Slowing productivity growth in major economies amid seemingly booming technology presents aparadox. Income inequality has been rising at the same time. Is there a nexus between technology, productivity, and distribution that explains these trends? Indeed so. Slowing productivity and rising inequality have important common drivers, with technological change and its interaction with market and policy failures playing a major cross-cutting role. The agenda to boost productivity and improve equity, often seen in terms of a trade-off, is positively interconnected in significant ways. It will require much innovation in policies to respond to the profound ways in which digital technologies are reshaping markets and work.

Evidence of technological change, led by advances in digital technologies, is all around us. One must only bear witness to the increasing sophistication of cell phones and computer systems, digital platforms transforming information and communication, and expanding uses of robotics and artificial intelligence. Technology is a key engine of productivity growth, allowing humans to achieve ever higher levels of efficiency. How is it then, one might ask, that productivity growth has been slowing in major economies in the past few decades, just as these technologies boomed? What explains this apparent paradox?

Concurrently, income inequality has been rising in most major economies. The distribution of both labor and capital income has become more unequal, while income has shifted from labor to capital. Might these trends in productivity and inequality, which have been particularly marked in advanced economies, be interconnected?

The slowdown in productivity and the rise in income inequality have emerged as two dominant concerns of our times. Together, they contribute to weaker and exclusive economic growth, slower and unequally-shared rises in living standards, and societal woes and divisiveness. In fact, they are tied to the forces behind the recent rise of political populism seen in many major economies. How should policy respond to reinvigorate productivity and support a pattern of growth that is more inclusive?

This paper intends to address these questions, through the analysis of recent and ongoing research. These questions are rich in import and of considerable topical interest. Unsurprisingly, they have spawned much analytical investigation and policy discussion. The aim of this short paper is to provide an overview of the key issues and findings, and demonstrate how they are reshaping policy agenda.

Booming Technology, Slowing Productivity, and Rising Inequality

The last two-plus decades have been marked by a boom in digital technologies— advances in computer systems, mobile devices, communication platforms, robotics, and much more. How significant are these new technologies–in terms of their potential to boost productivity and economic growth? The answer is intensely debatable. At one end, we find the “techno-pessimists”: those who believe that today’s technological advancements are inherently less consequential than their predecessors and simply cannot bring the kind of economy-wide productivity and growth benefits that were brought by past technological breakthroughs, such as the internal combustion engine and electrification.2 The pessimists also believe that most of the ‘fruit’ from these digital innovations was plucked back when they were first introduced, and subsequent advancements have predominantly been incremental. At the other end of the debate, we find “techno-optimists”: those who believe digital technologies are transformative, and do have potential to drive rapid productivity growth ––their benefits are merely subject to lags; they come in waves.3 Even if the advantages of the first wave of digital innovations are considered to have already been realized, the optimists deduce that productivity could continue benefiting from the next waves—such as radical increases in mobility from smartphones, cloud computing, 3D printing, artificial intelligence, and the Internet Of Things.

New technologies are contributing to increased market concentration by altering the structure of competition in ways that produce “winner-takes-most” outcomes.

The middle ground in this debate is occupied by “techno-adaptationists”: those who believe in the continuing promise of new technologies to deliver productivity gains, but recognize that the realization of these gains is not automatic, and can be thwarted by countless barriers. The gains depend on complementary improvements and adaptations in workforce skills, organizational structures, and policies affecting the functioning of markets.4

