Introduction: How the Histories of Economies, Technologies and Cultures Intermingle

The standard literature has recognized, not without theoretical misapprehension, the imposing recurrence of the short ‘Juglar’ or business cycles, but instead has generally avoided the longer grasp of history in economic analysis. This chapter argues that understanding the larger processes of social, economic, technological and even cultural innovation in modern economies requires establishing the framework of cultural values, of social relations in production and trade, and of the establishment of institutions and learning processes, and that these require the interpretation of recurrent long waves of capitalist development. Furthermore, it argues that an understanding of the formation of cultures and values can benefit from analysis of the historic framework of the successive modes of development of modern economies — what have been called the long or Kondratiev waves.

There are two sound reasons for choosing this approach and framework. The first is the crashing evidence of facts: between 2007 and 2009 the developed economies suffered the deepest general recession since 1929, proving the impact of the Juglar, but this happened after decades of mild expansion with many recessions, with low rates of accumulation and deep financial and structural mismatches, evoking the impact of the longer processes of economic and social rearrangements, described by the long waves. The second reason is also relevant for the purpose of this collective book, and it is the evidence of the impact of historical processes such as the technological revolution in course. As Chris Freeman has consistently argued, the crux of the matter in economic development is either the match or the mismatch between the techno-economic and the socio-institutional systems, and these long phases of adjustment or crisis mark each age of modern economic growth, or capitalist development.1The question for many is therefore, why is it that the ongoing deep technological revolution is so slow to change the general economic conditions? Or, for the purpose of this chapter, how is it that the changes in the general economic conditions contain or shape the evolution of values and cultures?

In the following paper I will argue that this change is on its way, and that it is deeper than commonly suspected. In particular, the interest is concentrated here on the mutations in the landscape of culture, both in the strictest sense of the production of cultural artefacts generating sense and reference, and in the widest sense on the changes in values spreading over communities and societies under the impact of challenging radical innovation.

In order to present this short contribution, I will summarise the common characteristics of each of the four long waves, also present in the emergence of the probable fifth wave. According to this view, the reason for the long contradictory process of structural adjustment and successive crises with low profitability and accumulation—and strong tendencies to concentrate capital on short-term adventurous financial applications—is that there is a mismatch between the already available technological capabilities and the economic restructuring of the major economies. This was the reason for previous long periods of slow expansion and general crises, and it may be the case nowadays, as described by previous long waves of economic development. Furthermore, this mismatch generates social and cultural tensions.

Whereas, however, many of the earlier long-wave theories relied mainly or exclusively on statistical evidence of fluctuations in rates of growth of GDP, industrial production or prices, Freeman and I argued in As Time Goes By that such aggregates conceal as much as they reveal and that the really important long-wave phenomena were the successive structural transformations of the economic system brought about by successive waves of technical change and the accompanying organizational and managerial changes. Gerhard Mensch used the expression ‘metamorphoses’ to characterize these transformations and this is a good way to describe what has taken place — a process Schumpeter had emphasised.

From this standpoint it was unfortunate that many of those investigating and developing the long-wave concept followed Kondratiev in attempting to substantiate their ideas with purely statistical evidence of aggregate movements in production and prices, rather than evidence of structural transformation and waves of technical and economic change.2 This made it possible for those who believed that the test of a theory was exclusively in terms of econometric procedures on data and on aggregate trends to mount a plausible attack on the very idea of long waves.

Instead, in our book we challenged our colleagues to consider that, during a period of turbulent structural change, some new industries and activities grow very rapidly but others decline, stagnate or grow more slowly. The combined outcome of these contradictory tendencies will vary in different countries at different times, depending on wider political and institutional factors, as well as on more narrowly defined economic and technological trends. Typically, a structural crisis of adjustment will tend to be a period when the expansionary impetus from emerging constellations of new products, processes and organizational innovations will not yet be widespread enough to overcome the depressive constraining effects of the slow-down or contraction in the older established industries.

However, this may not always be the case. The expansionary impetus from the new developments may be so great that it imparts an upward thrust to aggregate industrial production and/or GDP despite a structural crisis of adaptation and high levels of structural unemployment. This was apparently the case in Britain in the 1830s and 1840s and in the United States in the 1880s and 1920s. On the other hand, the tempestuous growth of the automobile and oil industries in the 1920s was not sufficient to overcome the depressive trends in the US and the world economy in the 1930s, exacerbated as they were by severe political crises, international conflicts and monetary crises. This is apparently the case today, with the lasting Solow paradox of general computerization but scarce effects on productivity.

Qualitative historical narrative, as well as disaggregated sectoral data, are more important than aggregate quantitative data in analysing successive industrial revolutions. As Keynes pointed out in his debate with Tinbergen, one of the main dangers in the standard statistical procedures is that they may obscure or altogether ignore processes of qualitative change.

However, to justify the use of the concept of ‘waves’ or ‘cycles’, rather than simply ‘stages’ or ‘periods’ of historical evolution, it is necessary to distinguish recurrent phenomena in each period as well as the unique features of each technological revolution. Moreover, it is essential to place these recurrent features of the changes in technology and the economy in a wider institutional and social context, a context in which political and cultural changes may sometimes predominate in determining the course of events.

In any case, a theoretical framework for the history of economic growth should satisfy three main requirements. First, it should provide a plausible explanation and illumination of the stylized facts that summarize the main features of the growth of the world economy. This is essential to pave the way for generalizations, which should of course be constantly tested against new historical evidence, as well as newly unfolding events. Secondly, it should do this for the three main categories identified by Abramovitz: forging ahead, catching up and falling behind, in order to discuss the uneven development of different economies. Finally, it should provide a framework for analyzing and reconciling the research data, case studies and generalizations emerging from the various sub-disciplines of history: the history of science and of technology, economic history, political history and cultural history.

As a step in an inevitably ambitious and hazardous undertaking, the following definitions were used in previous work:

- The history of science is the history of those institutions and sub-systems of society which are primarily concerned with the advancement of knowledge about the natural world and the ideas of those individuals (whether working in specialized institutions or not) whose activity is directed towards this objective.

- The history of technology is the history of artefacts and techniques and of the activities of those individuals, groups, institutions and sub-systems of society which are primarily concerned with their design, development and improvement, and with the recording and dissemination of the knowledge used for these activities.

