Introduction

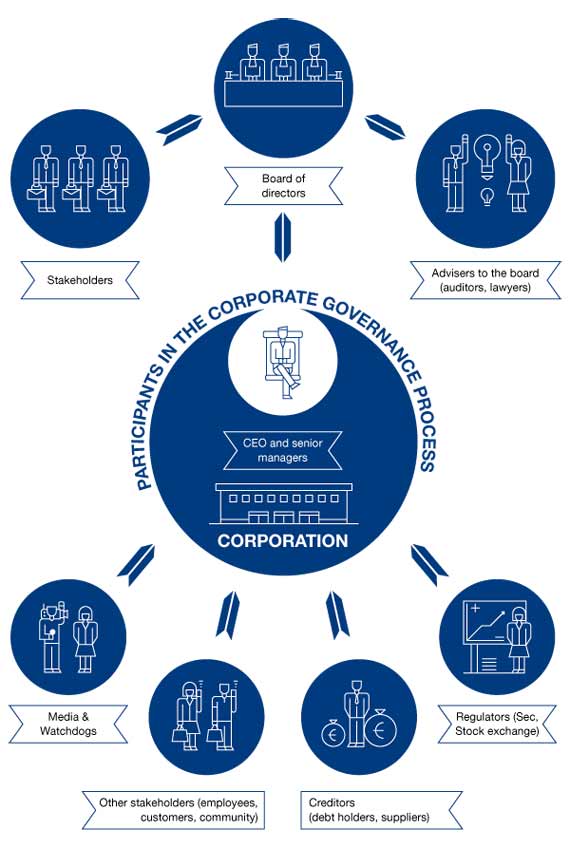

At Columbia Business School we teach corporate governance within our Individual, Society, and Business curriculum and explore the connections between corporate governance, value based leadership (a foundation for good corporate governance) and corporate social responsibility. In addition, we view corporate governance as a system of checks and balances among the stockholders, the board, and the CEO.1

What Corporate Governance Is: A System of Checks and

Balances Among the Stakeholders, the Board and CEO

My study of corporate governance and its intersection with executive leadership and corporate responsibility led me to write The CEO’s Boss: Tough Love in the Boardroom, published by Columbia University Press in 2010.2 The intent of this book was to help the Board of Directors operate more effectively as the boss of the CEO. The Corporate Board Member (First Quarter 2014) stated: “The CEO’s Boss serves up a wealth of practical, hands-on recommendations to build a productive partnership and a plan of action for a variety of business settings.”3 The core argument was that the CEO’s style needs to be matched to the business’s point in its cycle, and that the board needs to intervene actively with the CEO to help him or her close any gaps between their capabilities/style and the requirement of the company to address its current challenges. In addressing its current challenges, the company must manage the change from its present state to its desired future state. During each of the four years since The CEO’s Boss called for Tough Love in the Boardroom, I have presented case studies of governance in companies of the twenty-first century at the annual conference of the Financial Times/Outstanding Directors Exchange (FT-ODX) in New York City.

Case Series

These companies were chosen because they were in the FT headlines as facing strategic challenges that required their management of change. The one exception is the Wounded Warrior Project whose case was just completed at the time of this writing, but will be used as a model for governance and managing change in the twenty-first century.

In each of these for-profit corporate case studies, the companies were faced with a significant challenge in their business performance. They were confronted Wwith a downturn in their business cycle and their CEOs were coming under pressure to lead the change. Within the boardroom of these companies, times got tough. Tough times required tough love as prescribed in The CEO’s Boss:

Tough love is an expression used when someone treats another person sternly with the intent to help them in the long run

- Know your CEO’s behavioral style and leadership practices;

- Know your organization’s needs (Strategy, Priorities and Gaps);

- Match the organization’s needs with the leadership that is required;

- Look first at your CEO and then the senior team to find the correct match; and

- If you don’t find the correct match, look elsewhere4

In the most recent case study presentations at FT-ODX were BP (2011), HP (2012) and P&G (2013); each changed its CEO. BP, after its disaster in the Gulf of Mexico, removed its CEO and chose an insider. HP, after three CEOs in seven years, chose a current non-employee director on its board to be CEO. P&G, challenged by an activist investor, changed out its CEO for the former CEO. Let’s look at each of these companies of the twenty-first century in the context of their corporate governance and the management of change.

BP (a.k.a. British Petroleum)

In the aftermath of the 2010 Gulf of Mexico oil spill, a case study examining the implications for the management team and board of BP Oil was presented at FT-ODX in 2011 and published by Columbia CaseWorks.5The Gulf disaster became the most recent event to raise the question of BP’s leadership ability, including the CEO and board of directors, to manage its growth strategy and risk profile.

The Gulf Explosion

On April 20, 2010, the semi-submersible exploratory offshore drilling rig Deepwater Horizon exploded after a blowout; it sank two days later, killing 11 people. This blowout in the Macondo Prospect field in the Gulf of Mexico resulted in a partially capped oil well one mile below the surface of the water. Experts estimate the gusher to be flowing at 35,000 to 60,000 barrels per day (5,600 to 9,500 m/d) of oil. The exact flow rate was uncertain due to the difficulty of installing measurement devices at that depth and is a matter of ongoing debate. The resulting oil slick covered at least 2,500 square miles (6,500 km2), fluctuating from day to day depending on weather conditions. It threatened the coasts of Louisiana, Mississippi, Alabama, Texas, and Florida.