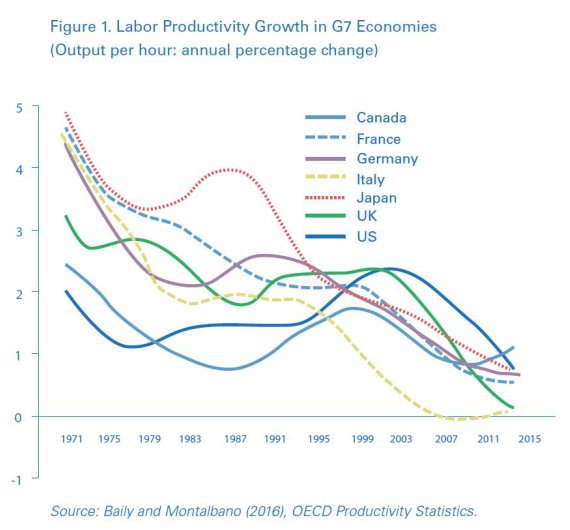

What do the data display? Aggregate productivity growth in most major economies has slowed. Figure 1 shows the evolution of labor productivity over the past three decades or so in the seven most advanced (G7) economies. The declining longterm trend in productivity growth since the 1980s is evident. Some economies experienced a rebound in productivity growth in the 1990s and early 2000s, which was principally a reflection from the adoption of digital innovations, where the United States was notably the leader. However, the rebound proved to be shortlived and productivity growth slumped again thereafter and the global financial crisis accentuated the slowdown. Although a cyclical element to the post-crisis deceleration of productivity growth can be observed, the productivity slowdown predates the crisis. The declining longer-term trend suggests that there are deeper, structural factors at play, which may have adversely impacted the underlying rate of productivity growth. While Figure 1 focuses on the G7 economies, productivity growth shows a similarly-slowing trend in advanced economies in general, and more recently a slowdown in most major emerging economies as well.5

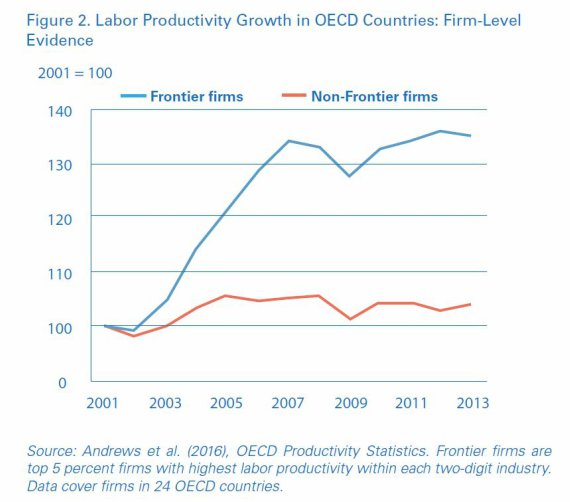

Analysis of the productivity dynamics at the firm level provides further important insights. Productivity growth has generally slowed down ––except in the leading technological firms. Gains have decelerated considerably in the vast majority of other, typically smaller firms, pulling the aggregate productivity rate lower. In Figure 2, a clear pattern of increasing inter-firm productivity divergence can be seen for the OECD economies.

The slowdown in productivity growth and the rise in inequality are interconnected.

The implication of this pattern can be summed up by the following: the problem may not be the technology itself, but rather its lack of penetration. It is not so much that innovation has weakened greatly (as feared by techno-pessimists), but that barriers are limiting productivity gains and preventing a broader diffusion of innovations across firms –a finding that is more akin to the views of techno-adaptationists. The widening gaps in productivity performance between firms go some way in explaining the paradox of slowing aggregate productivity growth amid advancing technology.

One view on the productivity paradox that has gained some traction is the notion that it may be illusory. Productivity is underestimated ––the argument states–– because statistics fail to fully capture the true extent of the gains from the new technologies. The statistical data disregard the improvements in product quality, variety, and provision of goods and services that are proven valuable to consumers but do not carry a market price (such as Google searches). However, research finds that although gains from new technologies are indeed underestimated, this mismeasurement can only explain a relatively small part of the slowdown in economic gains6 For the most part, the productivity slowdown, and the ensuing paradox, are real.

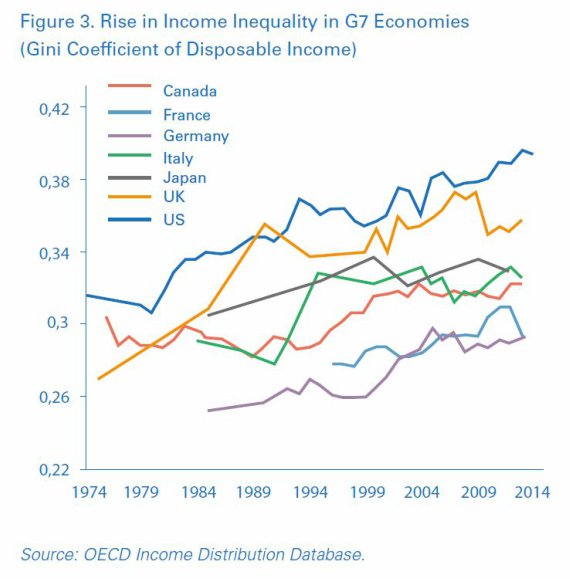

Concurrently with productivity growth rates decreasing, income inequality has been increasing. Figure 3 shows the trend in the distribution of disposable income (post taxes and transfers) in the G7 economies. Inequality has risen in every single G7 economy since the 1980s. In many cases, inequality has risen particularly sharply at the top end of the income distribution. Again, while Figure 3 covers the G7 economies, the trend of rising inequality applies more broadly to advanced economies. The data are more varied in emerging economies, but many emerging economies also witnessed a rise in inequality over the same period.