- Economic history is the history of those institutions and sub-systems of society which are primarily concerned with the production, distribution and consumption of goods and services and of those individuals and institutions concerned with the organization of these activities.

- Political history is the history of those individuals, institutions and sub-systems of society which are primarily concerned with the governance (legal and political regulation by central, local or international authorities) of society, including its military affairs.

- Cultural history is the history of those ideas, values, artistic creations, traditions, religions and customs which influence the behavioural norms of society and of those individuals and institutions which promote them. The next section will present an overview of the major changes in cultural history for the last decades, relating such processes to the major social, economic and technological innovations.

This chapter will refer to these five sub-divisions for conceptual and analytical purposes, whilst accepting of course that people make only one history and recognizing that in real life the five streams intermingle. However, the use of sub-divisions is not simply a matter of convenience in handling an extremely complicated topic, nor is it just a question of following the academic departmentalization and specializations which have emerged in the twentieth century and that were even accentuated in this century. Moreover, the establishment of separate sub-disciplines reflects the sense of dissatisfaction felt especially by scientists, technologists and economists that their special interests were being neglected within the wider rubric in which they were contained. Some protested against the neglect of technology in this approach, and I will add that other factors are also relevant, such as a wider range of cultural phenomena, in order to understand the reluctance to accept new technologies, the social imbalances these create, and the deep changes created by such innovation, including in the formation of novel values.

These five sub-divisions are proposed for fundamental reasons. In the first place, they are proposed because each one has been shown to have some independent influence on the process of economic growth, varying in different periods and different parts of the world, but at least sometimes extending over long periods. Finally, and most important of all, it is precisely the relative autonomy of each of these five processes which can give rise to problems of lack of synchronicity and harmony or, alternatively, of harmonious integration and virtuous circle effects on economic growth. It is thus essential to study both the relatively independent development of each stream of history and their interdependencies, their loss of integration and their reintegration, for the understanding of the long waves in the history of capitalism depends on these movements of synchronicity and mismatch.3

The next section summarises how these movements proceed, presenting some conclusions on the recurrence of economic and technological processes that account for the long waves, while the following one addresses the impact of systemic changes on culture. Finally, some conclusions on the contemporary problems of economic development are presented.

The Long Waves as the Result of Five Recurring Processes in Economic History

An historical approach to economic growth is unlikely to be acceptable, unless it not only tells a story using this type of theoretical framework, but is capable of identifying and explaining recurrent phenomena, as well as special cases. As Werner Sombart (1929) put it, ‘all history and particularly economic history has to deal not only or mainly with the special case, but with events and situations which recur, and, recurring, exhibit some similarity of feature—instances which can be grouped together, given a collective label and treated as a whole’ (Sombart, 1929: 18).

For this purpose, five recurrent processes involving the shaping of economic development were identified in our previous work: the creation of super profits of innovative entrepreneurship, the pervasive constellations of technological innovations, the organizational and management changes as the result of such impulses, the general crises of structural adjustment and those of the regulatory regimes. Together, they account for the existence of long waves as recurrent phenomena in modern economic development.

The recurrence of exceptional super-profits of innovative entrepreneurship in successive long waves

Both some of the sternest critics of capitalism (for example, Karl Marx) and some of its most ardent admirers (for example, Friedrich von Hayek) have argued that one of the foremost characteristics of capitalism has been its capacity to generate and to diffuse a torrent of technical innovations. Everything that is solid melts into air, claimed Marx in order to descry the hurricane of innovation in modern times.

The exceptionally favourable confluence of cultural, political, economic, geographical, scientific and social circumstances in eighteenth century Britain gave rise to that upsurge of technical and organizational innovations known ever since as the ‘Industrial Revolution’. It is also understood that other capitalist economies, and especially that of the United States, were not only able to achieve similar results but, as time went by, were also able to outstrip Britain with new constellations of innovations, namely within the framework of the second technological revolution and of the age of electricity and the automobile.

Capitalist economies have been able to achieve these remarkable results, ‘surpassing the wonders of the Ancient World’, as Marx and Engels again put it, by a combination of incentives and pressures ultimately affecting numerous firms and individuals: in short, they were able to do so through a culture of innovation and organization of structural change. First of all, of course, a well-functioning capitalist economy offers the possibility, but by no means the certainty, of profit from successful innovation, and sometimes very large profit. This profit may be accompanied by other rewards: status, privilege, political advancement and fame. Some of the most successful entrepreneurs in each technological revolution did indeed achieve extraordinarily large profits, although they did not necessarily seek the other advantages often sought by very wealthy individuals. Fame itself they could hardly avoid and indeed this was a very important social mechanism for the dissemination of their innovations and for efforts to surpass them. Arkwright, Wedgwood, Hudson, Brunel, the Vanderbilts, Carnegie, Krupp, Rockefeller, Rathenau, Siemens, Diesel, Ford, Gates and Murdoch are all examples which we have cited of entrepreneurs and inventors, who achieved both fame and fortune through their innovations, whether technical, organizational or both. Schumpeter emphasised this trend of entrepreneurship, moved by ‘social deviants’ breaking the routine. In short, capitalism is adaptive since it rejects equilibrium.

A number of long-wave theorists (Mandel, 1980; Goodwin, 1985; Poletayev, 1987) have constructed models of the behaviour of the economic system based mainly on long-term fluctuations in the aggregate rate of profit. They have argued quite plausibly that a fall in the rate of profit tends to occur after a long period of prosperity and expansion, partly because of the Schumpeterian processes of erosion of innovators’ profits during dissemination and partly on account of wider pressures from rising costs of inputs. These tendencies for the rate of profit to fall at the peak of a long boom are among the main reasons explaining the upper turning point in the long wave and the onset of a prolonged downswing in which generally lower rates of profit prevail.

The statistics are very difficult to assemble, especially for the nineteenth century but, such as they are, they do provide some support for this interpretation (e.g. Entor and Poletayev, 1985). The plausibility of these models cannot be denied, but since the concern of this chapter is mainly on structural change, it is more accurate to stress here the exceptionally large ‘super-profits’ which may be realized through the exploitation of major radical innovations. These profits appear all the more remarkable if they are made during a period of general decline in the rate of profit in the ‘downswing’ phase of the long wave. Although he disagrees with Mandel and other long-wave theorists on the aggregate rate of profit, Tylecote (1992) also points to the extraordinary importance of the demonstration effect for key innovations in each long wave.