Past Incidents

This was not the first accident in which BP people were killed. In March 2005, BP’s Texas City, Texas refinery, one of its largest refineries, exploded causing 15 deaths, injuring 180 people and forcing thousands of nearby residents to remain sheltered in their homes. Under scrutiny after the Texas City refinery explosion, two BP-owned refineries in Texas City, Texas, and Toledo, Ohio, were responsible for 97% (829 out of 851) of willful safety violations by oil refiners between June 2007 and February 2010, as determined by inspections by the Occupational Safety and Health Administration. Jordan Barab, Deputy Assistant Secretary of Labor at OSHA, said “The only thing you can conclude is that BP has a serious, systemic safety problem in their company.”6

The CEOs

Sir John Browne was BP Chairman and CEO at the time of the Texas City refinery blast and resigned in 2007 when he lost the support of the board after a string of setbacks including a blast in 2005. In his memoir, Beyond Business (2010), which came out in February before the Gulf blowout, he wrote that BP pursued outsized risk—in acquisitions, foreign adventures, and deep-water drilling—to grow itself out of its status as a “middleweight insular British company.”7

When Tony Hayward became BP’s chief executive in May 2007, he promised to get the company back to basics. A plain-spoken geologist and longtime company man, Hayward said in a speech at Stanford Business School in 2009: “BP makes its money by someone, somewhere, every day putting on boots, coveralls, a hard hat and glasses, and going out and turning valves … And we’d sort of lost track of that.” Hayward also pledged to fix the safety problems that contributed to the downfall of his predecessor. Though the company would continue doing the “tough stuff,” he declared, it would make safety its “No. 1 priority.”8 Until the April 20 explosion of the Deepwater Horizon oil rig in the Gulf, Hayward repeatedly said he was slaying two dragons at once: safety lapses that led to major accidents, including a deadly 2005 Texas refinery explosion; and bloated costs that left BP lagging behind rivals Royal Dutch Shell plc and Exxon Mobil Corp. A Wall Street Journal examination of internal BP documents, legal filings, official investigations and reports by federal inspectors, as well as interviews with regulators, shows a record that doesn’t always match Hayward’s reports of safety improvements.9

Two weeks prior to the Gulf explosion BP admitted that malfunctioning equipment lead to the release of over 530,000 pounds of chemicals into the air of Texas City and surrounding areas from April 6 to May 16, 2010—the same refinery that had exploded killing 11 in 2005, but this time on Hayward’s watch. The leak included 17,000 pounds of benzene (a known carcinogen), 37,000 pounds of nitrogen oxides (which contributes to respiratory problems), and 186,000 pounds of carbon monoxide.10

The Board

The BP board had known for years that something was wrong with safety at BP. BP assembled an independent panel, headed by former Secretary of State James Baker, to investigate safety at its US refineries. While the panel worked, a BP pipeline in Alaska leaked more than 200,000 gallons of crude in March 2006. The panel’s report, published in January 2007, is brutally direct. While its immediate focus is BP’s five US refineries, its findings go far beyond them. Calling for “leadership from the top of the company, starting with the board and going down,” the report found that “BP has not provided effective process safety leadership.” Corporate-governance authority Robert A.G. Monks, who testified as an expert witness for a Texas City worker, says, “The BP board was on notice that the corporate culture of ‘saving over safety’ pervaded BP. They were on notice that the mechanisms for informing the board were dysfunctional. The board had an affirmative duty to understand the risks involved in the drilling of this well.”11

Calling for “leadership from the top of the company, starting with the board and going down,” the panel’s report found that “BP has not provided effective process safety leadership”

Carl-Henric Svanberg became the non-executive chairman of the board in June 2009, following a career at Ericsson that was marked by aggressive cost-cutting measures taken to return the company to profitability. At the time of Svanberg’s appointment to the board, Hayward stated that ‘’He is a businessman of international stature who is recognized for his transformation of Ericsson. Our shared views on many aspects of global business give me great confidence that we will work very effectively together on the next phase of BP’s progress.’’12

Leadership for the Future

BP’s board replaced Tony Hayward, whose repeated stumbles during the company’s three-month oil spill in the Gulf of Mexico alienated federal and state officials as well as residents of the Gulf Coast. Through the nomination committee, the board engaged external advisers who identified an external candidate and existing executive director, Bob Dudley, for the position of group chief executive. After interviews and detailed consideration it was concluded that Bob Dudley had the strong industry, operational and geopolitical experience required for the role and he was appointed as the group chief executive. Dudley, 54, who grew up in Mississippi and spent summers fishing and swimming on the Gulf, had been in charge of BP’s response to the spill. Dudley took over on Oct 1, 2010 after a two-month transition period. “We will look at what we have learned from this incident. We will look at our culture and our safety and operations,” Dudley said.13

Lessons Learned

How might the BP board and its new CEO, Robert Dudley, start their learning journey together? They could return to the 2007 Baker study of the Texas City refinery explosion and answer the four questions of the After Action Review (AAR):

- What was our intent (Recommendations from the Baker report)?

- What happened between 2007 and 2014—safety violations?

- Why did it happen—why do we continue to have safety problems?

- How can we make it better—manage concurrently our growth strategy and risk profile? It would be reasonable to assume that this AAR for post mortem has already occurred.

As is prescribed in The CEO’s Boss, “a strong partnership between the CEO and the company’s directors” is necessary. However, a strong partnership doesn’t occur simply by wishing for it. Dudley and the BP board need to form clear, mutually understood expectations for the partnership– a Social Contract. To paraphrase Rousseau’s original work, each must place “his person and authority under the supreme direction of the general will”—the CEO/board partnership. At a minimum, the Social Contract should include:

- Commitment to values

- Commitment to the stakeholders

- Commitment to risk assessment

- Commitment to transparency14

The BP CEO/board commitment to values is not meant to substitute for the public statement of what BP stands for:

We care deeply about how we deliver energy to the world. Above everything, that starts with safety and excellence in our operations

or its values:

Safety, Respect, Excellence, Courage, One Team.

