income inequality. Thomas Piketty’s work on inequality (Piketty, 2014) has attracted controversy, but one key proposal—to find a better way to tax wealth—certainly has merit. The wealth dynamics of recent decades paint a picture of private riches and public poverty. While private wealth has soared, public wealth has declined, hobbling the capacity of public policy.6

There is scope to recover some of the lost tax progressivity without hampering economic growth (IMF, 2017b). Higher progressivity does not necessarily mean sharply raising marginal tax rates. A more efficient way is to reform the assortment of regressive and distortive tax expenditures that characterize most tax systems—and curb tax evasion.

Conclusion

Digital technologies are transforming the world of business and work. A key challenge for policies is to harness the potential of these technologies to produce more robust and inclusive economic growth. Policies will need to be more responsive to change, which will only intensify as advances in artificial intelligence and other innovations take the digital revolution to another level. New thinking and policy adaptations will be needed in areas such as competition policies, innovation systems and knowledge diffusion, infrastructure underpinning the digital economy, upskilling and reskilling of workers, social protection regimes, and tax policies. The era of smart machines will demand smarter policies.

The politics of reform is inevitably complex. Reform may seem even more daunting in the current political environment. One thing reform action should not be paralyzed by, however, is continued trite debates about conflicts between growth and equity. Research has increasingly shown this to be a false dichotomy.

The dominant part of the agenda for change to make technology—and globalization—work better for all lies at the national level. Reforms are needed at the international level as well so that rules of engagement between countries in trade and other areas are fair. Not only must past gains in establishing a rules-based international system be protected from the recent rise of nationalist and protectionist sentiment, but new disciplines and cooperative arrangements must be devised to underpin the next phase of globalization led by digital flows.

Notes

Bibliography

—Acemoglu, Daron, and Restrepo, Pascual. 2018. “The Race between Machine and Man: Implications of Technology for Growth, Factor Shares and Employment.” American Economic Review 108(6): 1488–1542.

—Adalet McGowan, Muge, and Andrews, Dan. 2017. “Labor Market Mismatch and Labor Productivity: Evidence from PIAAC Data.” Research in Labor Economics 45: 199–241.

—Aghion, Philippe, Akcigit, Ufuk, Bergeaud, Antonin, Blundell, Richard, and Hémous, David. 2019. “Innovation and Top Income Inequality.” Review of Economic Studies 86(1): 1–45.

—Alvaredo, Facundo, Chancel, Lucas, Piketty, Thomas, Saez, Emmanuel, and Zucman, Gabriel, 2018. World Inequality Report 2018. World Inequality Lab.

—Andrews, Dan, Criscuolo, Chiara, and Gal, Peter. 2016. “The Best versus the Rest: The Global Productivity Slowdown, Divergence Across Firms, and the Role of Public Policy.” OECD Productivity Working Paper, No. 5. Paris: OECD.

—Autor, David. 2014. “Skills, Education, and the Rise of Earnings Inequality among the Other 99 Percent.” Science 344(6186): 843–851.

—Autor, David, Dorn, David, Katz, Lawrence, Patterson, Christina, and Van Reenen, Jon. 2017. “Concentrating on the Fall of the Labor Share.” American Economic Review 107(5): 180–85.

—Azar, José, Marinescu, Ioana, and Steinbaum, Marshall. 2017. “Labor Market Concentration.” NBER Working Paper Series, No. 24147. Cambridge, MA: National Bureau of Economic Research.

—Bivens, Josh, and Mishel, Lawrence. 2015. “Understanding the Historic Divergence Between Productivity and a Typical Worker’s Pay.” Economic Policy Institute Briefing Paper No. 406. Washington, DC.

—Boldrin, Michele, and Levine, David. 2013. “The Case Against Patents.” Journal of Economic Perspectives 27(1): 3–22.

—Brookings Institution and Chumir Foundation. 2019. Productive Equity: The Twin Challenges of Reviving Productivity and Reducing Inequality. Report. Washington, DC.

—Brynjolfsson, Erik, and McAfee, Andrew. 2017. Machine, Platform, Crowd: Harnessing Our Digital Future. New York: Norton.

—CEA (Council of Economic Advisers). 2016. “Labor Market Monopsony: Trends, Consequences, and Policy Responses.” Washington DC: The White House.

—Cette, Gilbert, Lopez, Jimmy, and Mairesse, Jacques. 2016. “Market Regulations, Prices, and Productivity.” American Economic Review 106(5): 104–108.

—Chetty, Raj, Grusky, David, Hell, Maximilian, Hendren, Nathaniel, Manduca, Robert, and Narang, Jimmy. 2017. “The Fading American Dream: Trends in Absolute Income Mobility Since 1940.” Science 356(6336): 398–406.

—Comin, Diego, and Mestieri, Martí. 2018. “If Technology has Arrived Everywhere, Why has Income Diverged?” American Economic Journal: Macroeconomics 10(3): 137–178.

—Decker, Ryan, Haltiwanger, John, Jarmin, Ron, and Miranda, Javier. 2017. “Declining Business Dynamism, Allocative Efficiency, and the Productivity Slowdown.” American Economic Review 107(5): 322–326.

—De Loecker, Jan, Eeckhout, Jan, and Unger, Gabriel. 2018. “The Rise of Market Power and the Macroeconomic Implications.” Working Paper.

—Denk, Oliver. 2015. “Financial Sector Pay and Labour Income Inequality: Evidence from Europe.” Economics Department Working Paper, No. 1225. Paris: OECD.

—Dube, Arindrajit, Jacobs, Jeff, Naidu, Suresh, and Suri, Siddarth. 2018. “Monopsony in Online Labor Markets.” NBER Working Paper Series, No. 24416. Cambridge, MA: National Bureau of Economic Research.