This demonstration effect is not only one of clear-cut technical efficiency but also one of great profitability and great potential for widespread application. This effect was so powerful in the case of Arkwright’s water-frame that it led some of his rivals and competitors to try to destroy his equipment. Despite this hostility, the successful and highly profitable operations of Cromford mill and his other factories stimulated numerous imitators to invest in cotton mills, especially after the expiry of his disputed patents. Some of the early canal investments, such as the Worsley-Manchester Canal, made very good profits. On a far greater scale, the Rainhill Trials of various steam locomotives, followed by the successful and profitable operation of the Liverpool-Manchester Railway, led to an enormous boom in railway investment and indeed to a huge financial bubble based on the excitement caused by often exaggerated estimates of the potential profits to be made.

Railway promoters, such as George Hudson in Britain and the Vanderbilts in the United States, made huge profits from speculation and financial manipulation, rather than technical innovation, even though Hudson lost his fortune in the end. Otherwise, the profits of Carnegie, Krupp and Ford provided examples of the vast amounts that could be accumulated by successful innovative entrepreneurship. The profits of IBM were not so much the result of individual entrepreneurship as of company performance; they were nevertheless hugely impressive and IBM was in some measure the most profitable firm in the world before it suffered setbacks in the 1980s, and its place as the most profitable player in ICT was usurped by Microsoft and, currently, by a number of challenging firms investing in the interface between mobile communications and internet.

The first distinguishing recurrent characteristic of the long waves, therefore, is that in each case, although the individual innovations were unique and very different, a cluster of innovations emerged which offered a clear-cut potential for immense profits, based on proven technical superiority over previous modes of production. Minor incremental improvements were, of course, occurring all the time, but the innovations which were at the heart of each wave offered quite dramatic changes in productivity and profitability. However, these highly profitable innovations were not isolated events but part of a constellation of inter-related product, process and organizational innovations. Numerous other firms jumped on the band-wagon, as Schumpeter had suggested, including many small new firms. Sometimes it was a new process, which generated the main super-profits, sometimes it was an array of new products, sometimes it was mainly organizational changes, as in the case of Ford’s assembly line or the internet, but in all cases there were interdependent developments, both technically and economically. The dramatic demonstration effects did not just make a fortune for individual entrepreneurs, but served to propel an entire technological system and to accelerate its dissemination world-wide. The first recurrent characteristic of long-wave behaviour is therefore directly connected to the second: the potential for very widespread application.

The recurrence of pervasive constellations of technical and organizational innovations

Each wave is characterized not just by one or two big innovations, nor even by a cluster of quite discrete individual innovations, but by a constellation of interdependent and mutually supportive technical and organizational innovations. As argued by Carlota Perez (1983), each of these constellations or paradigms has certain characteristics, which are common to them all. They all have identifiable and obvious core inputs, which have falling prices relative to other commodities during the critical transition period between one paradigm and the next. The principal producers and users of these inputs became the leading sectors (motive and carrier branches) in the upsurge of the economy. The demonstration effects occur relatively early in the diffusion of each new technological revolution and, whether they occur most conspicuously in firms making core inputs, in other leading sectors, or in associated infrastructures, they help to propel the diffusion of the whole constellation and not only a part of it.

It is not just the excitement generated by the first demonstration effects, important though these undoubtedly are, but the long-term potential which has become visible and which reverberates throughout the system as more and more applications of the new paradigm appear on the horizon. A second recurrent feature of the long waves is therefore that each one is characterized by the emergence and experimental testing of a new combination of inter-related innovations, which demonstrate remarkable gains in productivity and profitability at first in a few applications, but with the clear potential for very pervasive diffusion.

Ultimately, this full potential is realized in a period of prolonged prosperity but only after a structural crisis of adjustment, which can last. Examples of the pervasiveness of new technology systems in each new wave are the applications of steel and of electricity, of iron and steam power, of oil and internal combustion and, currently, of computers and new technologies of information and communication. The chip and the devices for communication are the key factors of the emerging long wave. As the following pages will indicate, these new devices are fundamental for creating new forms of economic production but also for generating new modes of cultural production.

The recurrence of waves of organizational and management changes in firms

A third recurrent feature of each revolution is that organizational and managerial changes introduced in the new leading sectors are widely imitated elsewhere. A new management style becomes fashionable and in the later waves in the twentieth century is disseminated by management consultants as well as through the media and social communication, propelled by example. The very success of the leading firms is sufficient in itself to stimulate imitative efforts in relation to their new management style but, of course, the technical innovations which they introduce are often also directly conducive to organizational changes in those firms which adopt them.

The use of computers and mobile communications are two obvious contemporary examples, but some organizational styles are not so directly dependent on technical innovations and have a momentum of their own. The sheer growth in the size of leading firms was itself an important factor in organizational and managerial changes in the nineteenth and twentieth centuries. The trends in organizational change are more complex than the narrowly technical changes but there is an identifiable recurrence of a new management style in each Kondratiev wave which influences many firms, although in diverse ways, throughout the economy.

This does not mean of course that every firm in every industry adopts a similar management style or organizational structure. The idea of a representative firm characterising all firms is one which has been widely influential in economic theory, but it is not embraced here: on the contrary, evidence shows that with each technological revolution, the effects are very varied. With the mass production style, for example, firms in some industries were capable of introducing standardized products and using an assembly line resembling the Fordist line in the automobile industry. Many others continued to produce unique customized or small-batch products. Still others modified some features of the Fordist management style so that there were actually many varieties of Fordism, even within the automobile industry itself (Boyer, 1988). Only a minority of firms became recognizably ‘Fordist’. Nevertheless, in industries as diverse as tourism, fast food, retail distribution and clothing, the influence of Fordist management philosophy and organizational change is clearly evident. Similarly with electrification, this led on the one hand to the growth of some giant electrical firms with specialized departmental management structures. On the other hand, it facilitated the de-centralized success of many small firms taking advantage of the new flexibility permitted by electric machinery, and the management of information-intensive processes allows for new forms of decentralization and delocalization.