It recommends that the CEO and board define the instrumental values to which they collectively subscribe for the good of their working partnership. An example of where this distinction made a difference was at Tyco International during its rise from the failed leadership of its former chairman and CEO Dennis Kozlowski who was sentenced to 8 to 25 years in prison for stealing $600 million from the company. Edward D. Breen was appointed the new chairman and CEO of Tyco in 2002. In August of 2002, with the priority of improving the company’s governance, Breen announced the appointment of Jack Krol as lead director. Together they lead the formation of their CEO/board Social Contract–How we conduct ourselves:

Integrity

We demand of each other and ourselves the highest standards of individual and corporate integrity with our customers, suppliers, vendors, agents and stakeholders. We vigorously protect company assets and comply with all company policies and laws.

Excellence

We continually challenge each other to improve our products, our processes and ourselves. We strive always to understand our customers’ and suppliers’ businesses and help them achieve their goals. We are dedicated to diversity, fair treatment, mutual respect and trust of our employees and customers.

Teamwork

We foster an environment that encourages innovation, creativity and results through teamwork and mutual respect. We practice leadership that teaches, inspires and promotes full participation and career development. We encourage open and effective communication and interaction.

Accountability

We will meet the commitments we make and take personal responsibility for all actions and results. We will create an operating discipline of continuous improvement that will be integrated into our culture.15

Today, these board Governance Principles have been extended to embrace all the employees of Tyco International and how they interact with its stakeholders and one another.

Reading the annual reports of BP since the Gulf explosion, it is evident that there is a heightened commitment to stakeholders, risk assessment and transparency. One can only recommend that they strengthen their resolve to their commitments through a renewed CEO/board partnership—a Social Contract of their governance principles.

Hewlett-Packard (HP)

Columbia CaseWorks first examined corporate governance at HP from the period of 1999 to 2005. “In July 1999 Carly Fiorina was lured from rising star status at Lucent Technologies to become CEO and, in time, Chairman of the Board. During her tenure, Fiorina spearheaded several moves to transform and revitalize the company. Most notable was her decision to merge with Compaq Computers, catalyzing a much publicized proxy battle led by Walter Hewlett, son of the company’s cofounder, over the direction the company should take. In February 2005, Fiorina was hastily fired, leaving many to speculate on what factors, other than her performance as CEO, might have been at play.”16

HP’s board made it clear that all directors, as well as officers and employees, should display the highest standard of ethics, consistent with HP’s longstanding values and standards

In 2012, it was time to look again at HP. At the FT-ODX conference, an updated case study of HP was presented.17 During the period between 2005 and 2011, HP’s board had hired and fired two other CEOs. Mark V. Hurd had been appointed as CEO after he investigated a boardroom scandal involving company spying on board members, employees and journalists. As an outcome of that investigation, the board made it clear that all directors, as well as officers and employees, should display the highest standard of ethics, consistent with HP’s longstanding values and standards. HP has and will continue to maintain a code of conduct known as the “Standards of Business Conduct” for its directors, officers and employees. This code is meant to build trust, one day at a time, by making ethical decisions, taking action when misconduct occurs, and avoiding retaliation while cooperating with investigations. In HP’s 2005 Annual Report, Hurd asserted that HP is on its way to building a culture of accountability and execution. We have a strong brand and an increasingly loyal customer base that wants to see HP win. And we will continue to expend every ounce of effort to make sure that we live up to each one of our commitments to our customers, our partners, our employees and our stockholders. In August 2010, Hurd was fired over the accounting of expenses for entertaining of a female contractor. Michael Holston, HP EVP and general counsel, stated that Hurd’s actions “showed a profound lack of judgment.”18

The board hired as its CEO Leo Apotheker, who had previously served in that same role at SAP. Apotheker had a vision of making HP a Web-oriented and software company. He was fired after eleven months on the job, during which period HP produced poor earnings and made expensive acquisitions. The most notable of these acquisitions was Autonomy, the British software maker, for $11.1 billion. HP wrote down $8.8 billion of its acquisition of Autonomy, an overpayment of 79%.19

At the start of his tenure as CEO, Apotheker was successful in bringing in five new directors to the board. Among those five was Meg Whitman, the former head of eBay. On September 4, 2011 she was named as the next HP CEO, its third in seven years. HP’s chairman Raymond Lane defended the board’s hasty decision to appoint Whitman, saying she was the “best choice” for the job. “Meg is a proven leader of people,” he said in an interview with CNBC. Apotheker “has great qualities, but not the qualities that are needed here and now.”20

In carrying out their duties as corporate leaders, a board and the CEO must be vigilant in looking beyond any short-sighted, short-lived interests to set policies and make decisions that are in the best interest of the company over a longer time horizon. The board has a unique responsibility to “ask questions, think independently, and show tough love when necessary” (The CEO’s Boss). In the case of HP, the board has accepted that the company is in a turnaround that will take more than a year’s tenure of its CEO. Whitman said that HP needs four more years “to have confidence in itself.”21

Lessons Learned

In the case of Apotheker, it was evident that the company needed to identify and hire a CEO whose talents and approach would take the company in a very different direction from where it had been heading. The board, as the CEO’s boss, needs to know specifically, what skills, vision, approach and management style would be required of this new CEO? What criteria would a board use in evaluating candidates and making the best choice for the company and its stakeholders?