Barriers to a broader diffusion of the new technologies are producing outcomes that are both inefficient and unequal.

Are these trends just coincident, parallel trends, or are they somehow connected by common factors? The slowdown in productivity and the rise in inequality have been the subject of intense scrutiny by economists, but much of the analysis has looked at them each in isolation. More recently, however, analysts have explored possible linkages between these trends. This research finds that the slowdown in productivity growth and the rise in inequality are interconnected, with important common drivers.7

The Technology-Productivity-Distribution Nexus

The mix of technological changes and market conditions as influenced by policies has been a vital cross-cutting factor, affecting the evolution of both productivity and income inequality. Technology, productivity, and distribution have been linked by a common nexus.

Technology is altering the economic setting in significant ways.

At its root, the productivity slowdown appears to reflect a growing inequality in productivity performance between leading firms and their smaller competitors. The benefits of new technologies have been captured, for the most part, by a relatively small number of larger firms. Aggregate productivity growth is slower in industries with wider inter-firm divergence in productivity. Barriers to a broader diffusion of the new technologies are producing outcomes that are both inefficient and unequal.

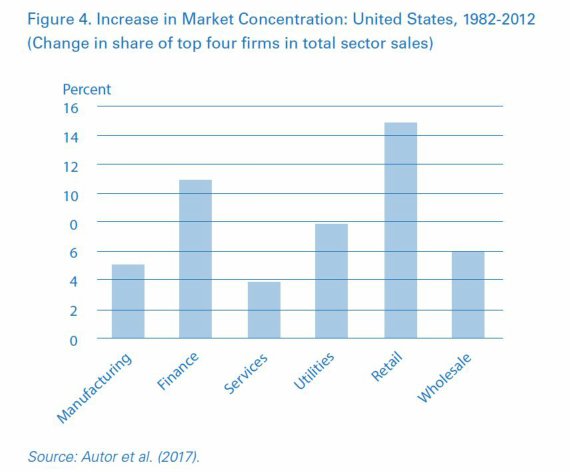

One reason for these outcomes is the decline in competitive intensity in markets, which has kept the natural forces of competition from working to prevent a continuous rise in productivity gaps between firms. The erosion of competition is indicated by the rise in market concentration and the decline in business dynamism, as measured by new firm formations. These trends, seen broadly across advanced economies, have been particularly apparent in the United States. The share of top four U.S. companies in total sales has increased in all of the six major industries shown in Figure 4. In 1982, young firms (five year old or less) accounted for about half of all U.S. firms and one-fifth of total employment; these figures dropped dramatically to about one-third and one-tenth, respectively, by 2013.8 In industries that are less exposed to competitive pressures, technological diffusion is weaker, productivity gaps between firms are wider, and aggregate productivity growth is lower.9

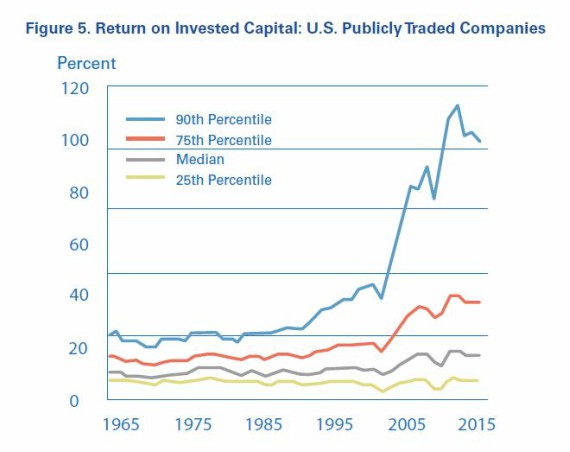

Across firms, the distribution of returns to capital has also become more unequal. In the United States, for example, the return on invested capital has diverged sharply, with the typical firm seeing only a modest increase in return, but a relatively small number of large firms reaping supernormal profits (Figure 5). Markets appear to have shifted toward oligopolistic structures, giving rise to higher economic rents.10 Inefficient and unequal outcomes resulting from decreased competition have been compounded by resource misallocations associated with rapid financialization.11