Recurrent crises of structural adjustment

These examples show that there is some danger of making too schematic a model of the successive technological revolutions, which would do violence to their individual variety. This is especially the case because each one of them not only embodies a unique combination of products and processes but also affects other parts of the economy very unevenly, requiring different types of machinery, of materials and components, of distribution and of supporting services. Some entirely new branches of the economy make their appearance while other branches experience only marginal changes. Moreover, sometimes they affect particular occupations within industries and services which are otherwise little affected. The process of dissemination is therefore unpredictable and extremely uneven as new applications are explored, tested, expanded, modified or rejected. Nevertheless, a clearly observable and recurrent characteristic of each new technological revolution is its pervasive effect on the structure of the economic system. Although the induced branches of the economy are different, they are very significant in every case, and so too are the induced changes in skill requirements and hence in the education and training systems.

The fourth recurrent characteristic of each long wave is therefore a crisis of structural adjustment as the skills and distribution of the labour force and of firms adapt to the new paradigm, while the social conventions, contracts, laws and generally accepted procedures tend to change slowly and sometimes after periods of conflict.

Recurrent high levels of structural unemployment are an important manifestation of these adjustment crises in each long wave. The statistics for the nineteenth century are very poor, but there is strong evidence of very serious unemployment in the 1830s and 1840s in Britain, while David Wells (1890) commented on the widespread unemployment in most industrial countries in the 1880s and especially in those which were most advanced in the use of machinery. There is, of course, abundant statistical evidence of the heavy structural unemployment in the 1920s and 1930s and again in the 1980s and 1990s. Even in the 1920s boom in the United States, as Fearon (1987) and the NBER pointed out, there were sectors experiencing severe adjustment problems, such as coal, railways and ship-building. In Germany and Britain, heavy industry generally, but especially the steel industry and the ship-building industry experienced prolonged problems of structural adjustment. In the 1980s, the automobile industry, the oil industry, the synthetic materials industry and again the steel industry were among the many industries which experienced severe adjustment problems.

Nowadays, the crisis of structural adjustment expresses itself in a large army of permanently unemployed as a consequence of the mismatch of qualifications and employment between those sectors and branches with high profitability and competitiveness but few jobs, and those which have a large number of jobs but diminishing competitiveness. Without the reorganization of a virtuous match between the technological capacities and the social and institutional framework, the recovery will be slow and interrupted by deep crises, such as those triggered by the financial crashes of 1987 and 2007.

Recurrent changes in the regulatory regime

Finally, a recurrent feature of the qualitative changes engendered by the long wave is a periodic re-configuration of the regime of regulation of technology and of the economy more generally. It is quite obvious that such extensive changes as mechanization, electrification, motorization, and computerization raise entirely new requirements for education and training, which have led with each successive crisis of structural adjustment to a variety of movements for education reform. It is also obvious that each major new technology entails new requirements for safety and protection, whether of operatives in industry, consumers or people in certain exposed areas. However, the recurrent changes in the regulatory regime go well beyond these immediate and obvious induced effects. Even at this elementary level regulatory requirements can raise some fundamental political issues such as ‘self-regulation’ of industries versus state regulation, national versus international regulation or local versus national. They also raise questions of standards which tend also to become an area of conflict and dispute, both between competing groups seeking to promote their own version of the new technology, and between nations seeking to protect their own interests. Especially in the case of new infrastructural investment, questions of ownership and control also arise. If private ownership is the solution which is adopted in any particular case, this again immediately gives rise to questions of monopoly, competition and price regulation. Equally problematic are the questions of trade and protection, whether of new or of older industries.

Typically, the leaders in a new wave of technology, such as Britain in the nineteenth century or the United States in the twentieth century, will tend to advocate the opening up of world markets to the new products and services in which they excel, while catching-up countries will often deploy ‘infant industry’ arguments to justify various forms of protection. The leading economies will seek to advocate and, if they have the strength, to impose an international regulatory regime with institutions which promote the interests of their leading industries. Thus, what is at stake in each structural crisis is a re-constitution of the entire institutional and social framework because there is a mismatch between the regulatory framework developed and consolidated by a previous generation for older technologies and industries, and the needs of the newly emerging constellation and the interests of the new technological leaders.

Once a new technological and regulatory regime has become dominant and firmly established, the phenomenon of ‘lock in’ to the new regime becomes widely apparent. This is the case not only with lock in to dominant designs, technical standards, components and so forth, but also to all kinds of social standards and institutions, variable though these may be between different countries, in response to the changing balance of social and political forces in each country and on the international stage. The instability of the current international economic structure is revealed not by the challenge by emerging economies of the dominant role of the previous leaders, but instead by the fact that there is not a stable international order to make their trade coherent and to settle their disputes.

One of the aspects of this deep ongoing change, which is of interest for what follows, is the impact of economic and technological innovation on culture, altering previous modes of production of sense and images, distorting others, suggesting new ones, and creating universal references as part of a unified global market.

The Impact of Economic and Technological Innovation on the Production of Culture

In order to exemplify this analysis of some historical trends, and to define their impact on the creation of values, I will turn now to the impact of innovation on the creation of cultural traits. Let me take the extreme example of art. It is extreme since art is posited and defines itself as autonomous from other social relations, and as a peculiar expression of creation of new culture or communication. The production of works of art as part of cultural production is that province where the autonomy in relation to social processes and, in particular, to economic determination, is more radically affirmed. Yet, art is an interesting case of the interaction of individuality and society, of technology conditioning invention.

Indeed, art has logic and a time of its own; quite often, it anticipates the future or constructs alternative worlds. That is a reason for proceeding in this section from the production of art to the general production of cultural artefacts, images and sounds or, in general, to references, as part of the cultural changes in a changing society.

In spite of the vindication of the autonomy of art, the producers live in concrete societies and their horizon is largely defined by the potentialities of their epoch. In the same sense, the creation of a specific culture, in the general sense of the coherence of forms of communication in fashion, food, literature, architecture, dance, or music, just as the evolution of languages or other social artefacts is largely bound by its particular epoch. The technological framework, the social structure and the historical process of the formation of knowledge define the setting for the work of art as for the construction of social cultures.