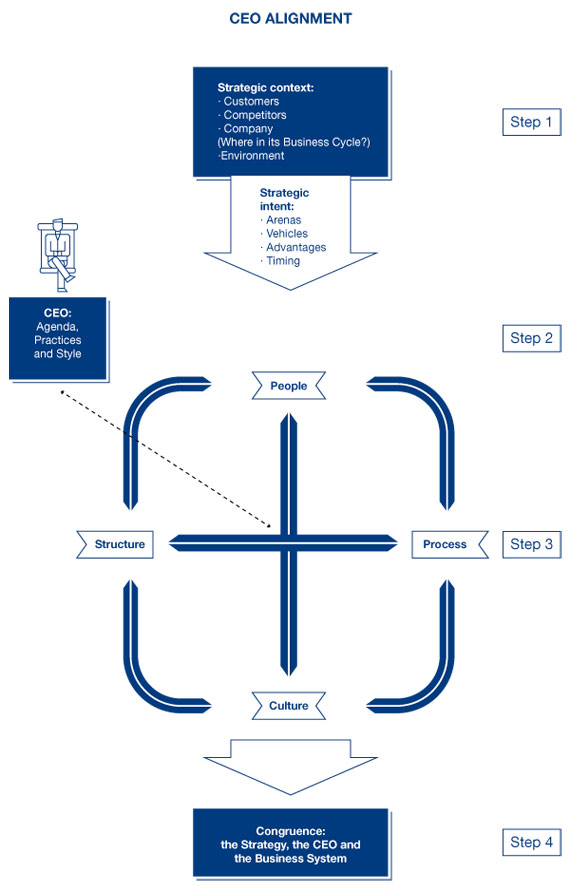

The following 4-step process is recommended to determine if a prospective CEO aligns with the needs of the business (CEO Alignment).22

Step 1

A board needs to fully understand its own strategic context and intent—collectively, its strategy—before it can hope to engage productively in the process of selecting a CEO. Only then can a board move on to the next step.

Step 2

Determine, given the company’s position, the agenda, practices, and style required of its CEO.

Step 3

The board must assess the alignment of the levers of its business system (structure, process, people, culture) and identify the gaps, because these gaps will become the CEO’s strategic priorities.

Step 4

Achieve a degree of congruence between the strategy, the CEO, and the business system.

As part of Step 1, it is not uncommon for the board to work with a management consulting firm to clarify its strategic context and revise its overarching corporate strategy. It is essential that the board start the process with this baseline analysis, as it will make apparent the specific strategic needs of the organization over which the new CEO will preside.

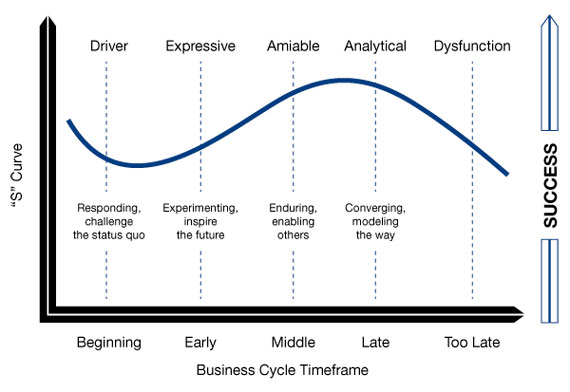

In carrying out Step 2, the board must be sensitive to the particular business cycle in which the company finds itself, as some leaders are better equipped to manage, for instance, an early stage of the business cycle, while others are better suited to manage a mature venture. The behavioral style of the CEO also matters a great deal in matching the leader to his or her circumstance. Is the prospective CEO, for instance, driving, expressive, amiable, or analytical—and to what extent does this personal style align with the current needs of the business? Attention to issues of behavior and style may be all the more pressing following a time of crisis.

During Step 3, the board places its focus on aligning the business system. Every CEO candidate will want to know what is broken in the company and what needs fixing. Before speaking with prospective CEOs, the board must determine what is broken—i.e. what levers of the business system are not aligned and, therefore, not supporting the current strategy.

As the board moves toward Step 4, its members must be mindful of the need for the CEO to provide both strategic leadership and strategic management. Strategic leadership requires a specific set of agendas, practices, and behaviors that will result in the “change an organization desires.” Strategic management aligns the levers of the business system to achieve that change. Once inserted into the business system, a CEO will serve either as a catalyst or an impediment to a board’s desired change.

Gaining congruence between strategy, the CEO, and the business systems is a process of discovery whose effectiveness is determined by asking the right questions. The following questions will be helpful to a board seeking to explore and validate their choice of a new CEO:

Structure

How would you align your activities as CEO to achieve the strategic objectives of the business? Does the current design of our organization provide the structure you would need to support our strategic intent? Are there any systems you feel are not aligned?

Process

How would you improve the work flow throughout the organization? What do you feel is the knowledge, skill, and information needed to improve our work processes? Do you feel our performance measures and indicators are aligned?

People

Do you feel our employees possess the required competencies? Do you envision any changes? If so, how are they aligned with our employees’ expectations and motivations?

Culture

How should we be doing things around here in support of our strategic intent? Are the norms and values aligned with yours, and if so, how?

The HP annual reports that have followed the appointment of Meg Whitman acknowledge the current turnaround strategy and leadership challenge to align its business system to this change. The board recently announced that its interim chairman Ralph Whitworth, who two months earlier assumed the chairmanship when its non-executive chairman Raymond J. Lane stepped down, had departed for personal reasons and that Meg Whitman would become CEO and Board Chair. HP had separated the CEO and Chair responsibilities after terminating Carly Fiorina in her CEO and Chair position in 2005. The elimination of the non-executive chair is not without controversy.23 Meg Whitman in her combined role of CEO and Chair will need to achieve congruence on two fronts: CEO alignment with the strategy/business system as well as congruence in the alignment of the CEO/board partnership which raises the preceding recommendation to BP to renew their Social Contract, its governance principles.