Besides the productivity paradox, the weakening of competition helps explain another paradox: the investment paradox. It can be described as the persistent weakness of investment in advanced economies, despite historically-low interest rates. Part of the weakness in investment resulted from post-global-financial- crisis macroeconomic factors, such as deficient aggregate demand and elevated policy uncertainty. Another contributing factor was the reduction in incentives to innovate and make new investment because of decreased competition and higher rents on existing capital.12 The two paradoxes fed off of one another: low investment depressed productivity growth by limiting capital deepening and slowing the adoption of capital-embodied new technologies, while weaker prospects for productivity growth depressed investment.13

Several factors contributed to the degradation of competition: flaws in the patent system (which acted as a barrier to the diffusion of new technology), regulations restricting competition, increased number of mergers and acquisitions (M&As) coupled with lax anti-trust enforcement, deregulation unsupported by competition safeguards, increased rent-seeking, and firm behaviors showing increased adeptness in erecting barriers to entry (through product differentiation and other means).

In addition to failures in policies regarding market competition, new technologies are contributing to increased market concentration by altering the structure of competition in ways that produce “winner-takes-most” outcomes. Digital technologies, in particular, offer scale economies and network effects that encourage the rise of dominant firms—and globalization reinforces the scale economies by facilitating access to markets worldwide. The “winner-takes-most” dynamic has been particulary evident in high-tech sectors, as reflected in the rise of “superstar” firms such as Facebook and Google. Increasingly, however, it is affecting broader segments of the economy as digital applications penetrate business processes in other sectors, ranging from transportation and communications to finance and retail.

In labor markets, a similar interplay between technology, productivity, and distribution has been at work. Increased inequalities in firm productivity are mirrored by increased inequalities in labor incomes. As productivity and profitability gaps widened between firms, so did wage gaps. Wage inequalities have increased sharply in the past couple of decades, and much of that increase is attributed to increased wage differences between firms.14

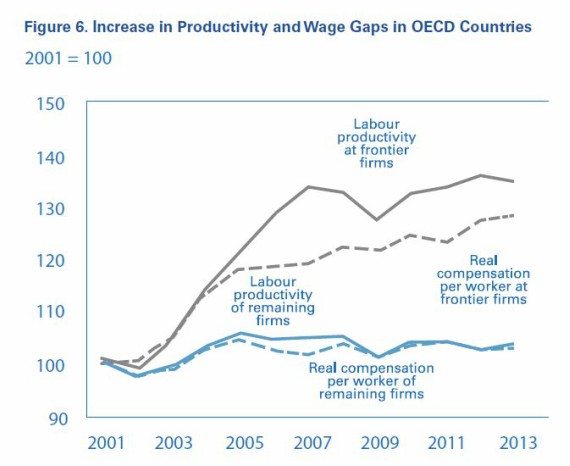

While workers employed in firms at the technological frontier earned more than did those in other firms, gains from higher productivity at these firms were shared unevenly, with wage growth lagging productivity growth. Wages rose in the better-performing firms, but at a lesser rate than the rise in productivity. For most other firms, limited wage growth reflected limited productivity growth, although even at these firms wage growth tended to fall short of the meager gains in productivity (Figure 6).

The decoupling of wages from productivity contributed to the decline in the share of labor in total income. Most OECD economies have experienced both increasing inequality of labor earnings and declining labor income shares over the past two decades. Using the United States to illustrate, the percentage share of labor in total income in non-farm business sectors dropped from the mid-60s around 2000, to the mid-50s around 2015. The increase in market concentration also shifted income from labor to capital by reallocating labor to dominant firms with supernormal profits and lower labor income shares.15 Dominant firms not only acquired more freedom to increase markups in product markets, but also monopolistic power to dictate wages in the labor market.16 These developments reinforced the effect of labor-substituting technological change on the distribution of income between labor and capital. The shift of income from labor to capital increased income inequality, as capital ownership is highly uneven.17 In advanced economies, international trade and offshoring also contributed to the shift in income toward capital. Overall, evidence suggests that the role of globalization in the decline of the labor income share has been more limited relative to that of technological change and related outcomes.18