This section explores this connection, in order to present an overview of large processes of the social production of cultural products. This topic was not previously discussed in the literature, and it is only sketched here as a suggestion for further investigation. In this sense, I argue that there are specific tides in cultural production that can be better understood in the framework of the societal and historical vision indicated previously, and that this specific nexus is crucial for the understanding of the forms of organised social communication prevailing in modern societies.

I certainly do not suggest that technological means determine the production of cultural values as such; that would mean an underrating of the influence of social and individual traits in the creation of cultural artefacts and communication. But evidence shows how the landscape of technological opportunities shaped different forms of cultural production, amplifying and selecting new means and inducing new trajectories such as the cinema, the video, the clip, and the continuous production of images and messages.

In a nutshell, the argument is, first, that major changes in the economy are causally related to dramatic alterations in the social structure, including in the forms of work and power, as well as the dominant modes of communication, and, second, that the trends in cultural production are unintelligible outside the context of these changes.

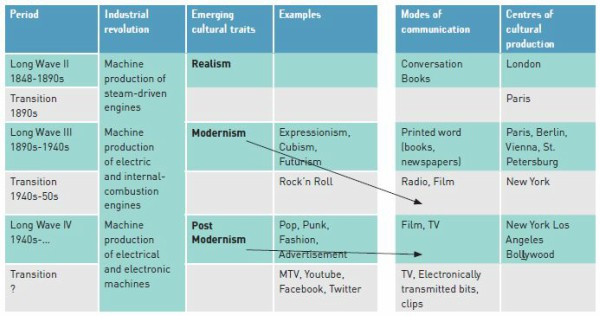

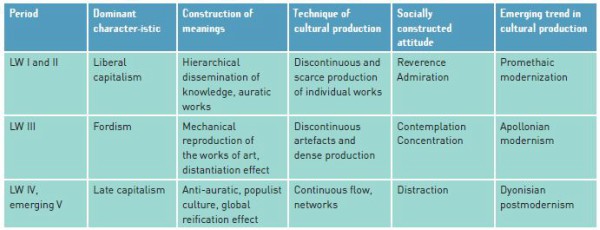

The next table takes up this argument. Each epoch is defined by the industrial revolution originating the maelstrom that changed the way of life and shaped each specific experience of modernity. Consequently, three main categories are indicated: while the original industrial revolution set the tone for the process of modernization, following on from the slow development after the Enlightenment and the sixteenth century, modernism was the emerging language for the conflict against the enlargement and dominance of the modern market. Not against technology or machines—indeed they were worshipped by the futurists and other modernists, who praised the automobile as the archetype of the progress of humankind—but against the impersonal relations of the market and the general reification under capitalism. Finally, the triumph of the market over its radical opposition was marked by its extension into what was, until then, the partially separated world of art production: this period has been called postmodernism. As Jameson puts it, “modernism [was] the experience and the result of incomplete modernization, (…) [and] the postmodern begins to make its appearance whenever the modernization process no longer has archaic features and obstacles to overcome and has triumphantly implanted its own autonomous logic” (Jameson, 1991: 366).

Table 1. The production of culture in a long-term perspective

That said, Modernism yesterday was not, and Postmodernism today is not either culturally dominant or even absolutely hegemonic: as indicated in the table, they can be considered as emerging traits in cultural production, representative of the ongoing conflict. But Modernism and Postmodernism are the trends most closely associated with the fractures of history in their own time. They were indeed seen by contemporaries as earthquakes—a celebrated example is that of the much quoted and tragic images of Angelus Novus by Paul Klee, a representation of the transformation imposed by the second industrial revolution and the motif for Walter Benjamin’s much quoted reminiscences:

An angel looking as though he is about to move away from something he is fixedly contemplating. His eyes are staring, his mouth is open, his wings are spread. This is how one pictures the angel of history. His face is turned toward the past. Where we perceive a chain of events, he sees one single catastrophe which keeps piling wreckage and hurls it in front of his feet. The angel would like to stay, awaken the dead, and make whole what has been smashed. But a storm is blowing from Paradise: it has got caught in his wings with such violence that the angel can no longer close them. This storm irresistibly propels him into the future to which his back is turned, while the pile of debris before him grows skyward. This storm is what we call progress. (Benjamin, 1973: 259-260)

This wave of progress invaded daily life and transformed the modes of production, distribution and communication at the end of the nineteenth century. The culture of the new century was part of this catastrophe: “Il faut être absolument moderne”, said Rimbaud. The next industrial and technological revolution imposed a new version of the dictum: we cannot but be postmodern. The structure of this evolution is the theme for the table below:

Table 2. Modes of cultural production

As the table indicates, there are considerable lags between causally connected events and trends; moreover, there is a large margin of autonomy between technological transformations, allowing for new methods of dissemination and permitting new experiences of the process of modernization, and their cultural counterparts. Yet the creation of new technological means sets the pace for the transformation.

The undisputed but not unique example is the creation of the ‘Gutenberg Galaxy’ in the fifteenth century: it allowed for the development ‘of a system essentially dominated by the typographic mind and the phonetic alphabet order’ (Castells, 1996, I: 331). As the alphabet was the dominant ‘conceptual technology’ since 700 BC Greece, it established itself as the privileged infrastructure for the codification of cumulative knowledge. But it became a dominant mode of communication just when the industrial capacity established the printed word as the direct form of expression and the book as the cultural tool of the elite. Consequently, for the whole period sounds and images were outside the scope of written discourse and were relegated to the domain of the separate and slightly esoteric artistic production.

A new epoch was then opened when Fordist production spread to the whole social fabric and extended to the mechanical reproduction of works of art. Radio and film—the first distinctively mediatic art form, since opera had only performed that function in restricted areas of Europe, such as Italy, as had been the case with theatre in Britain—then became the dominant modes of communication.

Finally, and we come to our own time, a ‘new alphabetic order’, a new digital meta-language is being imposed as the cultural infrastructure: ‘A technological transformation of similar historical dimensions [as the creation of the alphabet] is taking place 2700 years later, namely the integration of various modes of communication into an interactive network’ (Castells, ibid.: 328). These epoch-making transformations are the theme for the next table.

As previously indicated, the epochs depicted in Tables 1 and 2 were or are not periods of uniformity, and their cultural production was a fortiori a turbulent landscape of diversity and contradiction. Their emerging cultural traits were not necessarily dominant or hegemonic throughout the period, although they marked a peculiar vision of the storm of modernization, and eventually constituted the more distinguishable features of its inheritance.