Procter and Gamble (P&G)

At the 2013 meeting of the FT-ODX conference, the case of P&G board’s handling of its CEO’s strategy and activists was discussed. That case study then became the material for a Columbia Caseworks publication: “Procter & Gamble in 2013: A Board Adrift?”24 The reason for raising this question lies in the board’s response to the confrontation with its activist investor William Ackman, who called for the firing of P&G’s CEO Bob McDonald due to the company’s poor financial performance over his tenure. In May 2013 the board replaced McDonald, who had been appointed CEO in July 2009, with his predecessor, A.G. Lafley. This was not the first time that the P&G board had replaced its CEO in the face of poor financial performance. In July 2000 P&G stock hit bottom, dropping 50% in the space of several months. Lafley had replaced Durk I. Jager, who had been CEO for only 17 months. In the nine years that followed under Lafley’s leadership, annual organic sales grew—on average— 5%, core earnings-per-share grew 12% and free cash flow productivity increased 111%.25

McDonald’s accession to the top job at P&G had been the product of a careful, years-long succession planning process. As Lafley put it, “We benchmarked internal candidates against strong external CEOs that our directors knew. We concluded that an outside option wasn’t needed and wouldn’t be as good a fit for P&G.”26 McDonald, in many ways, was Lafley’s handpicked successor. He and Lafley had spent most of their professional careers at P&G and had developed together its growth strategy of moving into emerging markets around the globe. Now under McDonald’s tenure, P&G was underperforming against the competition (Colgate-Palmolive, Clorox and Unilever) from 2009 to 2012; and Unilever had been well established in the emerging markets space from which Lafley and McDonald believed its revenue growth would come.

“Procter & Gamble in 2013: A Board Adrift?” The reason for this question lies in the board’s response to its activist investor Ackman, who called for the firing of P&G’s CEO due to the company’s poor financial performance

McDonald’s push into emerging markets was accompanied by cost-cutting at home, and he laid out his goals in P&G’s 2012 annual letter to shareholders: “Earlier this year, we announced our objective of delivering $10 billion in cost savings by the end of fiscal year 2016. This program includes $6 billion of savings in cost of goods sold, $1 billion from marketing efficiencies, and $3 billion from non-manufacturing overhead.” Despite McDonald’s efforts, P&G struggled, with net earnings down and the stock largely flat, even as P&G’s competitors were outperforming it in the crucial emerging markets space. Yet this statement from the 2012 Annual Report indicated the board’s ongoing commitment to McDonald’s strategy: “We see significant remaining growth opportunities as our business in developing markets is still smaller as a percentage of sales than the developing markets businesses of some of our competitors, and we will continue to focus on growing our business in the largest and most important of these markets.”27

Activist Investor

In 2012 William Ackman revealed that Pershing Square Capital Management held roughly 1% of P&G’s shares, making him one of P&G’s largest shareholders. He immediately began pushing for change at the consumer products giant. He was respectful of the board in his public statements, but was critical of McDonald. He felt that he lacked focus and didn’t have the ability to execute the emerging market strategy while at the same time cutting cost.28Analysts also began criticizing the company along the lines Ackman had laid out.

In September 2012 Ackman met with two of P&G’s directors—Kenneth Chenault, the CEO of American Express, and W. James McNerney Jr., the chairman and CEO of The Boeing Company. Later that month BloombergBusinessWeek reported that P&G’s board reiterated its confidence in McDonald. McNerney acknowledged in a public statement that P&G’s directors were monitoring McDonald’s strategy and added, “The board also wholeheartedly supports Bob McDonald as he leads its implementation.”29

McDonald intensified his efforts to get P&G back on track and, potentially, blunt Ackman’s attempt to oust him. In November 2012, P&G announced an aggressive $4 to $6 billion stock buyback program for 2013, something that McDonald had strenuously argued against earlier in the year. The announcement came a month after P&G reported that its fiscal 2013 first-quarter profit had declined 6.9% and sales were off 3.7%.30

McDonald also took this opportunity to reiterate P&G’s cost-cutting goals, including plans to lay off between 2% and 4% of the company’s workforce, and reaffirm the “40-20-10” strategy he articulated in P&G’s 2012 annual report. In short, McDonald had charted a course to growth by pledging to refocus the company on its 40 most profitable products, its 20 largest innovations, and the 10 developing markets with the highest growth potential.31

For his part, Ackman remained undeterred, responding, “We’re delighted to see the company’s made some progress, but P&G deserves to be led by one of the best CEOs in the world. We don’t think Bob McDonald meets that standard.”32

The Board Acquiesces

On Thursday evening, May 23, 2013, P&G issued a press release announcing that McDonald would officially step down on May 30 and that Lafley would come out of retirement and return to his former role as CEO and chairman of the board.33

Under unrelenting pressure from Ackman and another disappointing quarter at P&G, McDonald had finally resigned, and Lafley was brought back in to take his place. Publically, McDonald’s exit was described as a resignation of his choosing, rather than an ouster by the board.

Lessons Learned

Whether or not the board chose to remove McDonald or was simply reacting to Ackman’s aggressive overtures, it did most decidedly choose Lafley as McDonald’s successor, giving him days of notice—rather than weeks or months.34 Was Lafley the best choice for the role? Some industry insiders, including Jason Tauber, a research analyst with the Large Cap Disciplined Growth team at Neuberger Berman Group (which then held 8.7 million P&G shares), suggested that bringing back Lafley “highlights poor succession planning by the board.”35

The CEO’s Boss stresses that there is a hierarchy of needs in every organization that is typically expressed in its strategy, priorities, and the performance and opportunity gaps—the measurable difference between the current and desired future state. If there is a mismatch between the current needs of the organization and the leadership practices of the CEO, then that is the point where the board must intervene, either with guidance (tough love) or action, such as removing the CEO. As in the case of HP, a process is offered in The CEO’s Boss for determining whether a prospective CEO aligns with the needs of a business.36

It is expected that Lafley will lead a successful second turnaround of P&G during his second term as CEO. He definitely left at the end of his first term as a hero, but at the end of the first year of his second term he has yet to significantly move the needle on the P&G stock price from where McDonald left it–around $80 per share. In the future, it is recommended that the P&G board look both inside and outside the company for the best match of a CEO for its needs. BP was under similar pressure to change out its leadership and took the time to engage a professional search firm to test their inside choice. At least one outside candidate was considered with leadership agenda, practices and style that matched up with their needs.