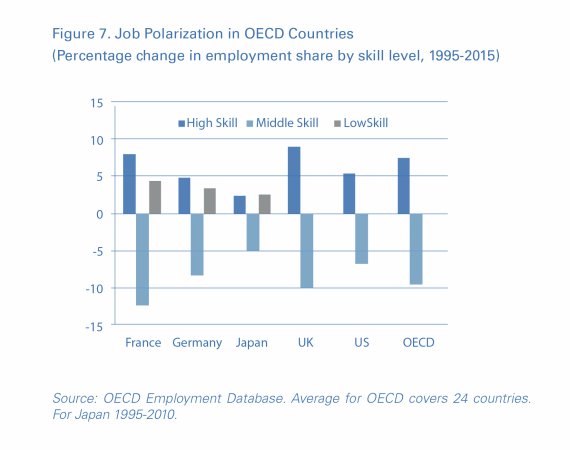

Digital technologies and automation have shifted the demand for labor toward higher-level technical and managerial skills. In particular, demand has shifted away from routine, middle-level skills that are more vulnerable to automation – jobs such as bookkeeping, clerical work, and repetitive production. Job markets have seen an increasing polarization; the employment share of middle-skill jobs is falling, while that of higher-skill jobs, such as technical professionals and managers, is rising (Figure 7). The employment share of low-skill jobs has also increased, but mainly service jobs that are hard to automate, such as personal care. A concurrent development has been the rise of the “gig economy”, with more workers engaged in non-standard work arrangements, such as temporary or part-time contracts and own-account employment.

Productivity and Equity: A Common, Dynamic Agenda

To achieve stronger and more inclusive growth, the twin trends of slowing productivity and rising inequality must be reversed. Productivity and equity are often seen in terms of a trade-off in economic debates. Recent research points to important complementarities between the two. The drivers of slowing productivity growth and rising inequality are closely interconnected, creating scope for win-win policies. Inevitably, there are trade-offs, and underlying forces, like technology and globalization, will always produce winners and losers. However, policies can help balance these impacts. The strong linkages between productivity and equity call for an integrated approach to formulating a policy agenda that promotes these goals –an approach that aims to exploit the reform synergies and mitigate the trade-offs.

The policy agenda for promoting productivity and equity in large part is not only common, but also dynamic. Technology is altering the economic setting in significant ways; it is changing the rules of competition between firms, the nature of work, and the demand for skills. These changes have profound implications for policy; new, out-of-the-box thinking and an inclusive frame of mind will be required.

One key area for attention is revitalizing competition. Regulatory reform should aim at both removing regulations that impede competition, and ensuring that adequate rules and regulations are in place to prevent abuse of market power. There is considerable scope for regulatory reform in a number of OECD economies, especially in network and service industries.22 The M&A activity in these economies has more than doubled since the 1990s. Given the rise in industrial concentration, the robustness and enforcement of anti-trust regimes merit special attention. There is a need to rethink anti-trust laws and other competition policies for the digital age, where the new technologies tend to produce winner-takes-most dynamics and quasi-natural monopolies. Once in dominant positions, firms often work to entrench themselves by erecting a variety of barriers to entry, discouraging business dynamism and further innovation.23

Competition policy also needs to become more global. Riding the forces of technology and globalization, today’s superstar firms are typically multinationals. Similar to the progress the OECD countries have made in strengthening cross-border tax processes to prevent companies from avoiding taxes through profit shifting, there is a need to strengthen international cooperation to address cross-border business practices that restrict competition.

A second area of focus should be the reform of technology policies, in order to spur innovation and promote its spread across more economies. Intellectual property regimes need to be better balanced so that they reward innovation but also foster wider economic impacts. There is evidence suggesting that stronger patent protection may be associated with greater market concentration, less follow-on innovation and diffusion, and wider productivity gaps within industries.24 Some have even called for a complete abolition of the patent system.25 Abolishing patents may seem too radical a step, but a fundamental review of the patent system seems warranted to reform overly-broad and stringent protections and give freer rein to competition that ultimately is the primary driver of innovations and their economy-wide penetration.

Public investment in research and development (R&D), which has declined in many major economies under fiscal pressures, needs to be bolstered. Public R&D in basic research complements private applied R&D. Many breakthrough innovations developed commercially by the private sector had their origin in government-supported research.26 Public research programs should pay particular attention to ensuring broad access to the fruits of direct public R&D investment, as well as access on a level footing by firms to any private R&D incentives provided through tax relief and grants. Governments could also explore ways of better recouping some of their investment in research to help replenish their R&D budgets. Creating a new balance of shared risks and rewards in public research investment would be in direct contrast to the current paradigm, in which risks are socialized, but rewards are privatized.