Realism represented the first interpretation of the changing world, and this new world reserved a specific role for the entertainment business: popular novels, theatre, and popular opera were, for some countries, the forerunners of the cultural industry of the second half of the century. Although this business was still separated from the production of high culture, the dissemination of the market in this direction anticipated the aestheticization of daily life—but even this would still require another major technological change.

Modernism was the response to these first moves: breaking with the aesthetics of representation in art and the theoretical discourse based on the insulated worlds of culture and social life (Lash and Urry, 1987: 13), the modernist revolution was built on challenges of the capitalist process of modernization. It led to non-representational and expressionist painting, to new lyric poetry, to existentialism in philosophy, to the films d’auteur. Attacking the market and not technology, the modernists were fascists with Marinetti and communists with Maiakovsky: they praised cars, speed and movement, neat colours and strong feelings. Picabia, Duchamp, Fernand Léger, Diego Rivera painted machines and the possibility of reconstruction of social life in a new technological world; Frank Lloyd Wright, Le Corbusier and Mies applied the new vision to architecture and rebuilt urban life.

But modernism was rooted in high culture, and the headquarters of resistance were established in the authenticity, originality and uniqueness of the work of art: its discourse was that of creativity (Lash and Urry, 1987: 286) and the defence of the aura of artistic artefacts. In that sense, art in society vindicated a radical separation of cultural forms from the social framework—and this was the reason for its intense appeal as well as for its failure. In a matter of decades, the expansion of the market conquered this last bastion of cultural critique and transformed it into an industry, and in particular into an industry of production in continuous flows.

In fact, the crucial alteration introduced in the post-war period was the widespread diffusion of commercial TV. Consequently, the film industry, the epicentre of cultural production since the beginning of the century, was transmuted from a production of episodic and unique pieces, seen by large audiences in unique settings, into a production of flows of images and sounds to be seen simultaneously in all private settings. The simultaneous collective experience was transmuted into a simultaneous individualised experience. Furthermore, the modifications went deeper than the setting of the experience of the cultural product: they imposed a change in the product itself, since the continuous flow abolished the effort of memory and imposed the loss of historicity, mixing news, films, soaps and contests at the same level of discourse. All sounds and images were reduced to bits of infotainment. The great consequence was the fully used potential for the construction of ‘fictive temporalities’ and therefore the ‘technological appropriation of subjectivity’, generating a specific and novel type of media populism that was to become the basis for the entertainment industry (Jameson, 1991: 74).

The social consequences of this dramatic change in culture are still to be fully understood. In any case, they were the result of the transformation of culture by the market. The growing importance of advertising, the consumption of the discourse of consumption and the narrative of desire inscribed in publicity constitute the image as the final form of reification of the commodity: the product is identified with its brand or logo. Advertising is the dominant form of production of signs in postmodern culture: postmodernism is that specific mode of production in which advertisement is the new technology of communication, a new ‘conceptual technology’ or ‘alphabetic order’ of our days. As a consequence, culture has a function for the market.

Fashion and fast food, B-films and remakes, Warhol’s pop art, parodies and kitsch, science fiction, music and video reduced to clips, these images populate this universe of pastiche, to use Thomas Mann’s concept. Categories of space have replaced categories of time, historical depth has been lost to ephemerity and concentration has been replaced by superficial trivia: commodification of culture is a devastating process.

As this process is our contemporary, its implications are still largely unknown, although there are two that follow from the pattern of communication imposed by this cultural revolution. First, ‘a crucial effect of the electronic media and spatio-temporal changes in our disorganizing capitalist societies has been the decentring of identities and the loosening or destructuration of group and grid’ (Lash and Urry, 1987: 299). But, second, this iconography of modernity also imposes a bipolar opposition between the Net and the Self, so that ‘in this condition of structural schizophrenia between function and meaning, patterns of social communication become increasingly under stress’ (Castells, 1996, I: 3).

How did machines then produce machines and information produce information to the extent that we are transported from a culture of virtual reality to a culture of real virtuality in this period of transition? This is the question for Castells, in his magnificent The Information Age: Economy, Society and Culture. The answer resides in the technological changes associated with the information and communication revolution emerging through the fourth long wave, and in the concrete process of social selection that has determined the shape of the new techno-economic paradigm challenging the still prevailing mode of development in our times of mismatch and transition. The answer is the network of cultural products and facilities of communication in a market economy.

In this framework, we follow Jameson’s suggestion to reconsider the concept of ‘late capitalism’ as it was used by the Frankfurt school, namely by Adorno and Horkheimer, and lately by Ernest Mandel. Late capitalism describes the galaxy of economic structures, methods of production and cultural substrata derived from the expansion of commodification towards Nature and the Self or the Unconscious. This is a process of reification of all social relations, i.e. one purer form of capitalism. Late capitalism is thus the name for the technological transformations diffused since the 1950s and for the cultural alterations emerging from the 1960s until the present. As a cultural constellation, it had a long period of maturation: it was even anticipated in the early decades of the century by Dada and Surrealism, which invented these postmodernist tones, although they rooted their activity in a mood of denunciation of the market economy as the adversary to art. Yet it was when the technology became available for the production of continuous flows of infotainment that postmodernism won the day.

Contrary to MacLuhan and so many other commentators, this victory did not represent the imposition of a complete universal culture: we do not live in a global village, but in ‘customized cottages globally produced and locally distributed’ (Castells, 1996-I: 341). Each cultural artefact is locally bounded and the production of icons is still mediated by national and regional frontiers: their understanding is largely local. The global world is a world of diversity. But icons are industrially produced and are the constitutive bits and clips of our social communication, and this aesthetic of distraction is universal. It marks the triumph of a new conceptual technology on the map of culture.

Yet, this technology does not by itself impose a social order; on the contrary, its prevalence depends on the social mutations here described as the long waves of capitalist development.