—Égert, Balázs. 2016. “Regulation, Institutions and Productivity: New Macroeconomic Evidence from OECD Countries.” American Economic Review 106(5): 109–113.

—Égert, Balázs. 2018. “Regulation, Institutions and Aggregate Investment: New Evidence from OECD Countries.” Open Economies Review 29(2): 415–449.

—Eggertsson, Gauti, Robbins, Jacob, and Getz Wold, Ella. 2018. “Kaldor and Piketty’s Facts: The Rise of Monopoly Power in the United States.” NBER Working Paper Series, No. 24287. Cambridge, MA: National Bureau of Economic Research.

—Furman, Jason, and Orszag, Peter. 2018. “A Firm-Level Perspective on the Role of Rents in the Rise in Inequality.” In M. Guzman (ed.), Toward a Just Society: Joseph Stiglitz and Twenty-First Century Economics. New York: Columbia University Press.

—Goldin, Claudia, and Katz, Lawrence. 2008. The Race between Education and Technology. Cambridge, MA: Harvard University Press.

—Gutiérrez, Germán, and Philippon, Thomas. 2017. “Investment-less Growth: An Empirical Investigation.” Brookings Papers on Economic Activity. Fall 2017: 89–169.

—Hanushek, Eric, Schwerdt, Guido, Wiederhold, Simon, and Woessmann, Ludger. 2015. “Returns to Skills Around the World: Evidence from PIAAC.” European Economic Review 73(C): 103–130.

—Haskel, Jonathan, and Westlake, Stian. 2017. Capitalism without Capital: The Rise of the Intangible Economy. Princeton, NJ: Princeton University Press.

—IMF. 2017a. World Economic Outlook. April 2017: chapter 3 on “Understanding the Downward Trend in Labor Income Shares.” Washington DC: IMF.

—IMF. 2017b. Fiscal Monitor. October 2017: chapter 1 on “Tackling Inequality.” Washington DC: IMF.

—ITU (International Telecommunication Union). 2016. ICT Facts and Figures 2016. Geneva.

—Krugman, Paul. 2015. “Challenging the Oligarchy.” The New York Review of Books, December 17, 2015.

—Krugman, Paul. 2016. “Robber Baron Recessions.” The New York Times, April 18, 2016.

—Kurz, Mordecai. 2018. “On the Formation of Capital and Wealth: IT, Monopoly Power and Rising Inequality.” Working Paper 17–016. Stanford, CA: Institute of Economic Policy Research.

—Lindsey, Brink, and Teles, Steven. 2017. The Captured Economy: How the Powerful Enrich Themselves, Slow Down Growth, and Increase Inequality. Oxford, UK: Oxford University Press.

—McKinsey Global Institute. 2015. Digital America: A Tale of the Haves and Have-Mores. McKinsey & Company.

—OECD. 2015. “Finance and Inclusive Growth.” OECD Economic Policy Paper, No. 14. Paris: OECD.

—OECD. 2016. OECD Economic Outlook. Volume 2016, issue 1, chapter 2 on “Promoting Productivity and Equality: A Twin Challenge.” Paris: OECD.

—OECD. 2017. A Fiscal Approach for Inclusive Growth in G7 Countries. Paris: OECD.

—OECD. 2018a. The Productivity-Inclusiveness Nexus. Paris: OECD.

—OECD. 2018b. OECD Economic Outlook. Volume 2018, issue 2, chapter 2 on “Decoupling of Wages from Productivity: What Implications for Public Policies?” Paris: OECD.

—Philippon, Thomas. 2016. “Finance, Productivity, and Distribution.” Paper prepared for Brookings-Chumir research project on The Technology-Productivity-Inequality Nexus, October, 2016.

—Piketty, Thomas. 2014. Capital in the Twenty-First Century. Cambridge, MA: Harvard University Press.

—Rajan, Raghuram, and Zingales, Luigi. 2003. Saving Capitalism from the Capitalists. New York: Crown Business.

—Schwellnus, Cyrille, Pak, Mathilde, Pionnier, Pierre-Alain, and Crivellaro, Elena. 2018. “Labour Share Developments over the Past Two Decades: The Role of Technological Progress, Globalisation and ‘Winner-Takes-Most’ Dynamics.” Economics Department Working Paper, No. 1503. Paris: OECD.

—Shambaugh, Jay, Nunn, Ryan, and Portman, Becca. 2017. “Eleven Facts about Innovation and Patents.” Washington, DC: The Hamilton Project, Brookings Institution.

—Song, Jae, Price, David, Guvenen, Faith, Bloom, Nicholas, and von Wachter, Till. 2019. “Firming Up Inequality.” Quarterly Journal of Economics 134(1): 1–50.

—Stiglitz, Joseph. 2016. “Monopoly’s New Era.” Project Syndicate, May 13, 2016.

—Summers, Lawrence. 2016. “Corporate Profits are Near Record Highs. Here’s Why That Is a Problem.” The Washington Post Wonkblog, March 30, 2016.

—Sundarajan, Arun. 2016. The Sharing Economy: The End of Employment and the Rise of Crowd-Based Capitalism. Cambridge, MA: MIT Press.

—Turner, Sarah. 2017. “Education Markets: Forward-Looking Policy Options.” Hutchins Center Working Paper No. 27. Washington DC: Brookings Institution.

—West, Darrell. 2018. The Future of Work: Robots. AI, and Automation. Washington, DC: Brookings Institution Press.

—Wolff, Edward. 2014. “Household Wealth Trends in the United States, 1962–2013: What Happened over the Great Recession?” NBER Working Paper Series, No. 20733. Cambridge, MA: National Bureau of Economic Research.

—World Bank. 2019. World Development Report 2019: The Changing Nature of Work. Washington, DC: World Bank.

Comments on this publication