The third area of improvement concerns investment in skills. Advances in digitization, robotics, and artificial intelligence have led some to draw up dire scenarios of massive job losses from automation, such as half or more of the jobs in OECD economies being at risk.27 Estimating the number of jobs that will be lost to automation may be the wrong focus though, as it only considers the destruction of existing jobs and ignores the creation of new jobs. As we learn from past major episodes of automation, when a technological change made old jobs redundant, it created new ones complementary with the new technologies.28 The main issue is that the nature of work is changing, and the main challenge lies in equipping workers with the higher-level skills demanded by the new technologies and supporting them during the adjustment process.

Education and training programs need to be strengthened and revamped to respond to the new skill dynamics. Traditional, formal education must be complemented with new models that offer options in re-skilling and lifelong learning, considering both the fast-changing demand for skills, as well as the ageing workforce in many economies. The old cycle of “learn-work-retire” is shifting toward one of continuous learning, creating the need for dramatically increased availability and quality of continuing education. This will require innovations in the design, delivery, and financing of training, and in public-private partnerships— including the promotion of digital literacy to reduce the digital divide and harness the potential of technology-enabled solutions, such as online learning platforms. Improving the access to the economically-disadvantaged must be part of this agenda. In many major economies, gaps in higher education by family income level have widened rather than narrowed.29

Digital technologies encourage the rise of dominant firms.

A fourth area, is revamping labor market policies and social protection. Labor market institutions and social protection arrangements need to adapt to a changing world of work; a new model characterized by more frequent shifts between jobs and more people working independently. Labor market reforms should have a forward-looking orientation to support workers through insurance mechanisms and active labor market policies, facilitating their transition to new jobs. Advanced economies, in general, need to do more and better on forward looking policies.. Reform of backward-looking policies, such as the reform of stringent job protection laws currently underway in France, has particular relevance for European economies.

Social contracts, traditionally based on long-term formal employer-employee relationships, will need to be overhauled, with benefits such as health and retirement made more portable and more universally-applicable to accommodate different types of work arrangements. There is currently an active debate on the options to reform social security systems. Proposals range from mechanisms such as a universal basic income (currently being piloted by some administrations),30 to various types of portable social security accounts that could pool workers’ social benefits. Just this year, France launched a portable “personal activity account”, which accumulates workers’ training rights acquired in different types of work. Learning from this debate and experimentation should help inform and guide policy.

Conclusion

Technology is a prime driver of productivity and, in turn, long-term economic growth and rise in living standards. Technological change is inevitably disruptive and, indeed, achieves its positive outcomes through what Schumpeter termed “creative destruction”. How new technologies translate into actual increases in productivity depends greatly on how these impacts and processes are managed through policies. Technology also significantly affects how the rewards of growth are shared, but again the actual distributional impacts depend on how policies respond.

Advancements in digital technologies hold much promise. Their potential to deliver productivity growth has not been fully tapped –in fact, the rate of productivity growth has decreased, while income inequality has increased. Much of recent political discourse has been focused on international trade, identifying it as the culprit to blame for higher unemployment rates, pay cuts for less skilled workers, and increased inequality. However, evidence indicates that the more influential factor has been technological change. A common set of factors— linked to the nature of the new technologies and how they have interacted with policy failures—has dampened productivity growth and exacerbated inequality. As sketched out in this paper, there is an integrated narrative that explains the interconnected nature of these trends.

To achieve better outcomes on productivity and equity, policies need to rise to the challenges of the digital age. A better tomorrow can be created by revitalizing competition, spurring innovation at the technological frontier (while also promoting its broad diffusion across economies), upskilling and reskilling workers, and reforming social contracts. Policymaking will need to be responsive to a context of significant and continuing change.

The challenges are enormous, and the political economy of reform is difficult. But, fortunately, the policy options are not limited to a binary choice between productivity and equity. There are policies that can promote both. Policymakers should approach them through an integrated agenda of reforms.

References

Acemoglu, Daron, and Pascual Restrepo (2016). “The Race between Machine and Man: Implications of Technology for Growth, Factor Shares and Employment,” NBER Working Paper Series, No. 22252, National Bureau of Economic Research, Cambridge, MA.

Adalet McGowan, Muge, and Dan Andrews (2015). “Labor Market Mismatch and Labor Productivity: Evidence from PIAAC Data.” Economics Department Working Paper, No. 1029. OECD Publishing, Paris.

Andrews, Dan, Chiara Criscuolo, and Peter Gal (2016). “The Best Versus The Rest: The Global Productivity Slowdown, Divergence Across Firms and the Role of Public Policy,” OECD Productivity Working Paper, No. 5, OECD Publishing, Paris.