In The CEO’s Boss, an integrated leadership model is offered as a means to match the CEO’s agenda, practices and style with the company’s business cycle requirements.

Integrated Leadership Model

Ceo Agenda, practices and style

The core argument is that the CEO’s style needs to be matched to the business at each point in its cycle and that the board needs to intervene actively to help the CEO close any gaps between his/her capabilities/style and the requirement of the company. Although attention to leadership styles and a commitment to tough love all make sense on paper, implementing these strategies in the midst of the business cycle is sometimes difficult. During a downturn, attention is often on immediate solutions rather than on overall strategies, and during an upturn it can feel irrelevant to examine a system or partnership that seems to be working. However, because of the changing nature of the business cycle, it is imperative that boards constantly evaluate their leadership and their strategy. This method can help boards and businesses at every stage of the business cycle and can help regulate one of the most important relationships in the company: the relationship between the board and its CEO.37

The Wounded Warrior Project (WWP)

In addition to the BP, HP and P&G case studies of twenty-first-century corporations in the for-profit world, there are lessons to be learned from organizations in the not-for-profit arena. One of those organizations, the Wounded Warrior Project, was founded in the fall of 2003 and marked its tenth anniversary in 2013 as a mission-driven organization existing to honor and empower Wounded Warriors, specifically those who suffered a physical or mental injury during the Afghanistan and Iraq wars that ensued after the September 11, 2001 terrorist attack on the New York City World Trade Center. The vision of this organization was simple: to focus on those newly injured and “foster the most successful, well-adjusted generation of wounded service members in our nation’s history.”38 The Columbia CaseWorks case study, “Wounded Warrior Project: Leading from the Front,” examines the governance and management of change of the WWP leadership over its ten year history and offers best practices for all organizations, for-profit and not-for profit, to emulate.39

The CEO’s style needs to be matched to the business at each point in its cycle and the board needs to intervene actively to help the CEO

WWP could look back on many successes over its ten year history. By September 2012 WWP was serving 27,492 veterans; one year later this number rose to 38,954. Revenues to fund programs were over $224 million for FY 2013 (year ending in September) and were being directed to a range of programs and services, with costs closely monitored relative to program effectiveness. Yet for all the organization’s successes, CEO Steve Nardizzi and his team believed that it was facing a significant inflection point. The scale and scope of the WWP had grown exponentially in terms of the organization’s size, funding, and programs and were pushing at the boundaries of the team’s managerial and business leadership capabilities. Importantly, with the end of the US presence in the conflict zones, awareness of veterans, their sacrifices, and ongoing needs would likely fade from top of mind and the result would be a decline in funding to groups like WWP. But the mental and physical needs of the veterans would not fade.

As Nardizzi reflected on earlier discussions that the WWP leadership team had with Professor William Klepper of Columbia Business School, he was more and more convinced that Klepper’s advice was on target. WWP needed to consider the required capabilities of leadership in the future and also ensure that it had a board in place capable of defining and directing the organization. If WWP was to achieve its vision of fostering “the most successful, well-adjusted generation of wounded service members” in US history, change was needed. Nardizzi summarized:

Discussions with Klepper really opened our eyes. Since our founding we were an organization and a board on the ‘inside looking out.’ We have had the same board since we were the tiniest of charities. At that time, we needed an operational board who understood warriors, warrior programs, the role of government, and, most importantly, because we had little resources for staff we needed board members willing to roll up their sleeves. Today, we have a staff to run the organization so our needs are more strategic. For the future, we need a board able to be on the ‘outside looking in.’ We still need a board to provide operating oversight but importantly, we need a diverse board that can see the broader landscape, the next big issue coming our way, and get WWP out in front of it.40

Klepper, drawn to Nardizzi’s passion for his organization’s value and mission, listened and suggested that WWP work with Korn Ferry International, a consultancy firm with specialized knowledge in the area of corporate governance. Within months, three broad areas had been identified for consideration: succession planning, the size of the board, and the composition of the board in light of future needs. The governance committee needed to make a recommendation to the board within a few short weeks. As the committee considered its options, it weighed several factors: that WWP was devoted to its mission, that either by serendipity or design WWP had so far managed to do everything right, and that the future loomed large.

Leadership, People, and Governance

In 2013, two of WWP’s founding fathers continued to lead the organization. Nardizzi was the chief executive / CEO responsible for the oversight of all aspects of the organization. Prior to taking on the role in 2009, Nardizzi had been deputy executive. Albion (Al) Giordano now acted as the deputy executive/COO. Giordano was himself a disabled veteran of the US Marine Corps. WWP’s board of directors was composed of 12 men and women, with all but two having military experience.

WWP used its core values of fun, integrity, loyalty, innovation, and service (FILIS) as the basis for its leadership. FILIS and teamwork drove action in the organization and guided decision-making aligned with the mission of fostering the most successful, well-adjusted generation of wounded warriors in US history. As Giordano noted, “It really is our people who identify the need, who develop the strategy, who implement the strategy, who figure out where the next great opportunity is programmatically. So if they’re all aligned and they’re all working together as a team, they have the same value set, passion about our mission, they’re going to figure it out and create the next great success.”