Conclusion: Social and Cultural Changes in the Long Waves

The preliminary presentation of recurrent changes characteristic of each long wave has already gone beyond purely economic and technological phenomena, and the previous section discussed the production of cultural references, which is largely autonomous although influenced by the social movement as a whole. As the crisis of structural adjustment and the periodic changes in the regulatory regime raise fundamental questions of the relationship between technical change, political change and cultural change, this is shortly evoked as follows:

First, consider changes in the regulatory regime, whether at a national or international level, since they can lead to the most fundamental political and ideological conflicts within and between nations. Lloyd-Jones and Lewis (1998) have made a particularly valuable study of the conflict over the Corn Laws in the 1830s and 1840s in Britain and the later conflict on Tariff Reform in Britain in the late nineteenth and early twentieth centuries. Both of these conflicts split the ruling Tory Party from top to bottom and led to major re-alignments in British politics and each was associated with a long-wave structural crisis. In the same sense, the problems of tariff protection also had profound effects in the United States, Germany and Japan as they were industrialising and catching up in technology. However, the political dimensions of free trade and tariff reform clearly go far beyond just the question of regulating some new products and services, or protecting older industries, even though these problems may trigger the conflicts. Fundamental national interests, as well as those of particular industries, are often felt to be at stake and friction over trade issues can be a major source of friction in international relations more generally, as illustrated in the Anglo-German naval armaments race before 1914. The World War between 1939-1945, marking the turning point after the depressive long wave of the first decades of the century and opening an epoch of growth and prosperity, is another illustration of this concatenation of political and military solutions for long-term disputes over markets and resources.

Second, consider the depth of the social clashes which may be exacerbated during a structural crisis, which is illustrated no less clearly by the labour conflicts that are engendered. History registers the widespread social unrest as well as the outbreaks of ‘Luddism’ associated with the destruction of old crafts and occupations, such as those of the hand-loom weavers. Some historians have argued that Luddism, especially in the hosiery industry in Nottinghamshire was inspired mainly by the desire to protect British quality standards in foreign trade. The workers supposedly feared more for the loss of jobs through the erosion of British sales in foreign markets than simply from mechanization. Whatever the interpretation may be, it is fairly obvious that the destruction of the livelihood of hundreds of thousands of people is bound to be a cause of acute social unrest and this has indeed been the case in every crisis of structural adjustment. There are also bound to be conflicts within the expanding industries and technologies over pay, status and working conditions for various groups of managers and workers. Modern conflicts raise a wider range of problems, with deep cultural implications, such as concerns about the ecological sustainability of industrial or urban policies, and the effects on climate change, international relations and poverty issues.

The third domain of interest here is the technical changes, which are relatively unrelated to other changes previously described. This is only superficially known, since it is widely accepted that the evolution, for instance, of the ship, of the hammer, of flints for tools and weapons, of the harnessing of the horse, and of the steam engine or the plough emphasize alike the relative autonomy of the improvements which were made over the centuries to these artefacts, so essential for human civilization. The selection environment, which interests, inspires and constrains engineers, designers, inventors and mechanics and many historians of technology, is primarily the technical environment, the criteria of technical efficiency and reliability and of compatibility with existing or future conceivable technology systems.

The reciprocal influence of science and technology upon each other has been demonstrated in numerous studies and is indeed obvious in such fields as computer technology and biotechnology today, as well as in earlier developments such as thermodynamics and the steam engine. Technology has to take account of the laws of nature and hence of science. Nevertheless, Derek Price (1984), Rosenberg (1969, 1982), Pavitt (1995) and many others have produced cogent arguments for recognizing the special features of each sub-system precisely in order to understand the nature of their interaction. Nor does this refer only to recent history, as the massive contribution of Needham (1954) to the history of Chinese science and technology clearly illustrate.

Historians of technology, such as Gille (1978) and Hughes (1982), have amply demonstrated the systemic nature of technologies and analyzed the interdependencies between different elements in technology systems. Both they and Rosenberg have also shown that the technological imperatives derived from these systemic features may serve as focusing devices for new inventive efforts. Finally, in their seminal paper ‘In Search of Useful Theory of Innovation’ Nelson and Winter (1977) drew attention to the role of technological trajectories, both specific to particular products or industries and general trajectories such as electrification or mechanization affecting a vast number of processes and industries, including compur. They rightly identified the combination of such trajectories with scaling-up in production and markets as one of the most powerful influences on economic growth. These ideas were further developed by Dosi (1982) in his work on technological trajectories and technological paradigms, in which he pointed to the relative autonomy of some patterns of technological development by analogy with Kuhn’s paradigms in science. Despite the obvious close interdependence between technology and the economy or technology and science, it is essential to take into account these relatively autonomous features in the history of technology.

A satisfactory theory of economic growth and development must certainly take account of these processes, but it should also recognize that the relative autonomy of evolutionary developments in science and technology justifies some independent consideration. An essentially similar argument applies to economic change. No-one can seriously doubt the importance of capital accumulation, profits, changes in company organization and the behaviour of firms and of banks for the evolution of industrial societies over the past two centuries. Economic institutions too have some relative autonomy in the cycles of their development. In any case, explanations of economic growth must pay especially close attention to the interdependencies between economic history and technological history. It is precisely the need to understand the changing nature of this interdependency which leads to the proposal of a theory of recurrent phenomena and ‘out of sync’ phases of development, when, for example, changes in technology may outstrip the institutional forms of the production and market system that may be slow to change or impervious to change for relatively long periods. The reverse may also occur, providing impetus to new technological developments, as with the assembly line or factory production.

Finally, cultural change is generally accepted as an important influence on economic growth. In the previous section I explored the opposite sense of influence: that from the economic mode of development and availability of technologies to the production of culture, the former creating opportunities and incentives for new developments of the latter. It is in order to emphasise now the impact of culture, as part of the creation of social values, on the dynamics of growth, since these values tend to concentrate the resistance or suspicion about characteristics of the institutional change imposed by the diffusion of the clusters of radical innovations. Social values are shaped by institutions and recognise contracts, laws, routines, types of communication, hierarchies, the forms of each social pact ruling each society, and tend therefore to be adverse to radical and unknown change. Although some societies—some cultures—are more inclined to accept the challenge of innovation and rupture in the previous trajectory, it is understandable that a flexible answer to the hurricane of change is to impose rules that are previously known to the society. Indeed, any new economy or new technology is appropriated according to the previously established knowledge. This is why modern developed societies are so stable: they change but tend to adapt to change. Evolutionary economics is certainly familiar with these processes, since they mimic natural evolution so well, with the creation of variety (i.e. innovation) and the selection of change (i.e. stable environment).