Autor, David, David Dorn, Lawrence Katz, Christina Patterson, and John Van Reenen (2017). “The Fall of the Labor Share and the Rise of Superstar Firms,” NBER Working Paper Series, No. 23396, National Bureau of Economic Research, Cambridge, MA.

Autor, David (2014). “Skills, Education, and the Rise of Earnings Inequality among the “Other 99 Percent”,” Science, 344 (6186): 843-851.

Baily, Martin, and Nicholas Montalbano (2016). “Why is U.S. Productivity Growth So Slow? Possible Explanations and Policy Responses,” Hutchins Center Working Paper, No. 22, The Brookings Institution, Washington DC.

Boldrin, Michele, and David Levine (2013). “The Case Against Patents,” Journal of Economic Perspectives, 27 (1): 3-22.

Byrne, David, John Fernald, and Marshall Reinsdorf (2016). “Does the United States Have a Productivity Slowdown or a Measurement Problem?” Brookings Papers on Economic Activity, Spring 2016: 109-182.

Brynjolfsson, Erik, and Andrew McAfee (2011). Race Against the Machine: How the Digital Revolution Is Accelerating Innovation, Driving Productivity, and Irreversibly Transforming Employment and the Economy, Digital Frontier Press, Lexington, MA.

CEA (Council of Economic Advisers) (2016). “Labor Market Monopsony: Trends, Consequences, and Policy Responses,” The White House, Washington DC.

Cette, Gilbert, Jimmy Lopez, and Jacques Mairesse (2016). “Market Regulations, Prices, and Productivity,” American Economic Review, 106 (5): 104-08.

Cowen, Tyler (2011). The Great Stagnation: How America Ate All the Low-Hanging Fruit of Modern History, Got Sick, and Will (Eventually) Feel Better, Dutton, New York, NY.

Decker, Ryan, John Haltiwanger, Ron Jarmin, and Javier Miranda (2017). “Declining Business Dynamism, Allocative Efficiency, and the Productivity Slowdown,” American Economic Review, 107 (5): 322-26.

Derviș, Kemal, and Zia Qureshi (2016). “The Productivity Slump – Fact or Fiction: The Measurement Debate,” Policy Brief, August 2016, The Brookings Institution, Washington DC.

Égert, Balázs (2017). “Regulation, Institutions and Aggregate Investment: New Evidence from OECD Countries,” Economics Department Working Paper, No. 1392, OECD Publishing, Paris.

Frey, Carl, and Michael Osborne (2013). The Future of Employment: How Susceptible Are Jobs to Computerization? Oxford Martin School, Oxford, UK.

Furman, Jason, and Peter Orszag (2015). “A Firm-Level Perspective on the Role of Rents in the Rise in Inequality,” Presentation at “A Just Society” Centennial Event in Honor of Joseph Stiglitz, Columbia University, New York, NY.

Goldin, Claudia, and Lawrence Katz (2008). The Race between Education and Technology, Harvard University Press, Cambridge, MA.

Gordon, Robert (2016). The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War, Princeton University Press, Princeton, NJ.

Gutiérrez, Germán, and Thomas Philippon (2016). nvestment-less Growth: An Empirical Investi gation,NBER Working Paper Series, No. 22897, National Bureau of Economic Research, Cambridge, MA.

Hanushek, Eric, Guido Schwerdt, and Simon Wiederhold (2013). “Returns to Skills Around the World: Evidence from PIAAC,” NBER Working Paper Series, No. 19762, National Bureau of Economic Research, Cambridge, MA. IMF (2017). World Economic Outlook, April 2017, Chapter 3 on “Understanding the Downward Trend in Labor Income Shares,” IMF, Washington DC.

Krugman, Paul (2015). “Challenging the Oligarchy,” The New York Review of Books, December 17, 2015.

Mazzucato, Mariana (2015). The Entrepreneurial State: Debunking Public vs Private Sector Myths, Public Affairs, New York, NY.

Mokyr, Joel (2014). “Secular Stagnation? Not in Your Life,” in Coen Teulings and Richard Baldwin (eds.), Secular Stagnation: Facts, Causes, and Cures, CEPR Press, London, UK.

OECD (2017a). “The Great Divergence(s),” OECD Science, Technology and Innovation Policy Papers, No. 3923, OECD Publishing, Paris.

OECD (2017b). Economic Policy Reforms 2017: Going for Growth, OECD Publishing, Paris.