By the end of 2013 the number of WWP offices had grown to 17 with 342 employees providing programs for alumni. In an annual survey of alumni, about 45% indicated that they were meeting their individual goals, about 26% indicated they were making progress, while the remaining 29% indicated they were not making progress toward their goals.

The leadership team and the board were responsible for oversight and setting the direction for the future. Anthony Principi, vice president of the WWP board and former Secretary of Veterans Affairs, addressed some of the challenges facing WWP:

Today the Department of Veterans Affairs faces numerous challenges, including allegations of misconduct at several VA medical centers; returning troops with severe battlefield wounds, a burgeoning backlog of claims for disability compensation, and rapidly changing demographics in a declining military and veteran population. As a former Secretary of Veterans Affairs I appreciate the enormity of these challenges and the need for strong and decisive leadership to chart a new course for the VA in the 21st century. The Wounded Warrior Project will play an important role in the VA’s transition, helping to develop innovative programs to meet the needs of today’s wounded warriors. The leadership and staff have propelled WWP to become the finest veterans’ service organization in the country. The future success of WWP in carrying out its mission ‘to care for him who shall have borne the battle, and for his widow, and his orphan’ [President Abraham Lincoln] will rest on the shoulders of today and tomorrow’s leaders. WWP’s board of directors has the important responsibility of ensuring that the men and women who bring WWP to life fulfill Lincoln’s charge to care for all who have sacrificed.41

Governing for the Future

If WWP were to continue its progress in fostering “the most successful, well-adjusted generation of wounded service members” in US history, change would be needed. As the team considered the changes, it was clear that change would need to come from the top—in leadership and direction setting. Notably, it would fall to WWP leadership—specifically the Board—to create an environment that would continue to support the organization and its mission. What was less clear was whether the existing Board and leadership had the skills needed to achieve the strategic goals. A strategy had been defined but questions remained. Did the organization have the resources to successfully execute the strategy? Did the leadership have the capabilities necessary to successfully execute the strategy? And was the Board sufficiently diverse to examine the internal and external context of the organization—a skill set that would be increasingly important for the future success of WWP?

Working with Korn Ferry International and Professor Klepper, the WWP team highlighted broad areas for consideration:

Succession Planning

Nardizzi and Giordano were two of the founding fathers of the WWP. Would their successors have the skills and competencies to lead the organization forward to the next level? Was there sufficient bench strength to take on an enterprise-wide leadership role? What were the skills and competencies needed to lead the WWP into the next decade?

The Board

In 2013 WWP’s board had 14 seats (with two currently unfilled) while most groups with decision-making responsibility functioned optimally with 7-10 members. Should WWP seek to downsize the board? If it needed to change, what should be the criteria? How should board members be evaluated? Did the current board have the core competencies to provide the oversight to get the best possible results? Did board members have the strategic competencies needed to help the WWP face the challenges of the future? Were they thinking ahead to potential successors?

As the WWP entered its second decade, its governance policies and practices would ensure its continued success. In addition, its CEO and board leadership share a common commitment to the WWP mission and its core values. They proactively addressed the changes required in their governance system and executive leadership over the next decade to serve wounded warriors. WWP is a model organization of good governance and leadership practices from which for-profits can profit.

Recommendations for Governing and Managing Change in the Company of the 21st Century

BP, HP and P&G are companies of the twenty-first century and each one has been challenged by a change in its current state that has put in jeopardy its desired future state. Each continues to confront these challenges and each needs a strong partnership between its CEO and board in order to endure. In examining the case studies and the lessons learned from each of these companies, recommendations were offered. By way of summary, the prescription for a prosperous partnership and future includes the following:

Develop your Social Contract

A Board/CEO partnership cannot be sustained by good intentions alone; it must be defined by an explicit statement of the beliefs and behaviors that are essential for the general will of the organization. Boards should share a set of common commitments with their CEO:

- Commitment to values: a leadership credo that answers the question “What do we stand for as an organization?”

- Commitment to the stakeholders—customers, employees, shareholders, and community

- Commitment to risk assessment— a willingness to manage the company’s risk profile

- Commitment to transparency— complete honesty in financial and non-financial matter

- Commitment to coaching for their continuous improvement

Practice Tough Love

Intentionally address the realities of your CEO’s tenure with the appropriate amount of tough love before your company and CEO become dysfunctional. Boards can learn from those who study CEO tenure, company performance, and successful leadership behaviors. Taking this research into account can help the company thrive at every stage in the life cycle of the business.

Constantly Assess Your CEO’s Leadership Agenda, Practices, and Style

Business cycles are unavoidable and uncertain, and the board needs to face this reality and be prepared to change its leadership if the CEO cannot adjust to the changing conditions.

Achieve Congruence

If you determine the current CEO cannot adjust to the changing business cycle, the Board must:

- Understand its own strategic context and intent, i.e., its strategy, before it can begin the CEO selection process;

- Determine the company’s position and the agenda, practices, and style required of its CEO; and

- Identify key gaps in structure, process, people, and culture, because these gaps will become the CEO’s strategic priorities.

Closing

Mark Twain once stated, “You know, I’m all for progress. It’s change I object to.” Unfortunately, both progress and change are required of the company of the twenty-first century. To achieve both, the board and CEO must form their Social Contract of shared values, commitment to stakeholders, risk management and transparency. This then provides a foundation for addressing the challenges to their strategy and alignment of their business system over time. Boards need to be the CEO’s boss, exercise the Tough Love in the Boardroom and match up the CEO’s agenda, practices, and style with what is required to progress in their business cycle. This chapter is offered as a succinct means by which organizations can both manage change and progress in the twenty-first century. A more comprehensive reading of this chapter’s content can be obtained from Columbia CaseWorks (BP, HP, P&G and WWP) and Columbia University Press (The CEO’s Boss: Tough Love in the Boardroom).