But this process of adaptation and creation of stability is also responsible for some conservatism against radical implications of social innovation flowing from radical innovation in the techno-economic system, where they tend to originate. The socio-institutional system and its cultural standards tend to generate the mismatch or desynchronicity previously indicated as the engine of the long waves of capitalist development.

In any case, a general view of the cultural determinations of social relations should emphasize all these contributions to the formation of social mentalities and modes of reasoning, including the motivation for accepting change and routine. Indeed, social, political and cultural changes interact in modern societies under the impact of technical and organizational changes, either to react or to resist. If retardation or acceleration phenomena are to be explained, the dominant cultures of an epoch reveal and register the combined effects of its histories of present and past. Institutions, which are the result of such cultures and social relations, are the decisive structures for economic evolution and the condition for growing or perishing.

The long waves, this modern curse of Heraclitus, encapsulate the social and economic processes of evolution and change, of adaptation and of creation of variety, or innovation. But innovation alters structures and culture, institutions and routines, which are locked in established trajectories. This is why the epoch-making radical innovations, clustering in industrial and technological revolutions, can create new upsurges in economic development but tend to confront large institutional resistance.

This is the case today. The early years of the 21st century were marked both by the magnificent extension of a cluster of innovations applicable to a wide range of productive processes and service economy, and simultaneously by the disarrangement of the financial markets, with speculation destroying wealth and savings, and accumulation undermining the creation of value. This is explainable by the asynchronous movements in the depressive phase of the long wave and by the emergence of new profitable branches, stimulating speculation and over-accumulation. As in previous long waves, the crucial question is not why the technological push does not translate into macroeconomic performance, but instead, how should the social networks be reassembled and economic institutions created that are able to regulate a new system, creating jobs, qualifications, welfare and further innovation. Some will say this is finally an issue of changing culture.

Bibliography

Benjamin, W. (1973), Illuminations, London: Fontana.

Berman, M. (1983), All That is Solid Melts into Air – the Experience of Modernity, London: Verso.

Boyer, R. (1988), “Technical Change and the Theory of Regulation”, in G. Dosi, C. Freeman, R. Nelson, G. Silverberg and L. Soete (eds.), Technical Change and Economic Theory, London: Pinter, pp. 67-94.

Castells, M. (1996), The Information Age: Economy, Society and Culture I, The Rise of the Network Society, Oxford: Blackwell.

Dosi, G. (1982), “Technological Paradigms and Technological Trajectories”, Research Policy, 11(3), pp. 147-62.

Fearon, P. (1987), War, Prosperity and Depression: The American Economy 1917-1945, Deddington: Phillip Alan.

Freeman, C., F. Louçã (2002), As Time Goes By – From the Industrial Revolutions to the Information Revolution, Oxford: Oxford University Press.

Gille, B. (1978), Histoire des Techniques, Paris: Gallimard.

Goodwin, R. (1985), ‘A Personal Perspective Economics’, Banca Nazionale del Lavoro Quarterly Review, pp. 152, 3-13.

Harvey, D. (1992), A Condição Pós-Moderna, São Paulo: Loyola.

Hughes, T. (1982), Networks of Power Electrification in Western Society, 1800-1930, Baltimore: Johns Hopkins University Press.

Jameson, F. (1991), Postmodernism or the Cultural Logic of Late Capitalism, London: Verso.

Lash, S., and J. Urry, (1987), The End of Organized Capitalism, Madison: University of Wisconsin Press.

Lloyd-Jones, R., and M. Lewis (1998), British Industrial Capitalism since the Industrial Revolution, London: UCL Press.

Mandel, E. (1980), Long Waves of Capitalist Development, Cambridge: CUP.

Nelson, R., and S. Winter (1977), “In Search of a Useful Theory of Innovation”, Research Policy, 6(1), pp. 36-76.

Pavitt, K. (1995), “Academic Research and Technical Change”, in MacLeod, R. (ed.), Technology and the Human Prospect, London: Pinter, pp. 31-54.

Poletayev, A. (1987), “Profits and Long Waves”, working paper, Montpellier Conference on Long Waves.

Price, D. (1984), “The Science-Technology Relationship”, Research Policy, 13(1), pp. 3-20.

Rosenberg, N. (1969), “Directions of Technological Change: Inducement Mechanisms and Focusing Devices”, Economic Development and Cultural Change 18, pp. 1-24.

Rosenberg, N. (1982), Inside the Black Box: Technology and Economics, Cambridge: CUP.

Sombart, W. (1929), “Economic Theory and Economic History”, Economic History Review 2: p. 18.

Tylecote, A. (1992), The Long Waves in the World Economy: the Present Crisis in Historical Perspective, London: Routledge.

Wells, D. (1890), Recent Economic Changes, London: Longman.

Notes

1 This section and the last one are largely based upon the book As Time Goes By—From the Industrial Revolutions to the Information Revolution, co-authored with the late Chris Freeman some years ago (Oxford University Press, 2002). Freeman, who died in the summer 2010, was certainly one of the leading researchers on innovation and evolutionary economics.

2 In spite of this, I follow the standard procedure introduced by Schumpeter to call these long phases and movements ‘Kondratiev waves’, since this author was the introducer of the modern debate on the historical trends in capitalist development.

3 This deals with developments within industrial capitalist economies, and does not address other issues. Indeed, there are other types of theories of long cycles which have a far wider scope, even going back to the Ancient World. Instead, the currently summarized theoretical sketch has a relatively limited domain of application: it relates to the evolution of capitalist economies from the late eighteenth to the early twenty-first centuries and it postulates for this period the predominance within the leading economies of recognizably capitalist institutions and in particular of private ownership and private wealth accumulation through profits.

To criticize this theory as ‘technological determinism’ is therefore wide of the mark. It is the very existence of certain social institutions which made possible the technological revolutions which have been shortly described. Moreover, these successive new technologies discussed here were not ‘manna from heaven’; they were the outcome of human social activities and institutions. Within this general framework, giving emphasis to the changes in technology as a dynamic element in the whole system is simply a way to stress crucial changes moving the whole economic and social process.

Comments on this publication