OECD (2015a). The Future of Productivity, OECD Publishing, Paris.

OECD (2015b). “Finance and Inclusive Growth,” OECD Economic Policy Paper, No. 14, OECD Publishing, Paris.

Ollivaud, Patrice, Yvan Guillemette, and David Turner (2016). “The Links Between Weak Investment and the Slowdown in Productivity and Potential Output Growth,” Economics Department Working Paper, No. 1304, OECD Publishing, Paris.

Philippon, Thomas (2016). “Finance, Productivity, and Distribution,” Paper prepared for Chumir-Brookings project on the Great Policy Challenge, October 2016, The Brookings Institution, Washington DC.

Piketty, Thomas (2014). Capital in the Twenty-First Century, Harvard University Press, Cambridge, MA.

Qureshi, Zia (2017). “Productive Equity and Why It Matters to the G20,” UpFront, The Brookings Institution, Washington DC.

Qureshi, Zia (2016). “The Productivity Outlook: Pessimists Versus Optimists,” Policy Brief, August 2016, The Brookings Institution, Washington DC.

Schwellnus, Cyrille, Pierre-Alain Pionnier, and Mathilde Pak (forthcoming). “The Structural and Policy Determinants of Wage-Productivity Decoupling: Industry- and Firm-Level Evidence,” Economics Department Working Paper, OECD Publishing, Paris.

Song, Jae, David Price, Faith Guvenen, Nicholas Bloom, and Till von Wachter (2015). “Firming Up Inequality,” NBER Working Paper Series, No. 21199, National Bureau of Economic Research, Boston, MA.

Stiglitz, Joseph (2016). “Monopoly’s New Era,” Project Syndicate, May 13, 2016.

Syverson, Chad (2016). “Challenges to Mismeasurement Explanations for the U.S. Productivity Slowdown,” NBER Working Paper Series, No. 21974, National Bureau of Economic Research, Boston, MA.

Turner, Sarah (2017). “Education Markets: Forward-Looking Policy Options,” Hutchins Center Working Paper, No. 27, The Brookings Institution, Washington DC.

World Bank (2016). Digital Dividends, World Development Report 2016, The World Bank, Washington, DC.

Notes

1 This article draws on, among other work, ongoing research by the author under a project on technological change, productivity, and inequality being undertaken jointly by the Brookings Institution and the Chumir Foundation on Ethics in Leadership. The author would like to acknowledge support from Brookings and the Chumir Foundation. The views expressed in this article, however, are the author’s own.

2 See, for example, Cowen (2011) and Gordon (2016).

3 See, for example, Brynjolfsson and McAfee (2011) and Mokyr (2014).

4 See Qureshi (2016) for an overview of the differing viewpoints in this debate.

5 While productivity trends are analyzed here in terms of labor productivity, trends based on total factor productivity present a broadly similar picture (OECD 2015a).

6 See Byrne et al. (2016) and Syverson (2016). Derviş and Qureshi (2016) provides an overview of the measurement debate.

7 See OECD (2017a) and Qureshi (2017).

8 See Autor et al. (2017) and Decker et al. (2016).

9 See Andrews et al. (2016) and Cette et al. (2016).

10 See Furman and Orszag (2015) and Stiglitz (2016).

11 See OECD (2015b) and Philippon (2016).

12 See Égert (2017) and Gutiérrez and Philippon (2016).

13 See Ollivaud et al. (2016).

14 See Song et al. (2015).

15 See Autor (2017).

16 See CEA (2016).

17 The role of uneven wealth ownership and returns on wealth as sources of inequality has been particularly emphasized by Thomas Piketty in his 2014 bestseller (Piketty 2014).

18 See IMF (2017).

19 See Goldin and Katz (2008) and Autor (2014).

20 See Adalet McGowan and Andrews (2015).

21 See Hanushek et al. (2013) and Autor (2014).

22 See OECD (2017b).

23 See Krugman (2015).

24 See Andrews et al. (2016) and Autor et al. (2017).

25 See Boldrin and Levine (2013).

26 Recent examples often mentioned in this context are the Internet, Google’s basic research algorithm, and key features of Apple smartphones (Mazzucato 2015).

27 See Frey and Osborne (2013) and World Bank (2016).

28 See Acemoglu and Restrepo (2016).

29 In the United States, for example, college enrollment and completion gaps by family income level have increased over the past few decades (Turner 2017).

30 For example, there is currently a two-year pilot in Finland and one in Ontario, Canada.

Comments on this publication