Columbia CaseWorks, http://www4.gsb.columbia.edu/caseworks

Columbia University Press, http://cup.columbia.edu/book/978-0-231-14988-4/droom

Notes

- Keehner and Randall, “Introduction to Corporate Governance,” IBS Curriculum, Columbia Business School, 2008.

- W. M. Klepper, (New York: Columbia University Press, 2010).

- D. Scally, “The CEO’s Boss: Tough Love in the Boardroom,” Corporate Board Member, First Quarter 2014.

- W.M. Klepper, The CEO’s Boss, Chapter 2.

- W.M. Klepper, “BP: A Company in Peril?,” Columbia CaseWorks, April 12, 2012.

- J. Morris and M.B. Pell, “Renegade Refiner: OSHA Says BP Has ‘Systemic Safety Problem’,” The Center for Public Integrity, May 17, 2010.

- D. Fisher, “Memoirs of BP’s Browne Foreshadow Blowout,” Forbes, August 12, 2010.

- S. Lyall, “In BP’s Record, a History of Boldness and Costly Blunders,” The New York Times, July 12, 2010.

- G. Chazan, B. Faucon, and B. Casselman, “As CEO Hayward Remade BP, Safety, Cost Drives Clashed,” The Wall Street Journal, June 29, 2010.

- R. Knutson, “BP Texas Refinery Had Huge Toxic Release Just Before Gulf Blowout,” ProPublica, July 2, 2010.

- G. Colvin, “Who’s to Blame at BP? The Board,” Fortune, July 28, 2010.

- J. Werdigier, “BP Taps the Telecommunications Industry for its Chairman,” The New York Times, June 25, 2009.

- The BP 2011 Annual Report, March 2, 2011.

- W.M. Klepper, The CEO’s Boss, The Social Contract, Chapter 1.

- Tyco International Ltd., Board Governance Principles, amended, December 6, 2007.

- D. Beim, R. Biggadike, F. Edwards, and D. Sorid, “Corporate Governance at Hewlett-Packard 1995-2005,” Columbia CaseWorks, March 18, 2010.

- W.M. Klepper, “Hewlett-Packard: Its Board, Its CEOs, Its Business,” FT-ODX, New York City, October 12, 2012.

- A. Vance, “HP Ousts Chief for Hiding Payments to Friend,” New York Times, August 6, 2010.

- Q. Hardy, “H.P. Takes $8 Billion Charge on E.D.S. Acquisition,” The New York Times, August 8, 2012.

- J. Menn and R. Waters, “HP Defends Whitman as ‘Best Choice’,” Financial Times, September 24, 2011.

- Q. Hardy, “Meg Whitman’s Toughest Campaign: Retooling H.P.,” The New York Times, September 29, 2012.

- W.M. Klepper, The CEO’s Boss, The Social Contract, Chapter 6.

- Governance Insight Alert, GMI Ratings, July 21, 2014.

- W.M. Klepper, “Procter & Gamble in 2013: A Board Adrift?”, Columbia CaseWorks, February 17, 2014.

- “Purpose, Values and Principles,” Procter & Gamble http://www.pg.com/en_US/company/purpose_people/executive_team/a_g_lafley.shtml [accessed July 27, 2014].

- A.G. Lafley, “The Art and Science of Finding the Right CEO,” Harvard Business Review, October 2011.

- Procter & Gamble, 2012 Annual Report, 2012.

- M. Farrell, “Ackman: P&G CEO May Need to Go,” CNNMoney, May 8, 2013.

- L. Coleman-Lochner, “P&G Confirms Meeting With Ackman,” Bloomberg News, September 27, 2012.

- Melodie Warner, “Procter & Gamble Hikes Stock Buyback Estimate,” MarketWatch, November 15, 2012 http://www.marketwatch.com/story/procter-gamble-hikes-stock-buyback-estimate-2012-11-15

- P&G, 2012 Annual Report.

- J. Reingold, “Can Procter & Gamble CEO Bob McDonald Hang On?” Fortune, February 8, 2013 http://management.fortune.cnn.com/2013/02/08/procter-gamble-mcdonald

- “A. G. Lafley Rejoins Procter & Gamble as Chairman, President and Chief Executive Officer,” Procter & Gamble press release, May 23, 2013, on P&G website http://news.pg.com/press-release/pg-corporate-announcements/ag-lafley-rejoins-procter-gamble-chairman-president-and-chi

- R. Kerber, N. Damouni, and J. Wohl, “Analysis: P&G All-Star Board’s Oversight Questioned as CEO Departs,” Reuters, May 29, 2013 http://www.reuters.com/article/2013/05/29/us-proctergamble-ceo-board-analysis-idUSBRE94S05U20130529

- Kerber, Damouni, and Wohl, “Analysis.”

- W.M. Klepper, The CEO’s Boss, Chapter 2.

- W.M. Klepper, The CEO’s Boss, The Right Partnership Matters, Chapter 3.

- Wounded Warrior Project, Mission Statement http://www.woundedwarriorproject.org/mission.aspx

- W.M. Klepper, “Wounded Warrior Project: Leading from the Front,” Columbia CaseWorks, July 24, 2014.

- Steven Nardizzi, interview by casewriter, Sawgrass, Florida, March 8, 2014. Applies to this and all other Nardizzi statements, unless otherwise noted.

- Anthony Principi, email message to casewriter, May 20, 2014.

Comments on this publication